Jeff Bezos Annual Letter

Earlier this week, Jeff Bezos’ annual Amazon.com shareholder letter was released. This “Buffettesque” letter is must-read for anyone interested not only in Amazon.com or business in general, but it also sheds light on the disruptive and transformative forces affecting investments and the way we live our lives. It is packed with good ideas and amazing updates related to Amazon.com itself. I could make many comments on the letter, but I will just provide you with the letter itself: Read Jeff Bezos' Annual Amazon.com Shareholder Letter. Once you read the letter, See Why Business Leaders Love Amazon CEO Jeff Bezos' Letter So Much

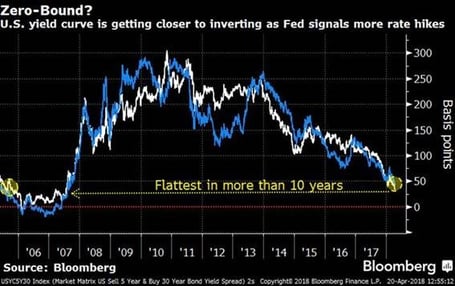

Yield Curve Suggesting Recession?

When volatility enters the market, it is common for market pundits to start talking about things to be worried about and the list of alleged reasons we are entering the next recession grows – some are more legitimate than others. One very good predictor of recessions over time has been the yield curve (Click here to watch a short video on what the yield curve is and its implications). Over time, a negatively sloped yield curve has been a very good predictor of recessions. Recently, as depicted in the chart below, the yield curve has been flattening. In fact, parts of the yield curve are the flattest they have been since 2007. This flattening suggests a mature and potentially slowing economy. The alarms of an inverted yield curve are not yet blaring, but this is something worth paying attention to. MORE: Inversion Angst is Intensifying

Yield Curve Changes (Three Years)

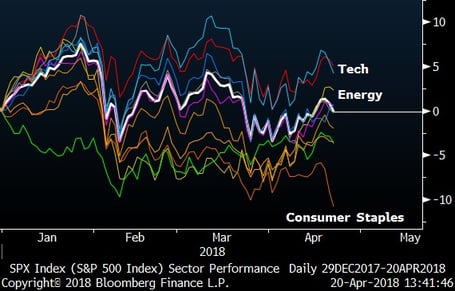

Market Scorecard

2018 has been a fairly volatile year so far. On a sector basis, there has been some dispersion too. As I type this, the market is flat on the year (white line). An outlier on the downside has been consumer staples, which are supposed to be less volatile and “safer” during volatile periods. This time around, fears of higher rates (and other headwinds) have meant trouble for this typically conservative sector. On the upside, tech is still leading the way. The consumer discretionary sector is up too, but guess what? The main two drivers are really tech stocks (Amazon.com and Netflix). One new development is that energy stocks, which have lagged for a while, are also up on the year now.