What We're Watching in November

November has arrived. The leaves may be falling, but equity markets remain supported by strong underlying forces. While investors continue to understand the Fed’s ongoing rate policy, we're keeping our focus on what matters, including capital flows, consumer strength, and the risks quietly forming below the surface.

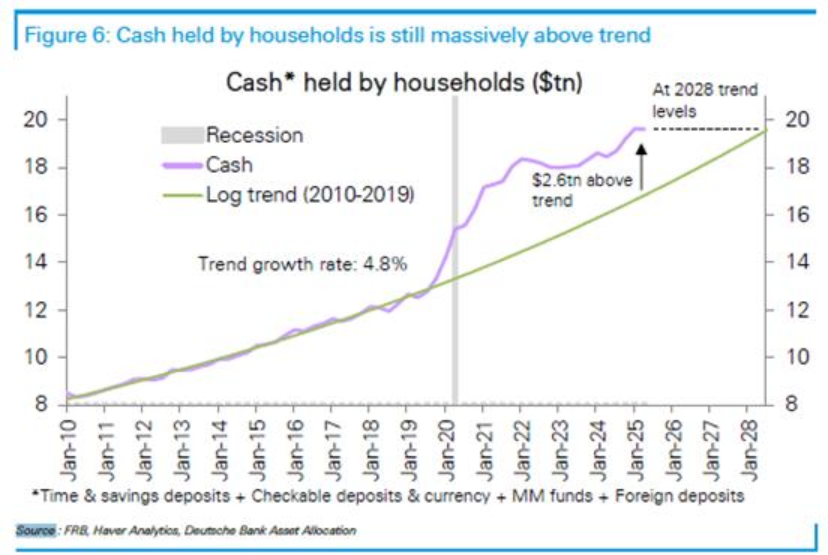

Cash on the Sidelines: A $20 Trillion Backdrop

Liquidity remains an underappreciated driver of today's market. One of the more surprising statistics: there’s now over $20 trillion in cash sitting across various financial instruments in the U.S. alone. While this is not poised to rush into equities, the sheer scale is important, which represents dry powder and confidence in the financial system. We are now tracking above long-term liquidity trendlines, nearly three years ahead of schedule. The market still has fuel if some of that cash comes into the stock market as interest rates are poised to decline further.

Chart of the Month

Steady Consumers, Solid Balance Sheets

Despite concerns about inflation and borrowing costs, consumers and corporate balance sheets remain historically strong. Default rates have ticked up slightly, but not alarmingly so. Some banks, like Morgan Stanley, set aside zero for loan loss provisions this past quarter, while others, such as JPMorgan, are remaining more cautious. We interpret this as a market bifurcation in which high earners continue to spend, while the lower-income brackets remain under pressure. That’s not a new development, but one that still tells how we assess market resilience.

Earnings Season: A Quiet but Confident Start

Earnings results, especially from the major banks and mega-technology companies, have been encouraging. Financial institutions are reporting healthy trading and lending activity, with future anticipated loan losses contained. The large technology companies posted solid results for the past quarter and continued high expectations going forward. With a large portion of 401(k) contributions flowing into index funds and, by extension, into the largest companies (including the Magnificent 7), this structural tailwind continues to provide upward pressure on market valuations and returns.

Private Credit: The Black Box of the Market

We are closely monitoring developments in private credit. Although we are not investing in the asset class, it has become popular, attracting trillions in capital and marketed as an alternative to traditional bonds and even equities. Yet, the opacity of many private credit structures remains a significant risk. With recent bankruptcies involving several auto parts and lenders using questionable accounting practices, we’re reminded of the risks embedded in vehicles that aren’t transparent or easily examined by regulators or investors.

Is There an AI or Quantum Bubble? A Look at Speculative Euphoria

The enthusiasm around artificial intelligence and quantum computing is real and so is the spending. Many of the largest players, like Microsoft, Amazon, Meta and Google, are funding their AI ambitions through free cash flow. But others, such as Oracle, are now taking on debt to support their efforts. This shift in financing raises questions about sustainability if profitability doesn’t materialize.

Meanwhile, smaller companies tied to critical minerals (so-called “rare earths”) or quantum computing themes are seeing explosive returns, some going from mere cents to double-digit share prices in under two years, with correspondingly large percentage increases (and plenty of volatility). These moves are reminiscent of previous bubbles. Whether this is speculative excess or the start of something transformational remains to be seen. Either way, it’s a reminder that while innovation is exciting, discipline remains essential.

The 401(k) Effect on Market Concentration

This month’s featured chart focuses on the impact of 401(k) flows on market structure. With the average U.S. worker contributing roughly $8,500 annually to a 401(k), and 71% of that allocated to equities, approximately $6,000 per person is funneled into the stock market every year, much of it through passive index funds. Considering that the Magnificent 7 make up around 40% of the S&P 500 Index, the result is clear: passive flows are a powerful force pushing large-cap tech higher, regardless of fundamentals.

Factor in share buybacks and corporate M&A activity that reduce the overall stock supply, and the result is a structurally supportive environment for the major indexes. ETFs are required to remain fully invested, unlike traditional mutual funds that once held cash reserves, meaning those inflows must be allocated and quickly.

Final Thoughts: Staying Selective in a Crowded Market

With ETF inflows passing the $1 trillion mark this year and fewer shares available due to buybacks and acquisitions, investors face a paradox: more money chasing fewer opportunities. This helps explain why markets remain elevated even in the face of geopolitical and macroeconomic uncertainty.

At Carnegie, we’re focused on identifying true value amid the noise. Whether it's avoiding opaque private credit deals or assessing whether AI-linked companies are genuinely creating durable growth, our approach remains consistent: seek clarity, maintain discipline, and think long-term. We appreciate your continued trust and will keep a close eye on these market forces as we approach year-end. In the meantime, we hope your November includes more turkey than turbulence.

This commentary is for informational and educational purposes only and includes general economic and market conditions. Forward-looking statements cannot be guaranteed. Past performance is not a guarantee of future results. Data and other market and economic information referenced is from sources believed to be reliable and opinions are subject to change. All investments involve risks, including the loss of principal.

References to indices:

An index is a portfolio of specific securities (such as the S&P 500, Dow Jones Industrial Average, and Nasdaq composite), the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. Past performance is neither a guarantee nor indicative of future results. Reference to the “Magnificent 7” is for educational and information purposes only and not a recommendation to purchase the securities. The Magnificent 7 stocks are seven of the world's biggest and most influential tech companies: Apple, Microsoft, Amazon, Alphabet (Google's parent company), Meta (formerly Facebook), Nvidia, and Tesla. These companies are known for leading the way in industries like artificial intelligence.

Carnegie Investment Counsel (“Carnegie”) is a registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. For a more detailed discussion about Carnegie’s investment advisory services and fees, please view our Form ADV and Form CRS by visiting: https://adviserinfo.sec.gov/firm/summary/150488.

You may also visit our website at: https://www.carnegieinvest.com.