Warren Buffett, the Chairman and CEO of Berkshire Hathaway, is widely known for his tried-and-true investment philosophy. His approach is grounded in simplicity, discipline, and a focus on businesses with durable competitive advantages.

Warren Buffett and the Evolution of Berkshire Hathaway’s Apple Investment

Topics: Investing

Monthly Market Commentary: September 2025

What We're Watching in September

It may be back-to-school season, but markets never took a summer break. Equities are hovering near all-time highs, inflation progress is uneven but improving, and earnings have topped cautious expectations. The backdrop: a potentially pivotal policy moment after the Jackson Hole Economic Policy Symposium, where a September rate cut is now squarely on the table. A well-telegraphed, data-dependent cut would ease financing costs for households (mortgages, autos) and corporates (refinancing, capex, M&A); helpful tailwinds as consumers grapple with housing affordability and companies navigate tariffs and supply chains.

Topics: Investing

Smart Ways to Pay for College: Funding Options Every Family Should Know About

The rising cost of higher education presents a challenge for many families. The good news: with thoughtful planning and the smart use of available tools, these costs can become much more manageable. For parents and grandparents who want to support education goals, understanding the different savings vehicles and tax benefits is key.

Topics: Investing

Stablecoin: What It Is, Why It Matters, and Where It's Headed

Stablecoins have been around for a little while now, but they’re back in the spotlight thanks to some new legislation—the GENIUS Act. With all the buzz, it’s worth unpacking what stablecoins are, why they’re gaining traction globally, and whether they really matter for the average U.S. consumer.

Let’s start from the top.

Topics: Investing

Monthly Market Commentary: August 2025

What We're Watching in August

It is August, and that means we are in the middle of the “Dog Days of Summer.” However, the stock market is acting like anything but a dog. Stocks continue to rise while inflation data has held steady, and corporate earnings have generally exceeded expectations. Several factors are affecting the long-term outlook, such as uncertainties regarding future Federal Reserve policies, bond market conditions, and patterns in consumer spending. Here is what our investment team is keeping a keen eye on this month.

Topics: Investing

Investing in America’s Future: What Today’s Manufacturing Boom and AI Race Mean for Investors

We’re witnessing a wave of announcements from companies across multiple sectors, promising trillions of dollars in capital investment into the United States. While some of these commitments remain aspirational, even a portion materializing would mark a significant economic shift. As investors, understanding the magnitude and interconnected nature of these developments can help us identify long-term opportunities.

Topics: Investing

Monthly Market Commentary: July 2025

What We're Watching in July

As we enter July and the second half of 2025, markets and the economy remain resilient against a backdrop that feels anything but calm. The U.S. airstrikes on Iranian nuclear facilities over the weekend of June 21–22 introduced a serious geopolitical variable, raising the specter of escalation and potential global conflict. And yet, despite the weight of these headlines, equity markets have moved higher.

Topics: Investing

Stock Fundamentals: Return on Invested Capital

In general, earnings growth drives stock prices higher. If investors are willing to pay 20 times earnings for a company, and company earnings grow from $5 per share to $6 per share, the stock price will increase from $100 to $120.

Topics: Investing

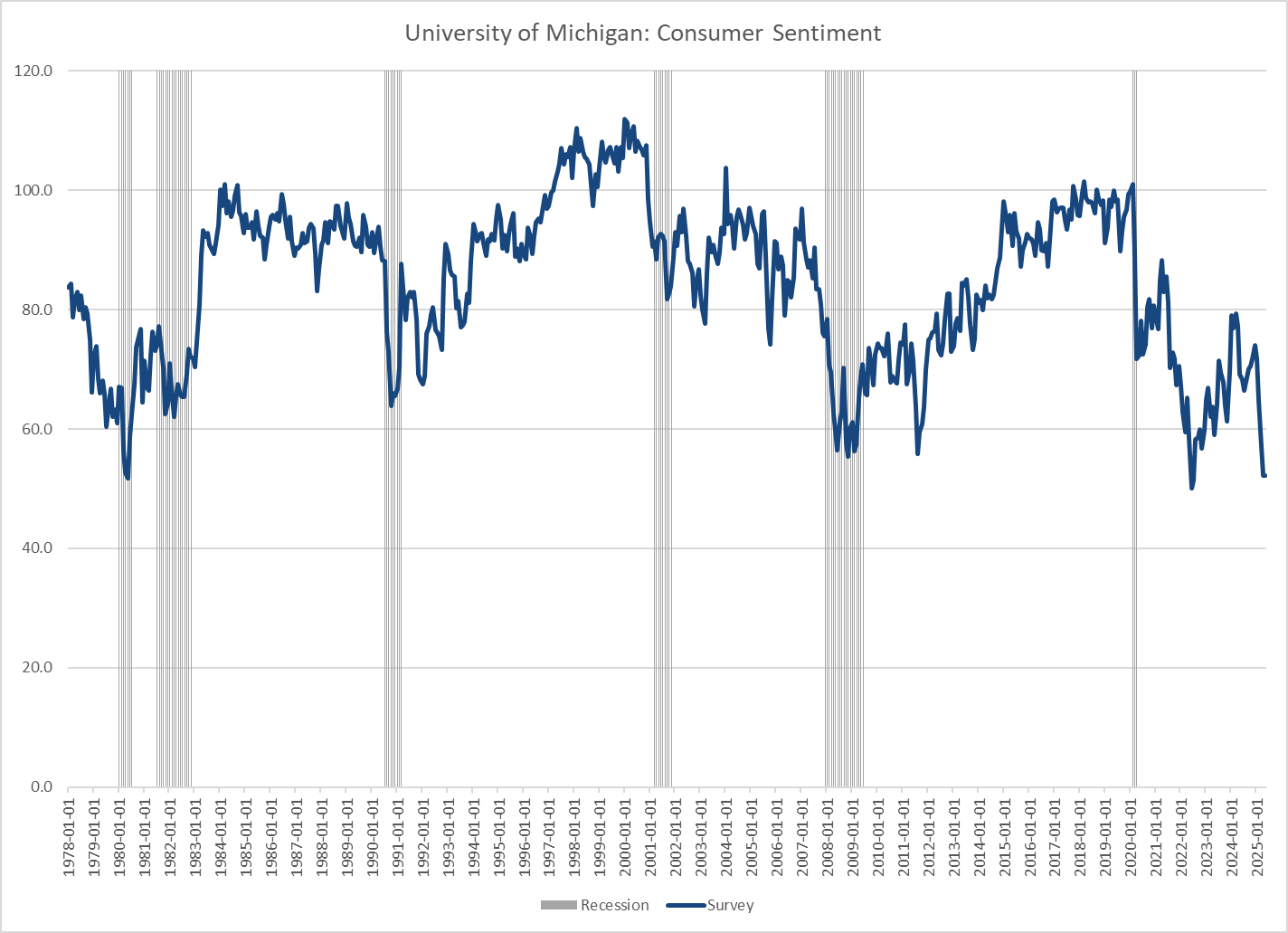

Reading the Tea Leaves: How Do We Understand Consumer Confidence?

A few days ago, the University of Michigan released its final reading for the Consumer Sentiment Index through May. The measure matched the prior month’s reading of 52.2 but remains well below the 71.7 reading we saw in January. The Conference Board’s own release of the Consumer Confidence clocked in at a very high 98, up from the April reading of 85.7 but down from January’s 104. Why are these indices so important to follow, and what are they telling us?

Topics: Investing

Monthly Market Commentary: June 2025

What We're Watching in June

Summer is here, and while many take time to unwind and travel, the markets remain in constant motion. For those who closely follow financial news, the headlines often point in conflicting directions. At Carnegie, we cut through the noise by staying grounded in long-term fundamentals, thoughtful portfolio positioning, and informed decision-making.

Topics: Investing