Stock Market Contest

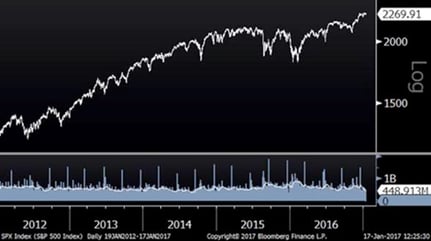

Now is the time of year where people like to make predictions about the coming year, so please make your guess for the 2017 (12/31/2017 closing price on S&P 500) stock market contest by responding to this email or clicking here. You must respond before the next blog, which will likely be next week. I hope many of you answer so we can have some “big data” on this subject matter. Here is a five-year chart of the S&P 500 to help frame your guess:S&P 500 (Five Years)

Congratulations to Todd Maugans, the 2016 winner who guessed 2240 – the S&P 500 ended up at 2238.83, so he was very close. Interestingly, last year, the blog readers were somewhat bearish, guessing only a two percent rise in the market. It turns out that the market beat 97% of your guesses (see chart below). Last year’s guesses were split into two distinct groups, although even the bullish group mostly underestimated the end result. I have some theories on how this year’s guesses will turn out, but I will keep those to myself so I do not bias you.

Wall Street Strategist Predictions

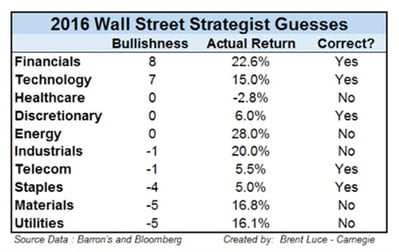

Wall Street strategists tend to guess that the market will be up 8-11% in a given year, which is roughly how the market has performed on average over the years. It rarely has an “average” year, but 2016 was pretty close. As such, the top Wall Street strategists did better than normal on their S&P 500 guesses. They also guess which sectors will be the strongest and weakest. I tabulated their results and in the table below; 10 represents the most bullish level possible and -10 represents the most bearish possible viewpoint. In looking at their guesses, they were correct on their guesses related to financials and technology in particular, and completely missed the mark on energy, industrials, materials and utilities…there is always next year, right? MORE: Wall Street's Annual Stock Forecasts: Bullish, and Often Wrong.

Interest Rates

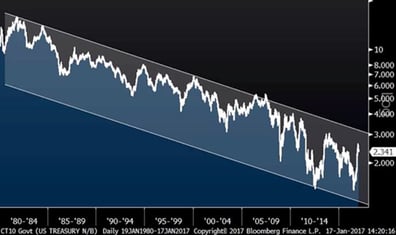

There has been a lot of talk about the recent spike in interest rates and most believe that we have begun a new uptrend after 35 years of decline. While it may be true that interest rates have bottomed, an uptrend in its simplest form is defined as a period of higher highs and higher lows. If you look at the long-term chart below, the 10-year U.S. Treasury yield has not yet broken the downtrend.

10-Year U.S. Treasury Yield (Since 1980)

Factoid

Amazon is now worth more than Macy’s, Kohl’s, Sears, JC Penney, Nordstrom, Best Buy, Barnes & Noble, Dillard’s, Gap and Target COMBINED. Very few people would have guessed that would happen when it first went public almost 20 years ago.

Domino’s > Google?

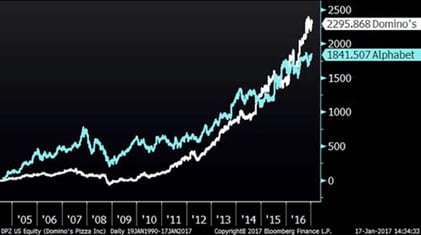

If we were playing “market trivia” and someone asked 1,000 people to name one stock that has outperformed Google since 2004, zero would say Domino’s Pizza. Surprisingly, since its IPO, Domino’s is up 2300% compared to 1840% for Google (chart below). More on the Success of Domino's Pizza

Domino’s vs. Google (Since Domino’s IPO)