Island in the Sun

One of the visions of Tesla CEO, Elon Musk, is to develop affordable and efficient technology that will enable people to live without the electric power grid. To do this, he is using solar panels (Solar City) to generate the energy and Tesla lithium-ion battery packs to store the energy. It seems far-fetched to many, but Tesla/Solar City is already powering an entire island, albeit a small one, in American Samoa that formerly used diesel generators -- Check out this Video

Millennials are Happy

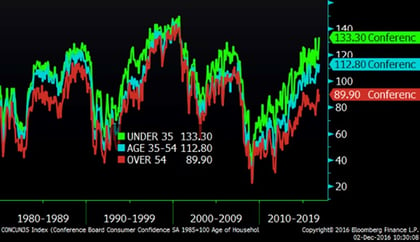

The chart below shows consumer confidence since 1980 for three groups of people – those under 35, 35-54 and 55-plus. While younger people have always exhibited higher levels of consumer confidence, since the last recession the gap has expanded measurably to its highest level ever. It is not clear exactly why this is happening, but I wonder if technology has something to do with it. Since 2009, there have been incredible advances in technology, many of those advances – the sharing economy would be one example – have been beneficial to consumers by allowing goods and services to be cheaper and more efficiently acquired. There are also many new ways to make money without going to a “job” from 8 to 5. Which age group has adopted these changes and benefitted the most? Millennials, of course. Many older people have not participated as much in the new economy, are more likely to be on a fixed or limited income and have been negatively affected by healthcare costs, as one example. Going forward, this rising gap in confidence might be a good thing as millennials become an increasing influence on the economy and the baby-boomers decline. I welcome any input you might have on this subject. RELATED: Millennial Confidence is Powering our Economy

Consumer Confidence by Age (since 1980)

Global Wealth

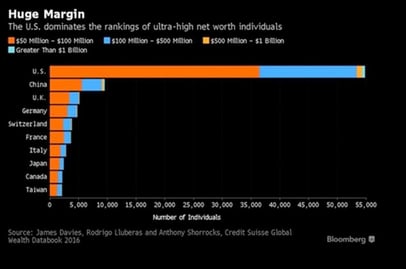

Anyone who has travelled to other countries can plainly see that there is a lot of wealth being created, especially in places like Dubai, India, or China. With that in mind, the chart below is interesting. It shows that the U.S. still dominates the world in the number of ultra-high net worth individuals. I would guess that if we looked at a derivative – namely the rate of change over the past 20 years – that other countries like China are growing their ultra-high net worth ranks faster than we are. RELATED: The World's Billionaires

Oil Rig Count

As you may know, energy has rebounded and as shown below, the U.S. oil rig count has been increasing steadily since June. Of course, back then, very few people predicted a rebound in rig count. The first chart shows the rebound in rig count – this is how the media has been typically projecting it. The second chart shows the exact same data over a different timeframe; in reality, while rig count is indeed recovering, it is still dramatically lower than a few years ago. (Bloomberg made these charts, so please excuse the “then” instead of “than”) RELATED: How Crude and Natural Gas Rig Counts Affected Natural Gas Prices