Cryptocurrencies

Two weeks ago, I talked about bitcoin in my blog. Here is what I said:

If you did not read this in the last blog, I encourage you to click on the Ted Talks link: How The Blockchain Will Radically Transform The Economy. In just two weeks since writing the above commentary, bitcoin has increased another 80% and the biotech company I referred to has doubled again – pretty crazy, huh? The Cryptocurrency craze has hit every demographic in America. I have had 87-year old retirees all the way down to my sixteen-year old daughter ask me about it. My daughter, who alleges I owe her $400, wanted to buy bitcoin with it, and now says I owe her $900 because of her lost opportunity cost. Beyond Bitcoin, numerous other cryptocurrencies have emerged as household names including Ethereum, Litecoin, Ripple along with many smaller ones. Bitcoin is now traded on the futures exchange and there are multiple filings for cryptocurrency ETFs in the works, along with many private investment partnerships. Here is a recent chart on bitcoin:

Bitcoin (One Year)

Low Volatility

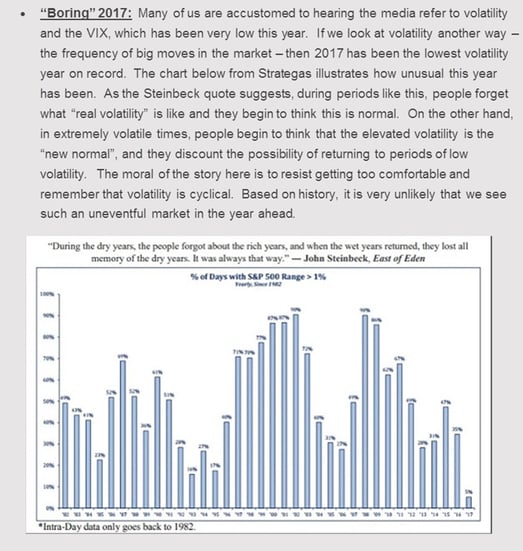

As we approach the end of the year, many people are wondering what to expect in the coming year and some may be getting comfortable or complacent. With this in mind, I thought it would be good to flash back to the 9/20/17 Carnegie Market Blog (I specifically like the Steinbeck quote and its relevance to financial markets):

2017 Wall Street Forecasts

Looking back at the Wall Street Strategist forecasts for 2017, it was pretty much as usual. With the exception of one analyst, they had a very narrow band of guesses for the S&P 500, centering around 2350. Those guesses are currently wrong by approximately 14%. They always seem to guess it will be an “average” year, but the market rarely is average. In reality, there are usually a cluster of above average years and then a few terrible years, which create an average that rarely occurs. On the interest rate side, they overestimated interest rates (AGAIN!), with every single one of them overshooting – maybe 2018 will finally be the year they are wrong on the low side? Sector wise, every single sector in the market is up in 2017 except one. Each of the strategists came up with a list of sectors to avoid – not one of them thought we should avoid energy, which is the one down sector. On the positive side, Technology has been the clear winner this year from a sector standpoint. Only three of the ten strategists recommended technology at the beginning of the year as one of their favorite sectors. The moral of the story here is that it is good to know what consensus is and that consensus is rarely right. The forecasts below are from the annual Barron’s roundtable and came out in late 2016.

This might be the last blog of 2017. If so, I hope and your families have a wonderful holiday season and a happy New Year!