The new year is off to a brisk start, and January has already delivered signs that 2026 may diverge meaningfully from last year’s narrow, tech‑driven rally. Value stocks are leading the way so far, while policy developments from the Trump Administration continue to shape economic headlines. Although it’s still early, we’re closely watching a clear shift in market dynamics to begin to take hold.

Monthly Market Commentary: February 2026

How Market History Can Help Frame Your Expectations for 2026

After several years of strong market performance, it’s natural for investors to wonder what comes next.

Will this continue?

Are we due for a downturn?

What should investors realistically expect in 2026?

Let’s not pretend that not even the best analysts and researchers can look into the future and tell you exactly what markets will do next year. But what we can do, and what can offer both clues and confidence, is investigate the past. History offers something far more useful than predictions: perspective.

Let’s explore some valuable insights and patterns from the past that might help frame more realistic expectations for 2026 and better prepare investors to respond thoughtfully to whatever this year brings.

Topics: Investing

Monthly Market Commentary: January 2026

As we embark on 2026, we at Carnegie reflect on a resilient 2025 that saw the S&P 500 deliver solid gains amid headwinds such as tariffs and government budget cutbacks. The market tested many investors through sharp headlines portraying market news and pullbacks as dramatic declines, such as "Dow plummets 500 points," often representing less than 1% moves.

Our take? Headline-driven commentary is designed to elicit an emotional response (to drive clicks!), but it is often the best time to remember your time horizon. Over longer horizons of 1, 5, or 10 years, these fluctuations pale in comparison to the power of compounding in quality investments. At Carnegie, we remain focused on identifying continual compounders striving to build wealth steadily through economic cycles.

As we enter 2026, maintaining discipline amid noise remains key, emphasizing long-term horizons over reactionary moves. Below, we share a few larger themes we are watching as we turn the page on 2025.

Why Cash Is Not a Long-Term Investment Strategy

For much of the past two years, holding cash felt like a rational long-term strategy. Money market funds offered yields of around 5%, and investors were paid to hold cash. Some investors found it particularly attractive after enduring years of near zero short-term rates. That environment has now changed, and the shift is structural rather than temporary.

Topics: Investing

Monthly Market Commentary: December 2025

What We're Watching in December

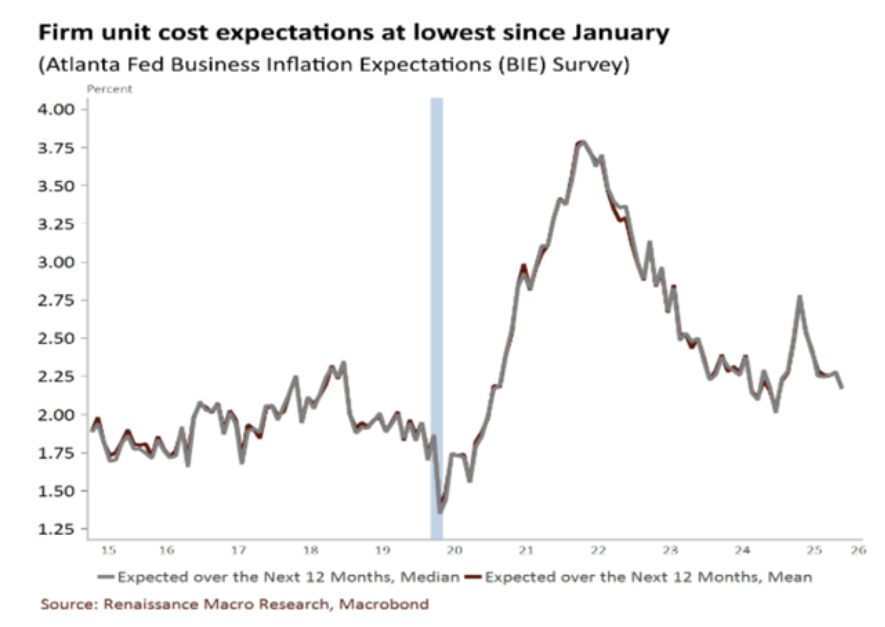

With only a month to go before the end of 2025, the financial markets experienced unexpected twists and turns that many didn’t expect during the year. Seasonal trends were cast out the window, economic signals sent mixed messages, and the promise of an AI boom was continually met with skepticism. In the face of this, we at Carnegie continue to focus on clarity, balance, and long-term discipline. From Fed policy and AI spending to the real story behind inflation, here’s what we’re watching closely as the year draws to a close.

Topics: Investing

The Risks Facing OpenAI and its $1.4T in Spending Commitments

OpenAI, the company behind ChatGPT, expects to end 2025 with an annualized run rate of revenue over $20 billion; its fourth quarter revenue will be about $5B. OpenAI’s CEO Sam Altman predicts revenue will grow to hundreds of billions by 2030. 2030 is also when the company is guiding positive free cash flow. Essentially, the company will have cash after paying all operating and maintenance costs. The common definition of free cash flow is Cash from Operations (CFO) minus Capital Expenditures.

Topics: Investing

Adding a Trusted Contact to Help Protect Your Wealth

For over twenty years, I have assisted clients in navigating market fluctuations, tax changes, and life transitions. Recently, I have encountered a new challenge: helping clients who do not have a trusted contact listed. In rare situations, it may be necessary to reach out to someone who can check on you if you are unwell or experiencing difficulties.

Most financial plans consider two key points in time: when you're fully able to manage your finances and when someone else legally takes over. However, there is often a vulnerable middle ground where your confidence and understanding can begin to diminish well before any formal diagnosis occurs. This gap may not be addressed in your financial plan, potentially putting your wealth at risk. Furthermore, this issue can be more pronounced for individuals who have no children, close family, or friends to support them.

It may feel like a difficult topic to bring up, but it's a simple fix that can have great impact later. Let's discuss the importance of adding a trusted contact.

Topics: Investing, Financial Planning, Wealth Management

Data Centers Are Driving Up Utility Bills, but Is That Fair?

Electricity prices are climbing as tech giants like Amazon, Google, and Microsoft build massive data centers to train and run their Artificial Intelligence (AI) models. These facilities are the digital backbone of today’s AI revolution, but they’re also consuming staggering amounts of power.

Topics: Investing

Monthly Market Commentary: November 2025

What We're Watching in November

November has arrived. The leaves may be falling, but equity markets remain supported by strong underlying forces. While investors continue to understand the Fed’s ongoing rate policy, we're keeping our focus on what matters, including capital flows, consumer strength, and the risks quietly forming below the surface.

Topics: Investing

Managing Concentrated Holdings: Is it Time to Tame the Beast?

Imagine your good fortune when checking portfolio balances and you notice that the value of a single stock holding in your portfolio has increased in value by more than an entire year of income! ‘Impossible!’ you say? Not so! At Carnegie, we have witnessed this happy situation more than once over the years.

Topics: Investing

.png)

-3.png)