Where has the blog been?

It has been three weeks since the last blog and wherever I go, people are asking where the blog has been. Fear not! The blog is alive and well, and so am I! We were dealing with some technology difficulties, but if you are reading this, then it means those issues have been solved.

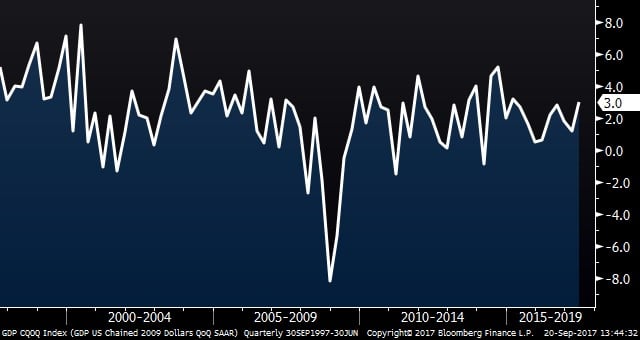

GDP

Don’t look now, but most economic indicators are pointing to a strong economy. U.S. GDP, for example, was up 3% in the second quarter, hitting the long-term target set by the President. There are many things to worry about and many reasons why people think the economy should be weak, but most major indicators, including the stock market, say otherwise. These strong numbers, of course, increase the chances of future interest rate hikes from the Fed, although rates on the 10-year Treasury have been dropping. MORE: Second Quarter GDP Hits Target

GDP Growth (20 Years)

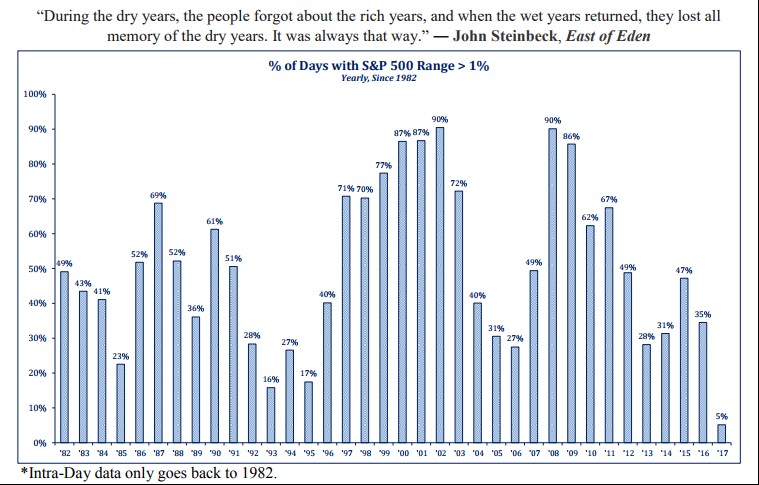

“Boring” 2017

Many of us are accustomed to hearing the media refer to volatility and the VIX, which has been very low this year. If we look at volatility another way – the frequency of big moves in the market – then 2017 has been the lowest volatility year on record. The chart below from Strategas illustrates how unusual this year has been. As the Steinbeck quote suggests, during periods like this, people forget what “real volatility” is like and they begin to think this is normal. On the other hand, in extremely volatile times, people begin to think that the elevated volatility is the “new normal”, and they discount the possibility of returning to periods of low volatility. The moral of the story here is to resist getting too comfortable and remember that volatility is cyclical. Based on history, it is very unlikely that we see such an uneventful market in the year ahead.

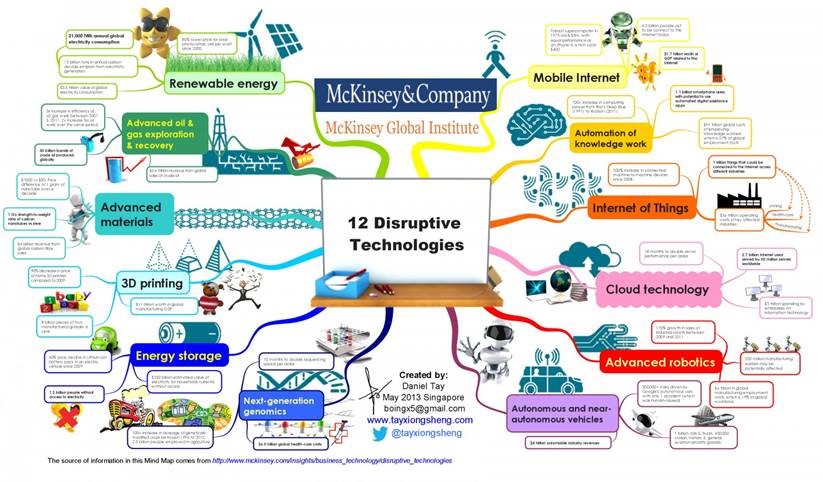

Disruption

I came across the infographic below from McKinsey. It does a great job of visualizing the landscape of disruptive technologies. Artificial Intelligence and related technologies are behind most of these. If you look back at the best performing tech stocks over the past few years, almost all of them are involved in one or several of these technologies.

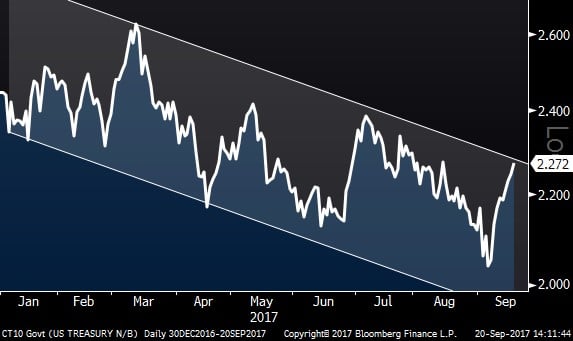

Interest Rates: Gurus who predict future moves in interest rates have been predicting that interest rates would start moving up since 2009. So far, they have been dead wrong. The charts below show interest rates from three perspectives, short-term, medium-term, and long-term. No matter how you look at it, the trend has been down. Betting against this downtrend has been wrong.

Interest Rates – Year-To-Date

Interest Rates – Five Years

Interest Rates – 30 Years