Significant lump sum expenses, such as home renovations, weddings, education funding, or a real estate purchase, often require more cash than you may keep on hand. Funding these purchases carries long-term financial implications that should be coordinated with your broader strategy to ensure they do not unintentionally disrupt your progress toward other vital goals.

Supporting the Next Generation: Grandparent Funded 529 Plans

Many grandparents want to support their grandchildren’s education, and a 529 plan remains one of the most effective ways to do that. Recent changes to rules and regulations have given 529s more flexibility, improved tax treatment, and fewer unintended consequences when it comes to financial aid.

Topics: Financial Planning

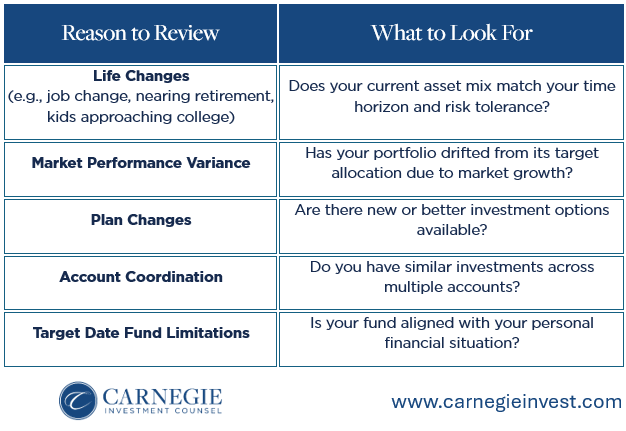

Remember to Review Investment Elections in Your Retirement Plans

Like many of us, you may remember starting a new job and being handed a stack of onboarding paperwork that consisted of tax forms, health insurance elections, direct deposit info, and somewhere in the mix, your 401(k) enrollment. At this time, you likely picked a contribution percentage and selected a few investment options, sometimes with little context or guidance. For you and many others, that might be the last time that those choices were reviewed or scrutinized.

Topics: Financial Planning

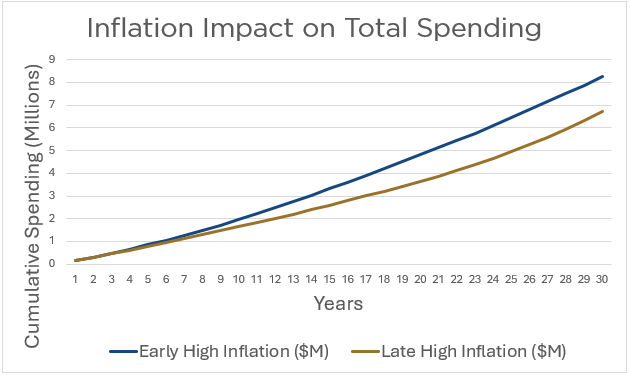

Retirement is about more than just building up savings—it’s also about figuring out how to spend those savings in a way that lasts. One common approach is to use a fixed or “safe” withdrawal strategy, like the “4% rule,” where you spend a set percentage of your portfolio each year. But life doesn’t move in a straight line, and neither does the market. That’s why it’s important to regularly revisit your financial plan to determine whether adjustments to your spending might be needed.

Topics: Financial Planning

Tax Season Prep: Planning Before the Deadline

As the April 15th tax filing deadline approaches, March is the ideal time to revisit your tax strategy, especially for families with trusts or more complex financial situations. By proactively addressing key tax areas, you can potentially reduce your tax liability and better position yourself for future financial success. Here are five essential tax strategies to consider this season:

Topics: Financial Planning

The Heckerling Estate Planning Institute, sponsored by the University of Miami (Coral Gables) School of Law, was held in Orlando, FL, the week of January 12th. This was the 59th consecutive year of the conference, bringing together more than 4,100 attendees, consisting of wealth managers, probate attorneys, accountants, life insurance professionals, trust officers, charitable planned giving officers, financial planners and IRS Estate and Gift Tax Agents. Heckerling is the largest such gathering and has long been regarded as the Platinum Standard for practitioners representing clients throughout the U.S. and abroad. Each session is conducted by a distinguished probate practitioner or law school scholar. Discussed below are some of the current pressing topics of interest to clients served by Carnegie Investment Counsel.

Topics: Financial Planning

Successful Financial Planning During Divorce: Building a Secure Future

Divorce can be emotionally and financially challenging, but with careful financial planning during divorce, you can navigate this difficult phase with confidence. Here are the financial strategies you need to get through this arduous time and build a secure future.

Topics: Financial Planning

Are You Raising Financially Responsible Children? 6 Tips to Empower the Next Generation

As a parent, you want to prepare your children to navigate the world confidently, and that includes the world of money. Instilling healthy financial habits from an early age will help set them on the path to being financially responsible children. But how do you know if you’re instilling those essential habits? Here are six tips:

Topics: Financial Planning

Seniors: Should You Add a Trusted Contact?

No one likes to think about falling victim to a scam or suffering a medical emergency, but the sobering truth is that these situations do occur. If this type of trouble arises, you may need someone to advocate for you or serve as your liaison. Having a trusted contact is extremely important when it pertains to the management and protection of your finances.

Here’s how to begin the process of adding a trusted contact to your financial advisor account to prevent any disconnect.

Topics: Financial Planning, Investment Management, Retirement Planning

How to Store Important Documents: At Home and Online

Storing important documents, like financial statements from your financial advisor, isn’t just a matter of organization: It’s key to keeping your information safe and limiting the risk of identity theft. Here’s everything you need to know about storing important documents at home or online.

Topics: Financial Planning, Investment Management

.png)