As someone who studied economics in college, I have always been fascinated by human decision making, not just in business but in life. I recently was listening to a Bloomberg podcast interview with Daniel Kahneman that was recorded last year. Kahneman is a professor emeritus of psychology at Princeton University, the author of the best-selling book Thinking, Fast and Slow and one of the world’s most renowned behavioral economists. Behavioral economics is the study of the psychological, emotional and social factors that impact the economic decisions we make. Below are some interesting points and examples Kahneman discussed:

Raz Pounardjian

Recent Posts

Behavioral Economics: Thinking about the way we think

Sector Performance, Smartphones & March Madness

Checking in at the quarter mile mark

With about 1/4th of the year almost over, I thought it would be good to check in on what market sectors are performing the best and worst thus far in 2017. Below is a table that shows the S&P 500 return YTD and each sector of the S&P 500. It is interesting to note that the sector that most Wall Street strategists recommended buying at the start of this year (financials) is underperforming the overall market. Also, other so-called “Trump Trade” sectors such as industrials and energy are underperforming so far. On the other side of the coin, consumer staples and utilities were universally unloved by this same group, yet they are outperforming the S&P 500. We don’t want to draw too much from this but it is nonetheless something to note, especially considering how often we hear about narratives in regards to price action on Wall Street. See the previous 2017 Stock Market Contest Blog

About five years ago, “Giving Tuesday” was created and is celebrated the first Tuesday after Thanksgiving. This day celebrates and encourages giving in both monetary and non-monetary ways. Just on that day alone, approximately $117 million was raised online for charities. The increased awareness for charitable giving is a testament to the

good hearted and selfless nature of many individuals and corporations.

We here at Carnegie recently spent an afternoon cooking lunch for those in residence at the Ronald McDonald House in Cleveland. Sometimes it’s best to get away from the grind of “every day” life and give back to those in need and less fortunate. As someone who spends the majority of his days in the office, I really enjoyed preparing a meal together for those in need with my fellow co-workers.

One of the ways we have helped encourage charitable giving is through the use of Donor Advised Funds.

Topics: Giving

While the recent market headlines have focused on Britain’s decision to leave the European Union, or “Brexit” as it has been dubbed, I came across an interesting news article last weekend. The article from the Wall Street Journal described how a certain robo-advisor froze all trading activity on their platform for two and a half hours after the market opened on June 24th (the first day of trading after the Brexit results were known). Even worse, they did not even communicate this in a simple email to their users. What would you do in this situation?

When we think about investing in equities here at Carnegie, we think of the companies we invest in as businesses. If I polled 5 random people off the street and asked them to list 5 good companies, depending upon their age, sex and race, I would probably hear names like Apple, Facebook, Google, Tesla and Netflix. While these companies have performed admirably in the last few years, we never lose sight of our pursuit in finding great businesses with sustainable business models or what Warren Buffet likes to call a “moat”. What if I told you that one of the best sectors to invest in over time is a collection of boring, slow growing businesses?

Spin-offs: Is the whole better than the sum of the parts?

As a firm with roots in Cleveland, the city is abuzz with excitement surrounding the Cleveland Cavaliers run to the NBA Finals. It is great to experience the excitement that cities like Cincinnati and Philadelphia have enjoyed in the past and our hope is that this team will end Cleveland’s 51 year title drought. The Cavs will need to play great team basketball to beat the Golden State Warriors but when it comes to investing; sometimes it’s best to separate certain parts of the “team” or businesses. This is often referred to as spin-offs on Wall Street.

Often times on the news, you may hear the names of famous CEOs like Tim Cook, Warren Buffett and Bob Iger. Why are they discussed so often? What separates them from their peers? Besides being at the helm of some of the most well-known and companies in the world, these CEOs, among many others have done a very good job of creating value for shareholders. How did these CEOs do such a wonderful job of creating value?

Topics: Investing

What Are the Pros and Cons of Low Interest Rates?

You may have heard about low interest rates in the newspaper, online or on TV, but what do low interest rates really mean for the general public?

Interest rates are based primarily upon the supply and demand for money. What are some of the positives and negatives of low interest rates? Watch our video or continue reading below.

Topics: Investing

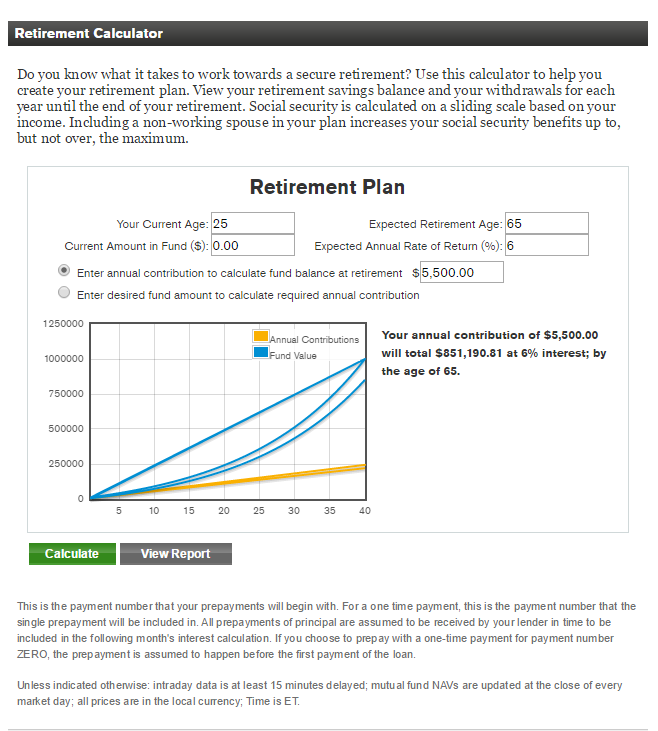

The Eighth Wonder

We all know how tempting it can be to buy those nice but expensive pair of sunglasses or shoes but would you be better off putting aside some those discretionary purchases to save, instead? Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn't ... pays it.”

Topics: Investing