Economic Tailwinds from AI’s CapEx

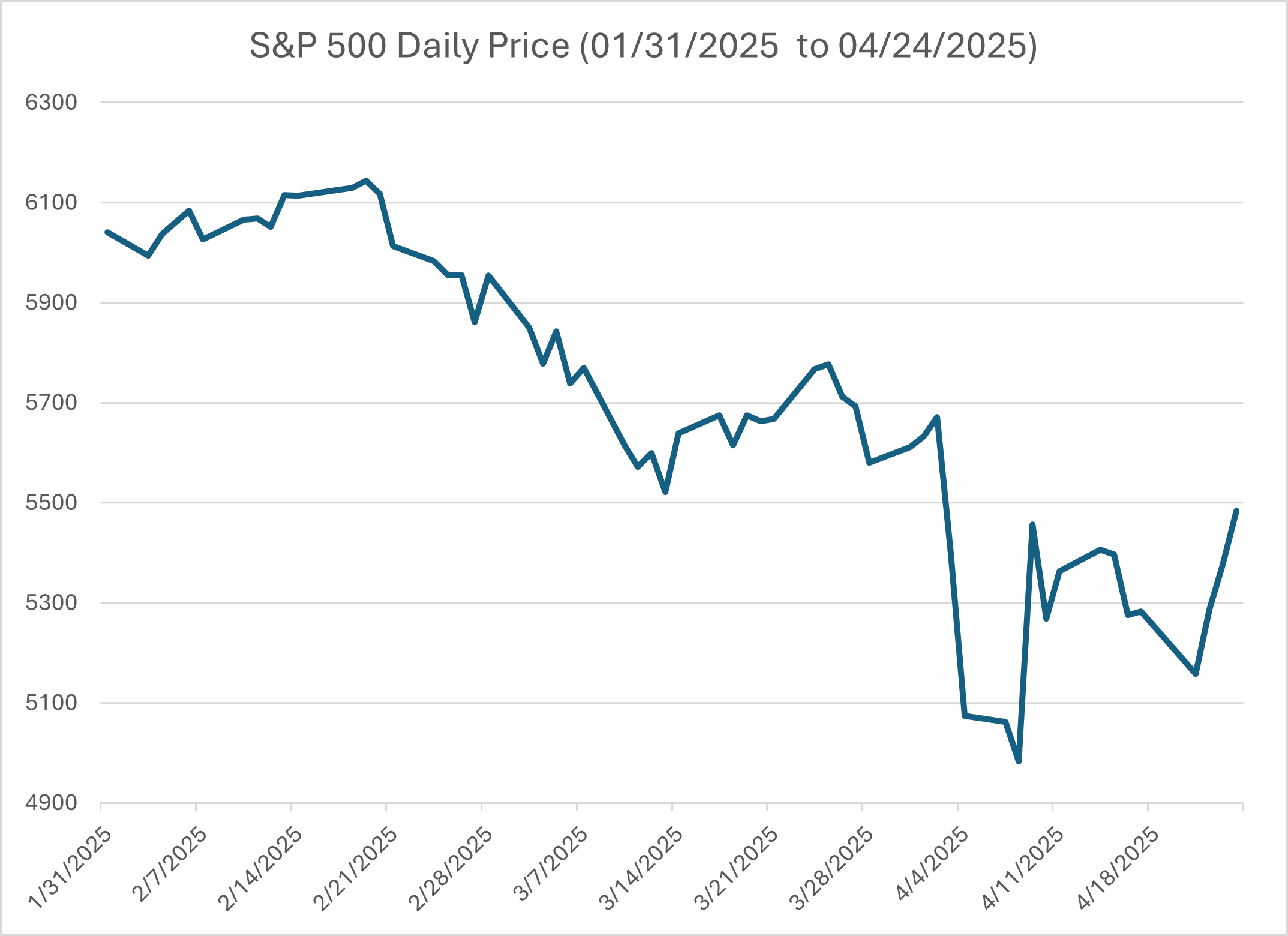

This year, the markets have been driven by the administration’s tariff policies. When higher than expected tariffs have been threatened or imposed, common stocks and fixed-income securities have lost value. On the other hand, lower tariff rates or delays in the assessment of these taxes have caused the markets to rebound. While these policy changes are extremely important, the secular growth in capital expenditures necessary to build out infrastructure for Artificial Intelligence (AI) is not getting the coverage that it deserves.