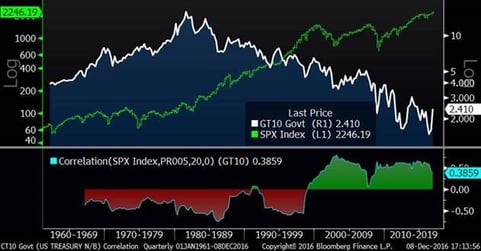

Interest Rates and Stocks are Positively Correlated

Contrary to the theory we all learned in ECON 101 about the relationship between interest rates and stock prices, (watch this video for a simple overview of the theory), the longer-term correlation between stocks and interest rates has been POSITIVE for almost 20 years. Take a look at the chart I created below. In this chart, the top shows the S&P 500 against 10-year U.S. Treasury rates, the bottom shows the trailing 20-quarter correlation between the two. Interestingly, there was a clear change in 1998, when stocks and interest-rates began to move more in tandem. I would love to hear theories from the readers as to why this change occurred. Here are a few related thoughts and observations:

- During and after bear markets the correlation has tended to rise. This makes a lot of sense to me, since as the economy weakens, rates tend to fall and so does the market. As the market recovers, the economy soon follows suit. As a result, rates tend to rise and the two instruments move together.

- This change occurred at the same time the internet and all the related financial market efficiencies came to the table. Is this a coincidence, or is there something about technology that has fostered this change?

- This changed occurred after rates dropped below about 4%. Are stocks and rates negatively correlated when rates are higher, but positively correlated in a low rate environment?

- Was there a change in monetary policy that began in 1998?

- Is this “new normal” likely to persist, and is it a good thing or a bad thing?

Interest Rates and Stocks (Since 1960)

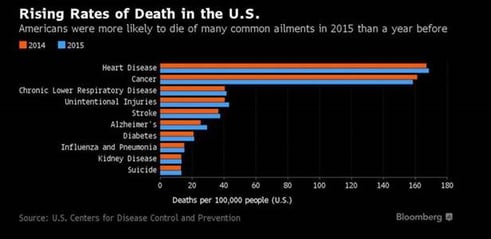

Rising Death Rates

Interestingly, death rates for many common causes of death rose last year, and people born last year had a lower life expectancy than those born a year before. The one exception was cancer, which is good. I believe (and hope) that the coming revolution in technology will meaningfully reduce some of these figures. For example, A.I. (click to learn what A.I. is) powered autonomous vehicles have the potential to dramatically reduce deaths resulting from automobile crashes. Just yesterday, there was a 70 car pileup locally; with A.I. driven cars, that would have been completely or mostly avoided. Another example would be that A.I. and deep learning will significantly change the landscape of medical research and treatment, thereby reducing cancer rates and otherwise. Watch: Watson Joins Cancer Fight

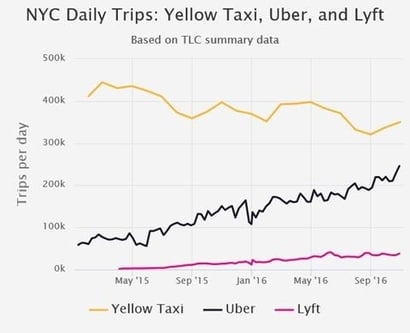

Uber

Less than two years ago, I rode in my first Uber in NYC. At the time, it felt like a novel idea. Now, like many Americans, I Uber (yes, it is so popular it has turned into a verb) frequently, especially when in other cities. Check out the chart below which shows the adoption of Uber in NYC in just 18 months. My guess is that this is reflective of other places in the U.S.. The other amazing thing is that if Uber is doing 250k trips a day in NYC, that equates to around $2 billion in revenues – perhaps at a loss – for Uber in New York alone. This is yet another example of new technology or at least new uses for technology changing the landscape. Related: Ten Lessons Startups can Learn from Uber