Stock Market Contest

Now is the time of year where people like to make predictions about the coming year,

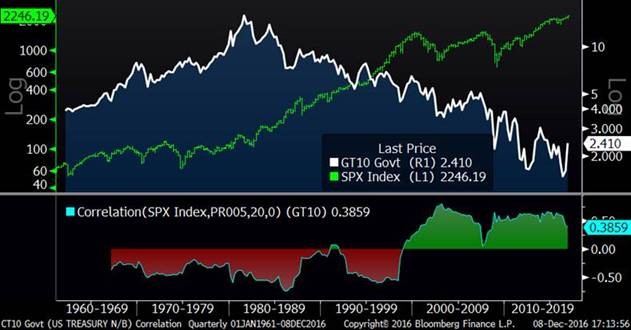

so please make your guess for the 2017 (12/31/2017 closing price on S&P 500) stock market contest by responding to this email or clicking here. You must respond before the next blog, which will likely be next week. I hope many of you answer so we can have some “big data” on this subject matter. Here is a five-year chart of the S&P 500 to help frame your guess:

S&P 500 (Five Years)

Congratulations to Todd Maugans, the 2016 winner who guessed 2240 – the S&P 500 ended up at 2238.83, so he was very close. Interestingly, last year, the blog readers were somewhat bearish, guessing only a two percent rise in the market. It turns out that the market beat 97% of your guesses (see chart below). Last year’s guesses were split into two distinct groups, although even the bullish group mostly underestimated the end result. I have some theories on how this year’s guesses will turn out, but I will keep those to myself so I do not bias you.