As a firm with roots in Cleveland, the city is abuzz with excitement surrounding the Cleveland Cavaliers run to the NBA Finals. It is great to experience the excitement that cities like Cincinnati and Philadelphia have enjoyed in the past and our hope is that this team will end Cleveland’s 51 year title drought. The Cavs will need to play great team basketball to beat the Golden State Warriors but when it comes to investing; sometimes it’s best to separate certain parts of the “team” or businesses. This is often referred to as spin-offs on Wall Street.

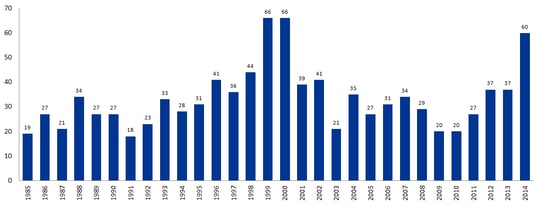

Stock spin-offs have sprung back to popularity in the last three years due to increased activist pressure and slow organic growth for many large companies. In 2014 alone, there were 60 spin-offs completed and another 50-55 are projected in 2015. Why do companies spin-off or separate a certain portion of their overall business? It allows the newly independent company to operate in a more focused fashion and this eliminates competition for capital with the parent company. Also, this action can enhance shareholder value by unlocking the value of an underlying asset that may be mispriced by the stock market.Number of Completed U.S. Spin-Offs by Year

One example of this was the spin-off of spirits maker Beam from Fortune Brands in 2011. Fortune Brands was a conglomerate of different operating businesses (home security, faucets, cabinets, golf and spirits) that lacked synergies. Management elected to narrow the focus of each business by spinning off Beam into a separate company and selling their golf business to a private equity group. Now, Fortune Brands is a pure play home furnishings and fixtures company while Beam sold out to Suntory Holdings in 2014.

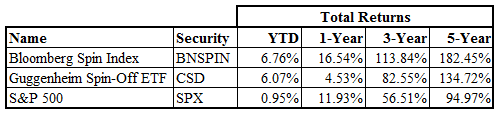

The unlocked value that is created through spin-offs has increased the performance of these stocks over time. Below is a chart that shows how the Bloomberg Spin-Off Index (an index of spin-off stocks held at the time of their spin for 3 years that have a market capitalization of over $1B) performed in the first quarter of this year versus the S&P 500 and the Guggenheim Spin-Off ETF. As you can see, a lot of value can and has been created through spin-offs.

At Carnegie, some of our core equity holdings were the products of spinoffs and we continue to monitor for opportunities within this space. Please let Carnegie be your guide when it comes to spin-offs.

Source: Spin-Off Research and Bloomberg