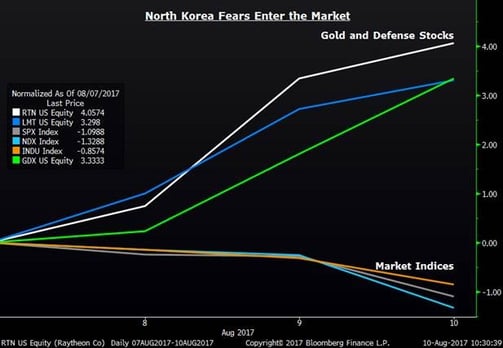

Market Weakness

Fears related to North Korea have knocked stocks out of the relatively flat range they have been in over the past few weeks. This fear is evidenced by the fact that almost all stocks are down, while defense stocks and gold are climbing higher. Although this is the biggest drop the market has seen since May, this “North Korea thing," is barely a blip on the radar screen (so far) as far as the market is concerned. Looking back, it has been almost a year and a half since the market has seen even a five percent correction. We know that the market dislikes uncertainty, so stay tuned…

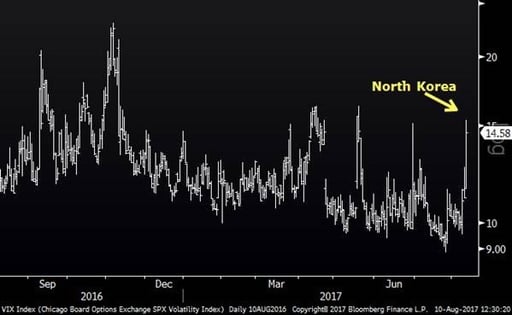

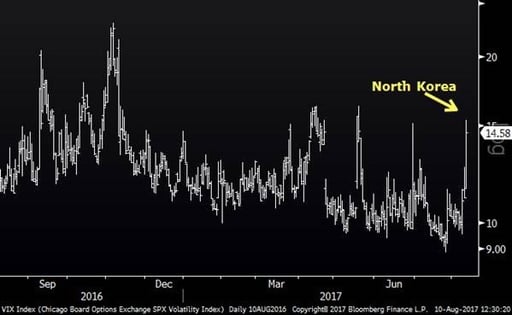

VIX Spike

Another measure of fear, the VIX Index is also spiking today and is up over 50% in three days. The VIX is a measure of expected volatility within the market over the next 30 days. It tends to spike when fear hits the market. The spike we are seeing today clearly reflects fear, but nowhere near the magnitude of past major market events. When it spikes to very high levels (not there yet), it is usually a buy signal.

VIX (One Year)

Tesla Model 3

The long-awaited Tesla Model 3 has finally arrived. Making a high-quality electric car for the masses has been a long-term goal for Elon Musk and Tesla. The Tesla Model 3 reflects just that. While there are still many unknowns and question marks surrounding Tesla as an investment, many are referring to the Model 3 release to be the “iPhone moment” for the auto industry. There is no question that this vehicle is a leap toward the future and driving it is a very different experience than driving a traditional car. These cars are said to contain only eighteen moving parts compared to thousands of parts in our traditional internal combustion driven vehicles and they are now quicker and more fun to drive, too. If you think about the current vehicle fleet, we have been driving around in internal combustion engines for over 100 years – have we finally reached an inflection point for electric vehicles? If so, this will have broad reaching investment implications. RELATED: The Electric Vehicle Takeover? Think Different