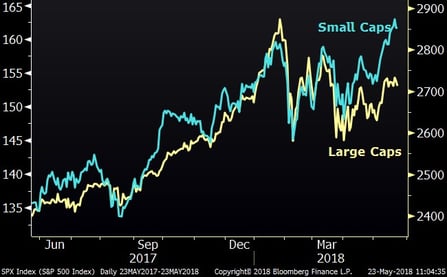

SMALL CAPS AT NEW HIGHS

As you know, the stock market has been a bit weak this year, with the S&P 500 trading about 6% below its January high. Interestingly, small- and mid-cap stock indices have diverged from the S&P 500 and are trading at all-time highs. It would be very unusual for this condition to exist as the market enters a new bear market, so I would consider this to be a bullish sign. In thinking about this unusual divergence, I suspect that the huge swing to ETF trading/investing is an influence. The large cap companies are the constituents of the major ETFs. When investors buy and sell based on shorter-term emotions, more than ever, they are using ETFs as their tools. This, in turn, moves the larger cap indices while the smaller companies not in the major ETFs are less affected. With this in mind, it may be that the new highs in smaller companies are reflective of strong business conditions/results while the weaker large cap stocks are reflecting the weaker sentiment and fears that have entered the picture this year. MORE: Why Soaring Small-Cap Stocks Signal Bear Is At BayDivergence Between Small and Large Cap Stocks

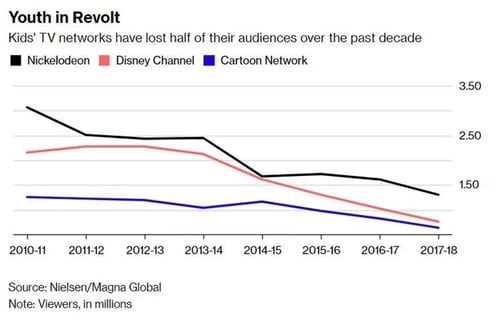

Kids and Cable

Most of us have probably noticed our own migration from watching traditional television to absorbing information and entertainment from other sources. “Cord-cutting” is becoming commonplace and the thought of having to plug a cable cord into the back of our televisions is starting to seem as archaic as actually depending on a landline phone. Nowhere is this trend more pronounced than in young people who were born into the wireless age. Just in the past year, viewership of Nickelodeon, Disney Channel and the Cartoon Network is down a whopping 20% and in the past decade (chart below), viewership is down 50%. Take a wild guess where all these viewers are going – this is the poster-child of disruption. MORE: Netflix-Loving Kids Are Killing Cable

Akron Housing Market is Hot

Whenever I go to Akron, it seems that the economy there weaker than its northern neighbor, Cleveland – maybe I am biased. To my chagrin, Akron recently ranked number one on a list of “10 Surprising Cities Where Bidding Wars Are Booming”… READ MORE