For over twenty years, I have assisted clients in navigating market fluctuations, tax changes, and life transitions. Recently, I have encountered a new challenge: helping clients who do not have a trusted contact listed. In rare situations, it may be necessary to reach out to someone who can check on you if you are unwell or experiencing difficulties.

Most financial plans consider two key points in time: when you're fully able to manage your finances and when someone else legally takes over. However, there is often a vulnerable middle ground where your confidence and understanding can begin to diminish well before any formal diagnosis occurs. This gap may not be addressed in your financial plan, potentially putting your wealth at risk. Furthermore, this issue can be more pronounced for individuals who have no children, close family, or friends to support them.

It may feel like a difficult topic to bring up, but it's a simple fix that can have great impact later. Let's discuss the importance of adding a trusted contact.

What Is a Trusted Contact?

The concept grew out of recent financial regulations designed to help protect investors, particularly older adults, from fraud and financial exploitation.

A trusted contact is someone you authorize your financial firm to contact if they suspect unusual account activity, can't reach you, or have concerns about your well-being.

This is not a power of attorney, which means it does not grant this person the authority to move money, execute trades, or make decisions on your behalf. Instead, they serve merely as a point of contact for your advisor to verify that everything is fine. Most importantly, it acts as a small safeguard that protects the middle ground and can make a significant difference.

Free Planning Resource

A comprehensive checklist to help you organize documents, clarify wishes, and ease the transition for your loved ones. Download the Beyond the Will Checklist

Why Designate a Trusted Contact

Protection Against Financial Exploitation

Elder financial abuse affects millions annually. The FBI reports over $28 billion is lost each year to financial exploitation, with $4.885 billion in losses from fraud complaints in 2024 alone. A trusted contact acts as an early warning system. If your advisor notices red flags, such as sudden large withdrawals, unauthorized transfers, or unusual trading patterns, they can alert your trusted contact to intervene before irreversible damage occurs. This process respects your privacy, as your advisor shares only the necessary information to confirm their concerns.

Support During Incapacity or Health Challenges

Life events such as illness, cognitive decline, or an unexpected accident can hinder your ability to manage your finances. If you do not have a trusted contact, your financial advisor may need to freeze your accounts until legal documentation is provided, which can delay access to funds needed for medical care or other essential expenses.

By designating a trusted contact, you can streamline communication. This person can confirm your status or provide context, facilitating a quicker resolution. Additionally, having a trusted contact can be beneficial in everyday scenarios where regular communication may fail, such as during international travel, if your phone is lost, or if you are temporarily relocated. Your trusted contact can help bridge those gaps, ensuring that time-sensitive matters are addressed promptly.

Safeguarding Your Assets During Vulnerable Periods

Protecting your assets from risks such as fraud is crucial, especially during times of reduced capacity. Having a trusted contact can serve as an essential safety net, particularly during volatile market conditions or major life changes. This simple yet powerful step can significantly help in preserving the wealth you've worked a lifetime to build.

Trusted Contact vs. Power of Attorney: What's the Difference?

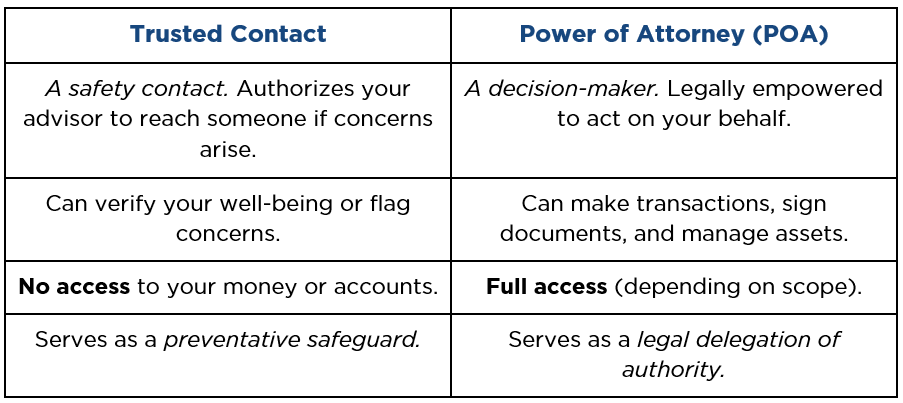

Many clients assume these are the same, but they serve very different purposes.

Both play a role in protecting your financial life, but the Trusted Contact serves as the first line of defense. A simple, proactive safeguard that costs nothing and requires no legal paperwork.

Choosing Your Trusted Contact Wisely

Who should you select as your trusted contact? It should be someone you trust to answer the phone, remain calm in a crisis, and always look out for your best interests.

You don't need to choose the same person as your power of attorney or executor. In fact, separating these roles can create beneficial checks and balances. Some individuals opt for a spouse or an adult child, while others may select a sibling, close friend, or even a professional advisor, such as an attorney or accountant. The most important factors are that this person is reachable and dependable.

In conclusion, reaching out to your advisor to designate a trusted contact is a straightforward task that can provide support and peace of mind for your wealth management and financial plan. To make sure your broader planning is complete, use our free checklist, Beyond the Will, to review the details that help your plan work when it matters.

For informational and educational purposes only.

Carnegie Investment Counsel (“Carnegie”) is a registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. For a more detailed discussion about Carnegie’s investment advisory services and fees, please view our Form ADV and Form CRS by visiting: https://adviserinfo.sec.gov/firm/summary/150488