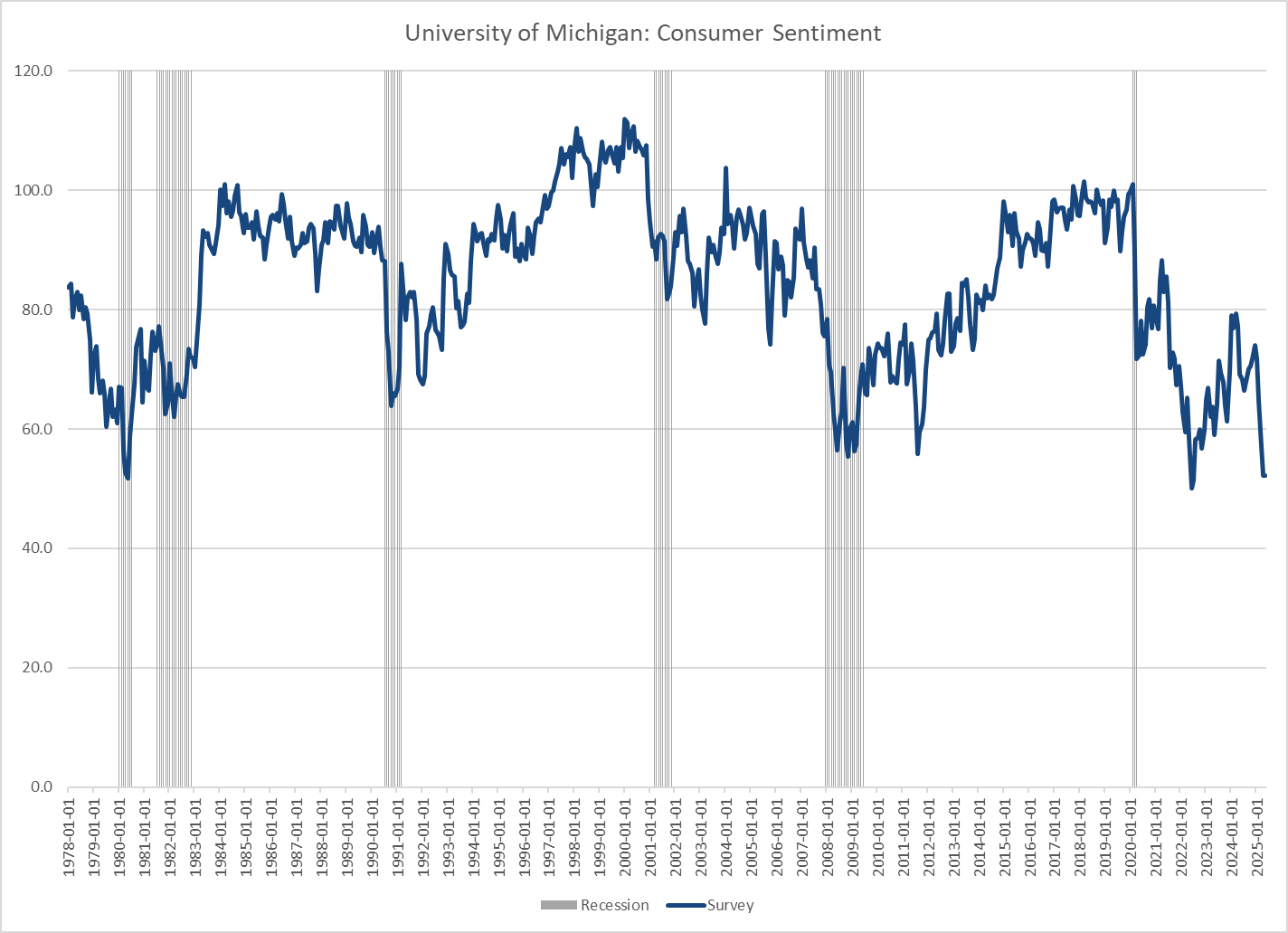

A few days ago, the University of Michigan released its final reading for the Consumer Sentiment Index through May. The measure matched the prior month’s reading of 52.2 but remains well below the 71.7 reading we saw in January. The Conference Board’s own release of the Consumer Confidence clocked in at a very high 98, up from the April reading of 85.7 but down from January’s 104. Why are these indices so important to follow, and what are they telling us?

Lynn Najman

Lynn Najman, CFP®, is Vice President and Wealth Advisor at Carnegie Investment Counsel, where she works closely with clients to address a wide range of financial issues. Her goal is to provide clarity and actionable strategies that align with her clients' aspirations.

Recent Posts

Reading the Tea Leaves: How Do We Understand Consumer Confidence?

Posted by

Lynn Najman on Jun 5, 2025 10:27:27 AM

Topics: Investing

The current on-again/off-again conversation about tariffs on imported goods is not new. In fact, before the general income tax was passed in 1913, tariffs were one of the few ways our government had to raise money, often comprising up to 95% of federal revenue. To some extent, tariffs in the developing American economy were part of the rivalry between the agricultural-based economy of the South and the developing industrial-based economy of the North. Some historians have pointed to the Tariff of 1828 (called The Tariff of Abominations), meant to aid small Northern industry, as the starting point for talk of Southern secession, eventually leading up to the Civil War.

Topics: Market