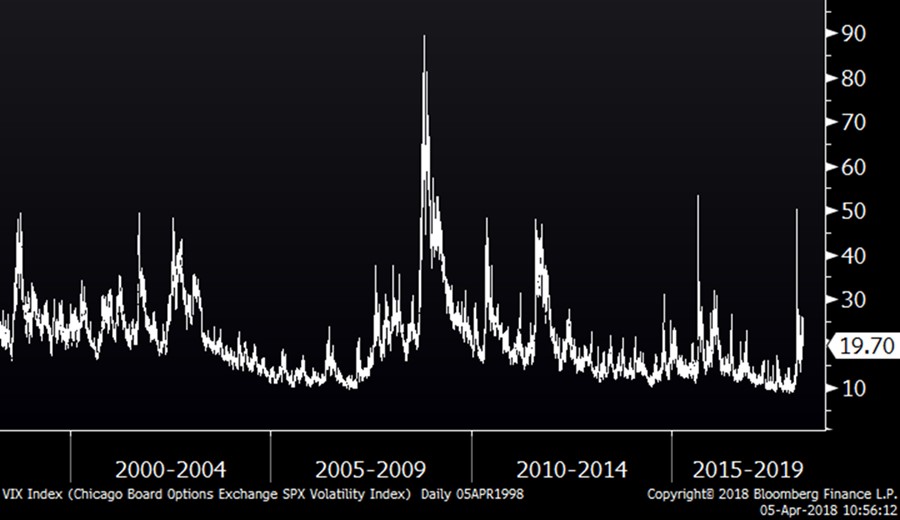

Market Volatility

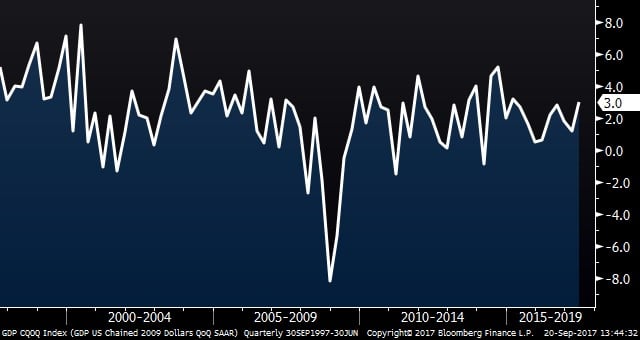

As I have mentioned in previous communications, 2017 was not a “normal” year when it came to volatility. In fact, it was one of the lowest volatility years on record. More normal volatility was bound to return – and it has. To some, this newly found volatility feels unusual, but spikes in volatility like this are very common over time. The chart below shows the Volatility Index over the last twenty years. As you can see, episodes like this have occurred at least every two years on average. MORE: Dueling Tariff Announcements Blamed for Stock Market Volatility