BITCOIN

The bitcoin craze continues. As of today, bitcoin is valued at almost $10,000. This is up from about $800 at the beginning of the year and $20 in 2013. There are many of people who believe this is a great investment, others who think it is a massive speculative bubble, and more who have no idea what the deal is with Bitcoin or blockchain. Last month a publicly traded biotech company decided to change its name to include the word “blockchain” change their focus to “buying cryptocurrency and blockchain businesses”. That change alone caused the stock price to quintuple in a short time. While Bitcoin itself may or may not be in a speculative bubble, the technology it is built on, blockchain, is quite promising. Blockchain technology has wide implications and may turn out to be an integral piece of the technology revolution we have entered. Here is an interesting and non-technical TED Talk explaining How The Blockchain Will Radically Transform The Economy

Bitcoin(Since 2010)

THE FOUR

Thinking about the new paradigm in technology, here are few interesting facts from Scott Galloway’s “The Four” – a book where he discusses Facebook, Amazon, Apple and Google and why they are the most important companies in history:

- One of every six minutes spent online is spent on Facebook.

- One of every six queries on Google has never been searched before.

- Facebook is worth $23,000,000 per employee – GM is worth $290,000.

- 55 percent of ALL (not just online) product searches start on Amazon.com.

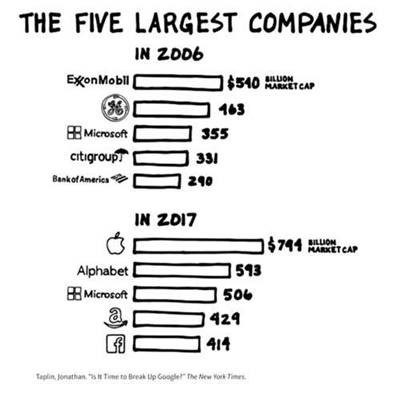

- Here are the largest companies in 2006 versus 2017:

Brick and Mortar Comeback?

There have been a number of traditional B&M retailing stocks that have rallied lately. Most of these have been crushed in the past year or two and were written off as being victims of Amazon. The question is whether the market has overreacted and there is actually good value in these stocks, or whether this is a “dead cat bounce”? On a related note, shares of Wal-Mart have been very strong because the market believes they are doing a good job defending themselves against Amazon and have been making great strides in their e*commerce presence. RELATED: Walmart and Best Buy Challenge Amazon Successfully