Jaguar and Shell Join the IoT Party

If I had told you a few years ago that Jaguar, Apple, Royal Dutch Shell, PayPal and a host of other behind-the-scenes technology companies teamed up to create a new product, you would not have believed me. The line between industries and sectors is becoming more and more blurred, as evidenced by an announcement yesterday that consumers will now be able to buy fuel from the dashboards of their cars via their Apple Pay or PayPal accounts. This is the latest in a countless number of new Internet of Things offerings that are changing the world we live in. Read More: Jaguar Launches In-Car Payments at Shell Stations.

This just the beginning. Before long, this technology will be in every car and the applications will expand. Consumers will be able to pay from their dashboards for pretty much anything that relates to being in your car and consuming something – parking lots, toll roads, restaurant drive-throughs, bridges, car washes, drive-in movies (ok, well, maybe they will not adopt this technology, but you get the point). This is just one minor example of the vast changes occurring because of the Internet of Things, Big Data and other new technologies. Even this minor new development can affect many things, but since this is a market related blog, here are a few investment related influences: More Big Data usage, revenue for payment processors, potentially better margins for merchants, less credit card theft (gas stations are a significant source of lost and stolen cards when people leave them on the pump), revenue for IoT sensor companies, more wireless data (good for tower companies and data providers). Of course, all of this technological change comes with downsides, one of the biggest being potential job displacement.

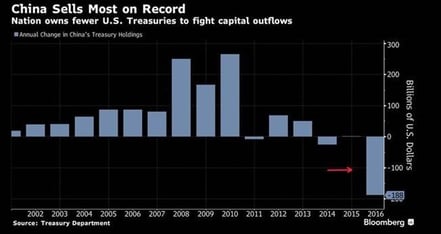

China Selling U.S. Treasuries

For many years, China had an insatiable appetite for U.S. Treasuries, for a number of reasons that would require a white paper to thoroughly explain. As you can see in the chart below, 2016 was much different. As interest rates rise in the U.S., it can encourage capital to leave China. China, which is the second biggest economy on earth, is then encouraged to sell their massive U.S. Treasury reserves to offset the capital outflows from their home country. Looking back at Econ 201, their selling of U.S. Treasuries should then have a negative impact on U.S. Treasury prices and thus a positive effect on our rates, which in turn hurts them more – a vicious cycle. The question is – how much influence do they really have on our Treasury rates? In any event, this change in behavior is something to be aware of. MORE: Higher Rates Could Spell Trouble For China

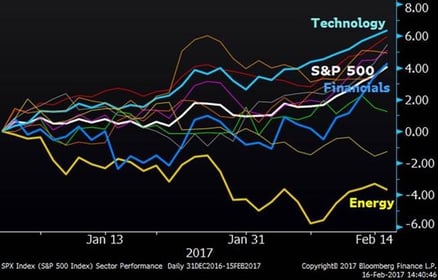

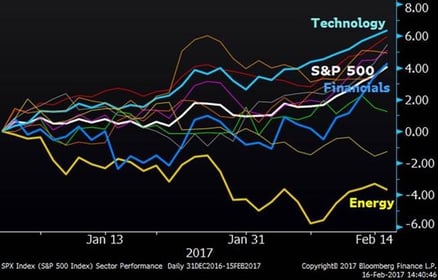

Sector Performance

So far this year, the market has experienced quite a bit of sector dispersion as illustrated in the chart below. There are a few interesting moves. For one, the S&P 500 is up 4%, which is a very strong start to the year. Technology is leading the pack and has had a very consistent move higher. Financials, which many anticipated would be a leader this year are in-line with the S&P 500 after a strong past week. And, interestingly, energy has been a negative outlier, down 4% already this year. So, what is going on with energy stocks? Does the market think oil prices are going to drop, did the stocks get ahead of themselves, or are people thinking that renewable energy sources are taking hold?

Sector Performance (YTD)