The IRS recently announced several updates that will shape tax and financial planning in both 2025 and 2026. These include higher retirement plan contribution limits, adjustments to tax brackets, and increases to the standard deduction. These changes give you more room to save and more opportunities to manage your tax bill.

Alex M. Velazquez

Recent Posts

Planning Ahead: Important Tax Updates for 2026

Topics: Financial Planning

The final months of the year give you an opportunity to take stock of your finances. It’s important to align your investment portfolio and tax strategy before the calendar turns. When you prepare thoughtfully now, you could reduce taxes, avoid penalties, and position your wealth more effectively for the future.

Topics: Financial Planning, Taxes

Significant lump sum expenses, such as home renovations, weddings, education funding, or a real estate purchase, often require more cash than you may keep on hand. Funding these purchases carries long-term financial implications that should be coordinated with your broader strategy to ensure they do not unintentionally disrupt your progress toward other vital goals.

Topics: Financial Planning

Supporting the Next Generation: Grandparent Funded 529 Plans

Many grandparents want to support their grandchildren’s education, and a 529 plan remains one of the most effective ways to do that. Recent changes to rules and regulations have given 529s more flexibility, improved tax treatment, and fewer unintended consequences when it comes to financial aid.

Topics: Financial Planning

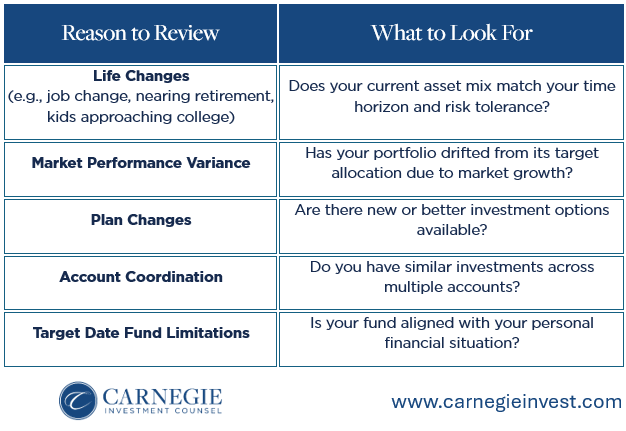

Remember to Review Investment Elections in Your Retirement Plans

Like many of us, you may remember starting a new job and being handed a stack of onboarding paperwork that consisted of tax forms, health insurance elections, direct deposit info, and somewhere in the mix, your 401(k) enrollment. At this time, you likely picked a contribution percentage and selected a few investment options, sometimes with little context or guidance. For you and many others, that might be the last time that those choices were reviewed or scrutinized.

Topics: Financial Planning

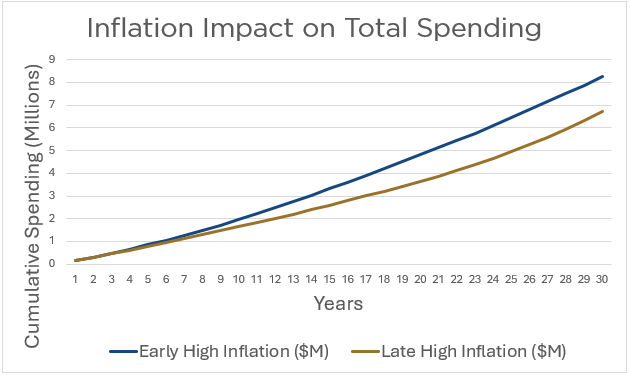

Retirement is about more than just building up savings—it’s also about figuring out how to spend those savings in a way that lasts. One common approach is to use a fixed or “safe” withdrawal strategy, like the “4% rule,” where you spend a set percentage of your portfolio each year. But life doesn’t move in a straight line, and neither does the market. That’s why it’s important to regularly revisit your financial plan to determine whether adjustments to your spending might be needed.

Topics: Financial Planning

.png)

.png)