Shark Week

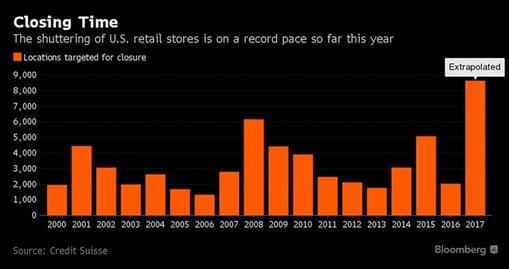

As some of you know, I was away on my annual family trip to Cape Cod last week, which is why it has been longer than usual since you received your last blog from me. This is not market related, but since it is “Shark Week”, I thought I would share my own shark related story. Back in 1972, after a dramatic decline in population, the U.S. government banned the killing of seals. Since then, not surprisingly, the seal population in Cape Cod has blossomed. Cape Cod is a perfect place for them because the entire outer beach is protected by the National Seashore, and as such, there are no houses and only sparsely populated beaches with miles of empty beach in between. In the past several years, as more and more seals are on the beaches, it has attracted a new wonder of nature – the Great White Shark. I guess what is happening is sort of like the market or economy, except it is Mother Nature’s economy. Humans have altered the supply and demand equation, and now that we are protecting the seals, we have increased supply to the point that the consumer (Great White Sharks) have identified an easy to attain product that they demand.

Just a few years ago, seeing or hearing about a Great White in these waters was uncommon. Today, there are verified sightings of them virtually every day on the Cape. Anyhow, on one of the “perfect” beach days we had last week, as we were boogie boarding on the relatively small waves, the lifeguards sounded off three blasts of an air horn. The result was a scenario right out of the movie “Jaws”. Everyone frantically ran out of the water as quickly as humanly possible – I wish I had recorded it, as that video would have gone viral. Sure enough, there was a Great White Shark only 50 yards offshore spotted by the shark plane; they actually fly planes up and down the coast looking for sharks. The sighting was followed by a tagging boat from which a scientist was throwing what looked like a spear into the water in effort to tag the Great White. So far, they have tagged almost 200 of these things off the Cape and they are constantly tagging more of them. The screenshot from my phone below shows a map of the confirmed unique Great White Shark sightings just in the past month: