Brent Luce

Recent Posts

JP Morgan Introduces a Cryptocurrency

Last week, JP Morgan announced that they are introducing the “JPM Coin”, their own version of a cryptocurrency. While some argue that it is not a true cryptocurrency, this is more evidence of JP Morgan’s commitment to technology and to some extent, it validates the whole blockchain and cryptocurrency concept. Interestingly, Bitcoin, the best-known cryptocurrency, spiked on this news. MORE: J.P. Morgan Rolling Out Cryptocurrency

The Cloud

The move to cloud computing is one of the really big secular trends taking place right now. We are probably in the early innings of this phenomenon and it has far reaching implications on investments, companies and how we live our lives in general (READ MORE: How is Cloud Computing The Driver of Digital Disruption). The slide below from KeyBanc shows a good visualization of anticipated SaaS and IaaS (software and infrastructure as a service) growth over the next five years:

NOWHERE TO HIDE

This year, 90% of asset classes are down. If the year ends this way, it would be an all-time record. This includes the Great Depression and the Great Recession. Read More: Why 2018 Has Been The Worst Year Ever, According To One Metric

Topics: Artificial Intelligence

October to Remember

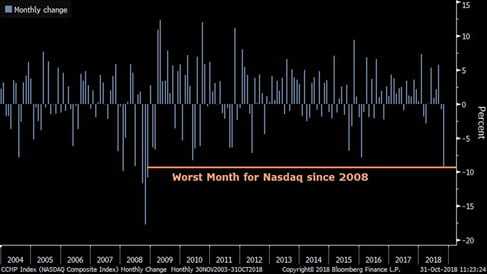

Even with the bounce over the past two days, this month has been the worst month for the Nasdaq since 2008, which was the worst period for the stock market since the Great Depression. The big question investors are now pondering is whether the party is over for tech and the market in general or whether this is just a healthy market correction. READ MORE: Red October Sees US Stocks Endure Worst Month Since Financial Crisis

Longest Bull Market Ever?

The media is talking about how we are now in the longest bull market in history. By the definitions they have decided to use to determine bull and bear markets, this is true…barely. It is true that on a closing price basis, the S&P 500 has not experienced a 20% decline since 2009. This headline implies that stocks have been smooth sailing for almost a decade and that we are now in dangerous territory. What they are not discussing is that for 14 years (see chart below), the S&P 500 did nothing. That is quite a long time, and one might expect a prolonged period of strength to follow. Another alternative view is that from 2009-2014, the market was merely recovering from a prolonged period of weakness. It did not start making new highs until mid-2013, which means that we are only five years into new market territory. READ MORE: What Does the Longest Bull Market Mean? A Debate

Alexa for Hospitality

By now, we are all familiar with Alexa. We have learned how to use the AI assistant to play music, buy things, change the temperature, turn off the lights and many other things. This is just the beginning – now that 50 million Alexa devices are in U.S homes, Alexa is moving beyond the home. Yesterday, Amazon announced the launch of Alexa of Hospitality and a partnership Marriott to roll this technology out across the world. This essentially brings the concierge and front desk to your room. Alexa will be able to handle many tasks like bringing more towels, changing temperature/lighting, ordering food, checking out and many other things. I wonder what Alexa’s next frontier is? Watch Alexa for Hospitality in Action

Topics: Artificial Intelligence

New Highs for Small Caps, Cord-cutting and Akron’s Hot Real Estate Market

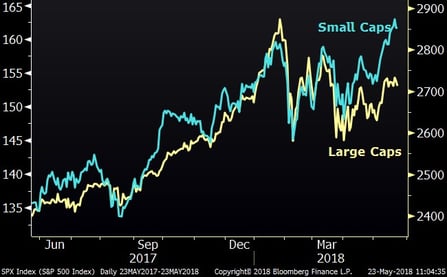

SMALL CAPS AT NEW HIGHS

As you know, the stock market has been a bit weak this year, with the S&P 500 trading about 6% below its January high. Interestingly, small- and mid-cap stock indices have diverged from the S&P 500 and are trading at all-time highs. It would be very unusual for this condition to exist as the market enters a new bear market, so I would consider this to be a bullish sign. In thinking about this unusual divergence, I suspect that the huge swing to ETF trading/investing is an influence. The large cap companies are the constituents of the major ETFs. When investors buy and sell based on shorter-term emotions, more than ever, they are using ETFs as their tools. This, in turn, moves the larger cap indices while the smaller companies not in the major ETFs are less affected. With this in mind, it may be that the new highs in smaller companies are reflective of strong business conditions/results while the weaker large cap stocks are reflecting the weaker sentiment and fears that have entered the picture this year. MORE: Why Soaring Small-Cap Stocks Signal Bear Is At BayDivergence Between Small and Large Cap Stocks

Kids and Cable

Most of us have probably noticed our own migration from watching traditional television to absorbing information and entertainment from other sources. “Cord-cutting” is becoming commonplace and the thought of having to plug a cable cord into the back of our televisions is starting to seem as archaic as actually depending on a landline phone. Nowhere is this trend more pronounced than in young people who were born into the wireless age. Just in the past year, viewership of Nickelodeon, Disney Channel and the Cartoon Network is down a whopping 20% and in the past decade (chart below), viewership is down 50%. Take a wild guess where all these viewers are going – this is the poster-child of disruption. MORE: Netflix-Loving Kids Are Killing Cable

Jeff Bezos Annual Letter

Earlier this week, Jeff Bezos’ annual Amazon.com shareholder letter was released. This “Buffettesque” letter is must-read for anyone interested not only in Amazon.com or business in general, but it also sheds light on the disruptive and transformative forces affecting investments and the way we live our lives. It is packed with good ideas and amazing updates related to Amazon.com itself. I could make many comments on the letter, but I will just provide you with the letter itself: Read Jeff Bezos' Annual Amazon.com Shareholder Letter. Once you read the letter, See Why Business Leaders Love Amazon CEO Jeff Bezos' Letter So Much