When we think about investing in equities here at Carnegie, we think of the companies we invest in as businesses. If I polled 5 random people off the street and asked them to list 5 good companies, depending upon their age, sex and race, I would probably hear names like Apple, Facebook, Google, Tesla and Netflix. While these companies have performed admirably in the last few years, we never lose sight of our pursuit in finding great businesses with sustainable business models or what Warren Buffet likes to call a “moat”. What if I told you that one of the best sectors to invest in over time is a collection of boring, slow growing businesses?

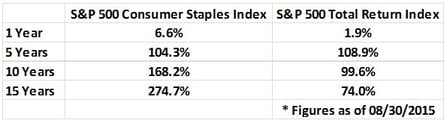

Below are total return figures for the S&P 500 Consumer Staples index and the S&P 500 index. As you can see, this boring yet resilient sector has led to some outsized gains through the early 2000s tech bubble, September 11th and the housing crisis/Great Recession of 2008-2009.

It is often said that “slow and steady wins the race”. Some of the companies in the consumer staples sector include: Philip Morris, CVS Health, McCormick, PepsiCo, Costco, Colgate-Palmolive and the J.M. Smucker Company. Many of the companies in this sector hold sustainable competitive advantages due to their sheer scale and recognizable brand names. Marlboro cigarettes, bottles of Gatorade and Twizzlers can be found in almost any gas station or grocery store. Purchasing a new car or home takes enormous amounts of time to plan and budget but we often don’t think twice about purchasing a box of Honey Bunches of Oates.

As human beings, we all need to eat, drink and occasionally indulge on a Hershey Kiss or two. The stability of these companies has allowed them to garner slow, but steady earnings growth over the years. Coke will probably taste the same one year from now but consumer tastes in fashion and computer software can change overnight. 10 years ago, Uber and Airbnb didn’t exist but people of all ages have been eating Tootsie Rolls for over 100 years. It’s quite telling that one of the world’s greatest investors, Warren Buffet, purchased Heinz and then a majority stake in Kraft this past year. This is on top of his ownership of See’s Candy and large equity positions in Coca Cola and Procter & Gamble.

While these companies may not grab the headlines on CNBC or the Wall Street Journal, they are sure to plod along, probably in a very boring way.

Read more about Why a Boring Market is Good for Your Portfolio.

Disclosure: Past performance is not indicative of future performance and Carnegie does not directly invest in any of the indexes noted above.