What We're Watching in December

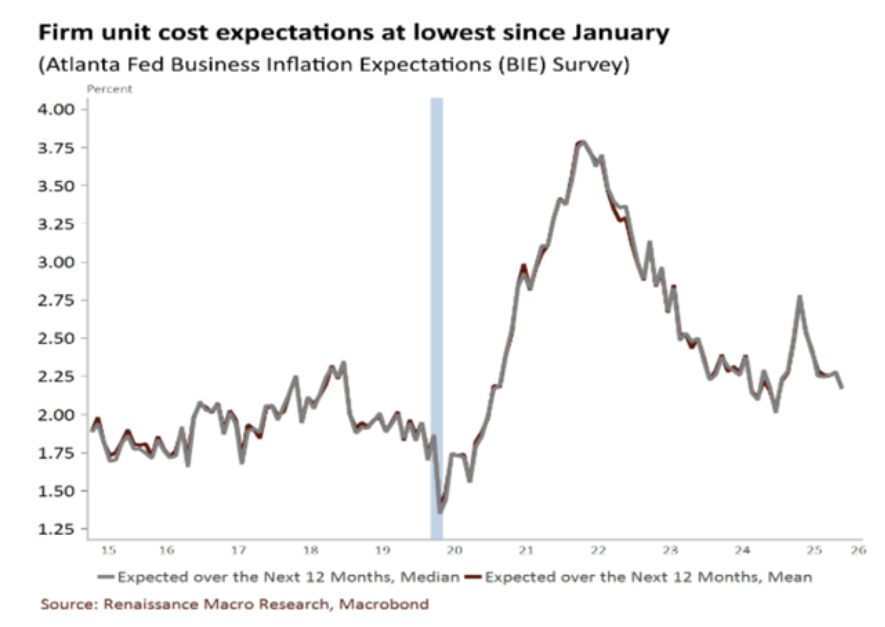

With only a month to go before the end of 2025, the financial markets experienced unexpected twists and turns that many didn’t expect during the year. Seasonal trends were cast out the window, economic signals sent mixed messages, and the promise of an AI boom was continually met with skepticism. In the face of this, we at Carnegie continue to focus on clarity, balance, and long-term discipline. From Fed policy and AI spending to the real story behind inflation, here’s what we’re watching closely as the year draws to a close.

-3.png)