There are countless articles about the election, how it happened, why the pollsters were wrong and many other election related issues. As I always try to do, I will remain apolitical and will try not to regurgitate the same things you can read in the paper (paper is now a figurative term since so few people actually read the newspaper these days) and will offer my observations on the stock market on this crazy and perhaps confusing day.

Leading up to the Election

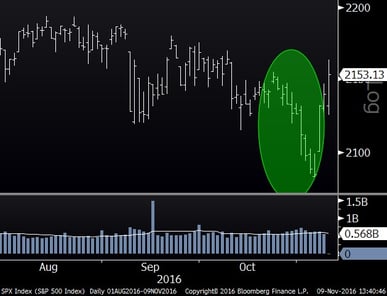

Over the last couple of weeks, the market was trading lower and at one point had the most number of down days in a row since 1980 (Read More: S&P 500 Logs Longest Losing Streak Since 1980). This orderly move downward was likely due to investors reducing risk leading up to the election. I do not believe the move was necessarily about who they thought would be president, but more about the fact that a large unknown was on the horizon. When investors face the unknown, they sell. Just eliminating that unknown, even if it is perceived as bad news, can often lead people to “get back in”. As we approached the election, the market believed clarity was increasing and that Hillary Clinton would likely be President. Thus, the market had two strong days leading up to the election. Going into this, most in the financial media believed that it was a foregone conclusion that Clinton would win and the prevailing prediction was that once she won, there would be a relief rally and investors would be happy. Very few thought that Trump would win and if they did, they would likely have thought the market would react very negatively.

Longest Losing Streak Since 1980

Last Night

Before last night, investors around the world had all bought into (some literally) the idea that Clinton would win the election. While some might have been waiting for this to actually happen before buying back in, most were comfortable in their positioning with the expectation of a Clinton win. Suddenly, as Trump began to win, U.S. market futures nosedived. By the time it was clear he would win, futures were limit down (Click to Learn about Limit Down), which essentially means that they were down so much that regulations prevent them from moving down any further. This is the type of thing that usually only happens during crises. In 2008-2009, this happened several times. The dramatic move in futures indicated that the U.S. stock market would move down at least 5% and that today would end up being a blood bath. Large market participants including international entities were following the old adage “shoot first, ask questions later”. Related: Icahn Leaves trump Victory Party to Bet $1 Billion on Stocks

Today

By the time the market opened today, futures were within a percent or two of flat and momentum had changed; the reversal was the biggest since 2008-2009. Investors had collected themselves from the initial emotional response and had begun to process what this all means and where to go from here. Since there are so many cross-currents, I thought I would work through the sectors and their moves today. You might be thinking, “why is XYZ stock up or down so much today?”, so hopefully this will help answer that question:

-

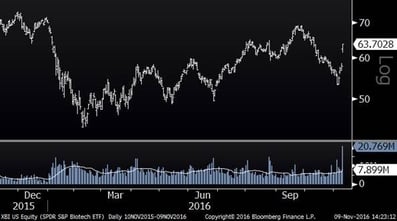

Health Care

This is an obvious one. I had expected a relief rally in this space after the election no matter who won. Clearly there was a cloud over this sector and it was under the microscope during the campaign period. With a Trump victory, investors believe much of that scrutiny will dissipate, which is good for health care stocks. Pharmaceutical and Biotech stocks are up strongly across the board with even large, low volatility stocks up over 10% in some cases. The exception to this strength is the hospital and medical device space. The S&P Biotech ETF (XBI), below, gapped up more than ever today and experienced its biggest volume in history:

S&P Biotech Index (XBI) – One Year

-

Financials

Financials are all up strongly today, with large banks up in the 5% range. Investors believe that Trump will mean less banking regulation, and therefore higher profits for banks. Additionally, rates are higher today on the election news, which is typically good for financial stocks. -

Staples/Utilities/REITs

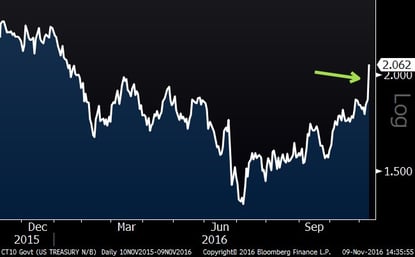

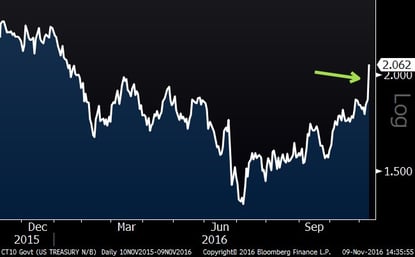

Interest rates are up today on the prospects of better economic growth and probably because there is a shift out of bonds. Regardless of whether Trump's policies are perceived as good or bad for these sectors, higher rates trump that that idea. Thus, the interest-rate sensitive stocks are down across the board. In the chart below, you can see today’s big move higher in rates:

10 – Year Treasury Yield (One Year)

-

Industrials

For the most part industrials are very strong today. Particularly strong are the defense and railroad stocks. Defense stocks are up because investors believe Trump will increase defense spending (duh), and railroad stocks are up as a derivative of the fact that investors believe that Trump is friendly to things like coal. Coal and other materials that Trump is friendly to are important to the rail industry. Most other industrials have joined the party as the day has progressed and the idea of more economic growth has infiltrated the minds of investors.

-

Energy/Materials

These stocks are strong today for a couple reasons. A) Trump is friendly to energy and materials companies, B) Expectations for higher economic activity means higher demand for materials and energy, and therefore higher profits for these companies.

-

Technology

Tech is somewhat mixed today and as crazy as the day is, it is a pretty normal day for technology. This makes a lot of sense to me.

-

Other

Stocks that are reliant on government subsidies and environmentally friendly policies are down today. Tesla is the poster-child for this phenomenon and is down roughly three percent.

When you add this all up, the market (as of 2:46) is up about 1.5% and the sectors one might have guessed that Trump would benefit are all up. Now it all makes sense, right? From a political standpoint, we have clearly entered a new era, good or bad. Whether today reflects a change and new era for the stock market or whether it is a one day adjustment of expectations is up for debate. When there is such a dramatic change in sentiment overnight like this, however, it is not unusual for it to be an inflection point…we’ll see. This is hard to believe, but if the Dow closes where it is now, it will be an all-time high close for the Dow Jones Industrial Average: