What We're Watching in April 2025

Tariffs: A Familiar Headwind with New Implications

Tariffs are once again making headlines — and history offers important perspectives. In 2018, during the first Trump administration, when tariffs were first introduced on a wide scale, markets reacted with caution but quickly digested the implementation once the total amount was clearly defined. Today, a similar narrative is unfolding, though this time the effects are more pronounced — not because tariffs have been enacted, but because of the uncertainty on the final outcome this past month.

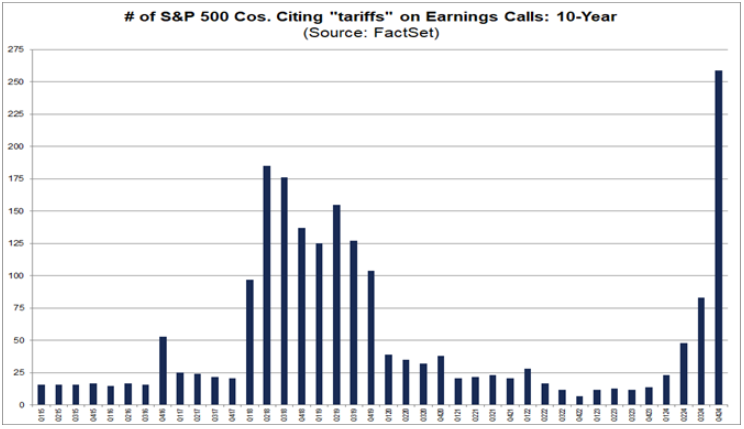

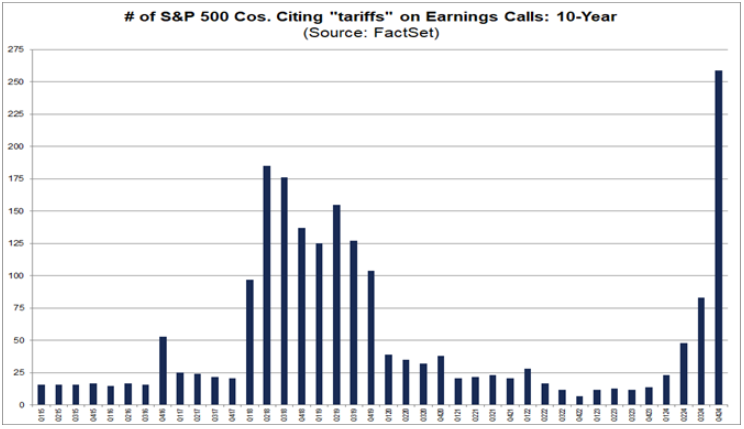

Recently, we’ve seen a significant uptick in companies citing tariffs as a top concern — more than we did in 2018. In our chart of the month below, this illustrates the concern amongst top corporate management. That alone is telling. The lack of clarity around trade policy is causing many businesses to delay investments and reevaluate near-term plans. As a result, corporate earnings estimates for the first quarter of 2025 have been revised downwardly from 11.5% to 7%.

It’s important to note that the full-year earnings outlook remains solid at around 11%, which is still above historical norms. The bigger issue isn’t the existence of tariffs — it’s the uncertainty surrounding them. Markets, and companies alike, tend to perform better when expectations are set, even if those expectations involve difficult adjustments. If history is any guide, once policy direction is established, markets recalibrate. Until then, we continue to focus on quality, diversification, and long-term strategy — recognizing that policy-driven noise often creates opportunities for disciplined investors.

Earnings Season: Lowered Expectations, Higher Potential

And speaking of earnings season, it kicks off again in mid-April. While Q1 expectations have been adjusted downward, particularly due to tariff uncertainty, the full-year picture remains strong. It’s also worth remembering that companies often outperform these lowered bars — more than half typically beat consensus. We’ll be listening closely to what executives say — not just about their results, but about how they’re thinking about investment, hiring, and navigating policy volatility. These insights often matter more than the numbers themselves.

The Fed: Patience Amid the Noise

The Federal Reserve continues to hold steady — a decision that speaks volumes. Despite economic jitters and calls for rate cuts, the Fed opted to keep rates unchanged at its March meeting. Chair Powell noted that while there’s concern over tariffs, their inflationary impact is expected to be muted — just a 0.2% bump in inflation and a potential 0.4% drag on GDP.

It’s also important to remember: tariffs are typically a one-time reset in pricing, not a compounding source of inflation. That perspective may help explain why the Fed is staying the course, even as headlines grow louder.

A Market Beyond the Magnificent Seven

For much of the past year, headlines have centered around the "Magnificent Seven" — the handful of mega cap tech stocks driving market returns. But in recent months, we’re seeing a welcome shift.

Energy and healthcare — two sectors often overshadowed by big tech — are now leading market performance. In contrast, many of the well-known mega-cap names have underperformed. This broader participation signals a healthier market environment, especially for diversified investors like us at Carnegie.

Budget Uncertainty and Consumer Behavior

In Washington, recent budget negotiations to avoid a government shutdown included preliminary plans to cut Medicaid spending — part of a broader strategy to reduce the deficit. While nothing is final, the potential $880 billion in program cuts could have downstream effects on consumer confidence and spending, particularly among lower-income households.

At the same time, some economic indicators remain resilient. For example, February’s existing home sales surprised to the upside, and refinancing activity has picked up as mortgage rates dip modestly. It’s a mixed bag — with conflicting signals depending on where you look.

Chart of the Month

Final Thoughts

As we look at the factors moving the markets in April, at Carnegie, we’re not chasing headlines — we’re focused on building durable portfolios that can weather noise and thrive in clarity. Whether it’s diversifying beyond the market’s usual stars or understanding how policy shifts affect long-term returns, we remain grounded in fundamentals. As always, we encourage you to reach out with any questions about how these dynamics may impact your portfolio.

Carnegie in the Media

Our team of financial specialists is dedicated to keeping you informed with the latest market insights, economic trends, and financial strategies that can impact your wealth. Through articles, videos, and market commentary, we share timely perspectives to help you confidently navigate an ever-changing economic landscape.

March 2025 Stories

- NYSE TV: Fed Decision / Market Update

- MarketWatch: Wall Street begins to cut S&P 500 targets as tariff worries rock the stock market. Should investors be concerned?

- Schwab Network: The Three L’s of Homebuilding

- Money Life: Ordinary expenses are now draining Americans' emergency funds

- Business Insider: Where to hide right now as tariffs hit markets (Subscription required)

-

Barron's: These Stocks Can Fight Through Trump’s Trade War (Subscription required)