In general, earnings growth drives stock prices higher. If investors are willing to pay 20 times earnings for a company, and company earnings grow from $5 per share to $6 per share, the stock price will increase from $100 to $120.

Stock Fundamentals: Return on Invested Capital

Topics: Investing

Supporting the Next Generation: Grandparent Funded 529 Plans

Many grandparents want to support their grandchildren’s education, and a 529 plan remains one of the most effective ways to do that. Recent changes to rules and regulations have given 529s more flexibility, improved tax treatment, and fewer unintended consequences when it comes to financial aid.

Topics: Financial Planning

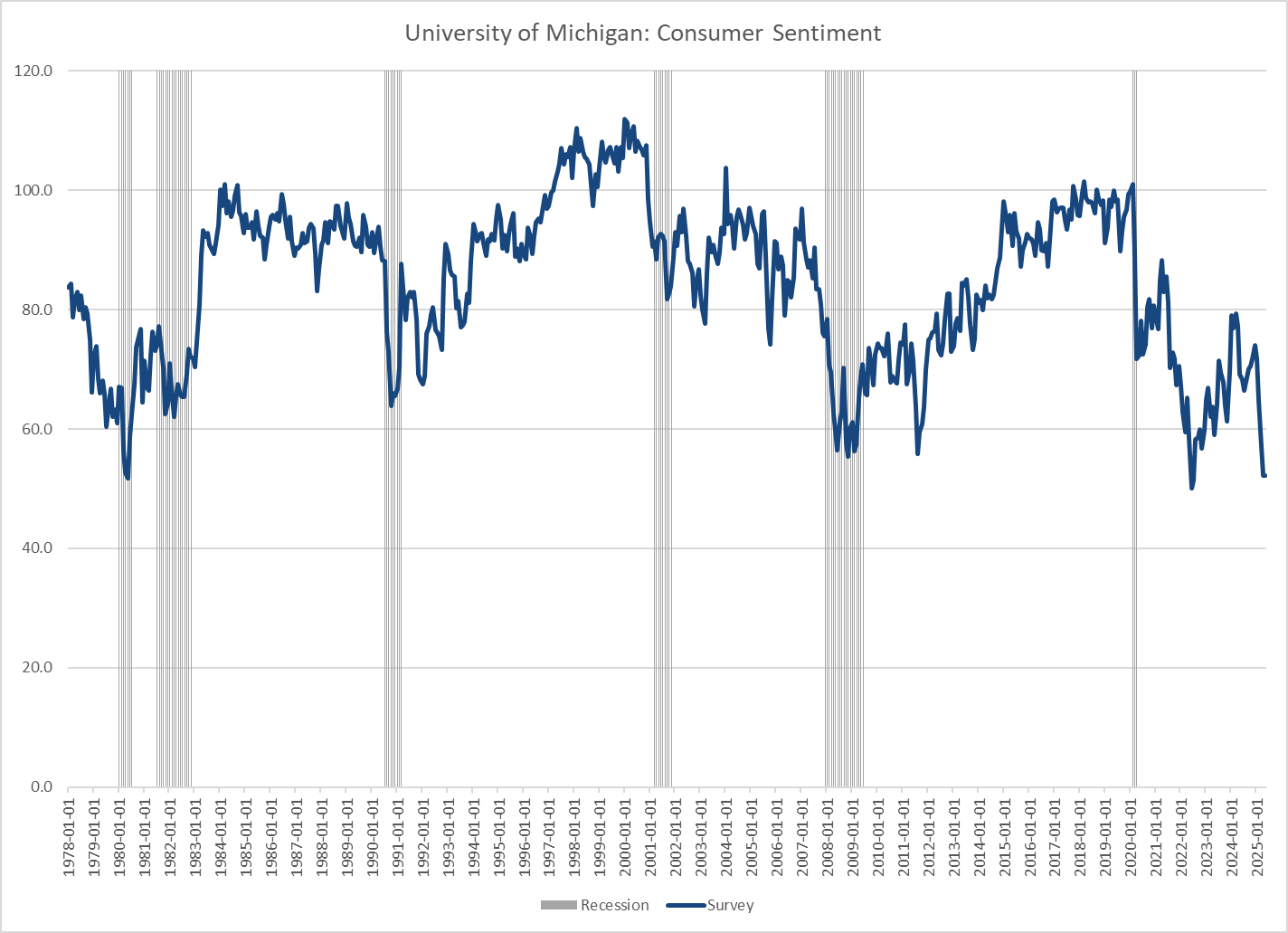

Reading the Tea Leaves: How Do We Understand Consumer Confidence?

A few days ago, the University of Michigan released its final reading for the Consumer Sentiment Index through May. The measure matched the prior month’s reading of 52.2 but remains well below the 71.7 reading we saw in January. The Conference Board’s own release of the Consumer Confidence clocked in at a very high 98, up from the April reading of 85.7 but down from January’s 104. Why are these indices so important to follow, and what are they telling us?

Topics: Investing

Monthly Market Commentary: June 2025

What We're Watching in June

Summer is here, and while many take time to unwind and travel, the markets remain in constant motion. For those who closely follow financial news, the headlines often point in conflicting directions. At Carnegie, we cut through the noise by staying grounded in long-term fundamentals, thoughtful portfolio positioning, and informed decision-making.

Topics: Investing

Economic Tailwinds from AI’s CapEx

This year, the markets have been driven by the administration’s tariff policies. When higher than expected tariffs have been threatened or imposed, common stocks and fixed-income securities have lost value. On the other hand, lower tariff rates or delays in the assessment of these taxes have caused the markets to rebound. While these policy changes are extremely important, the secular growth in capital expenditures necessary to build out infrastructure for Artificial Intelligence (AI) is not getting the coverage that it deserves.

Topics: Investing

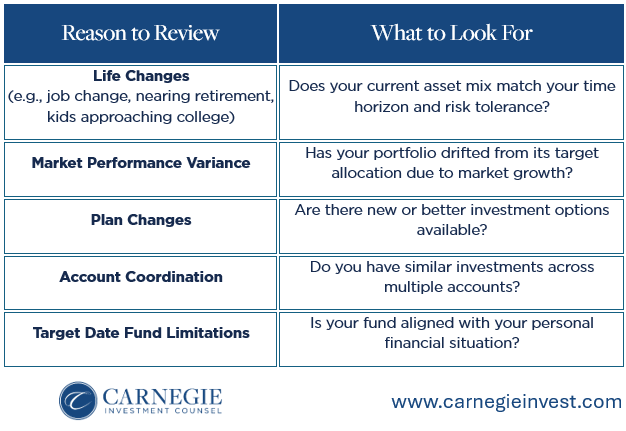

Remember to Review Investment Elections in Your Retirement Plans

Like many of us, you may remember starting a new job and being handed a stack of onboarding paperwork that consisted of tax forms, health insurance elections, direct deposit info, and somewhere in the mix, your 401(k) enrollment. At this time, you likely picked a contribution percentage and selected a few investment options, sometimes with little context or guidance. For you and many others, that might be the last time that those choices were reviewed or scrutinized.

Topics: Financial Planning

“Uncertainty” is the new buzzword. The term has been used repeatedly during earnings calls throughout the past month as company executives described the current state of the operating environment. This uncertainty is driven by the Trump Administration’s fluctuating tariff policy.

Topics: Market

What We’re Watching in May

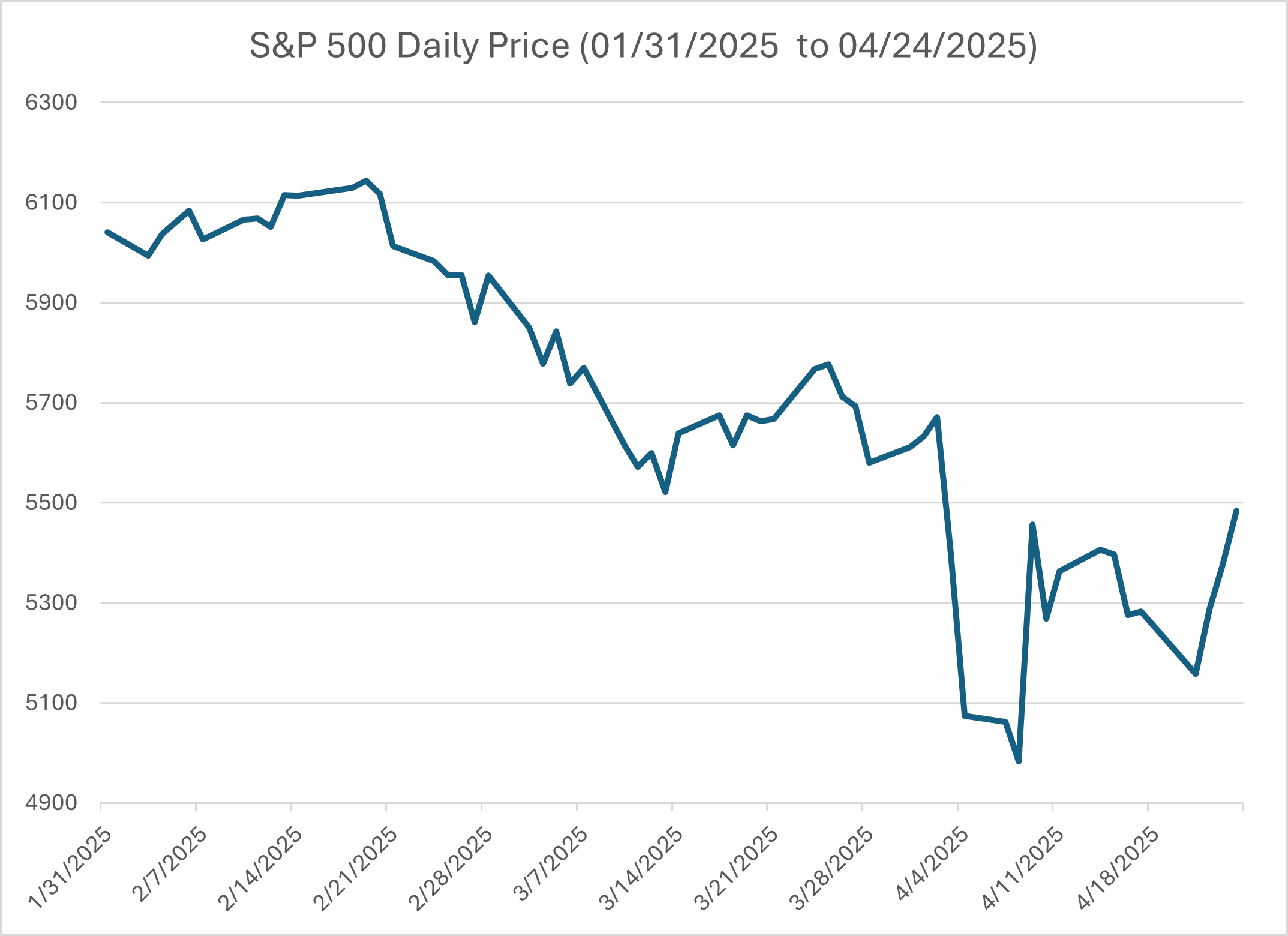

As the first quarter of 2025 experienced relative calm in the financial markets, April surprised investors with sharp pullbacks, increased volatility, and rising investor worries. While market swings are nothing new, the reemergence of tariffs, one of the Trump administration’s policy tools, has added uncertainty in the minds of investors and business leaders. For many, this month felt less like a typical bump in the road and more like a sudden derailment.

At Carnegie, we see this moment as a valuable reminder that staying grounded in the face of short-term noise is critical to long-term investing success.

Topics: Market

Volatility vs Long-Term Trends

Volatility in the market has spiked during the last month, coinciding with the Trump Administration’s tariff rollout. The rollout has been accompanied by shifting levels in the tariff, uncertainty when and where they will be implemented, and an escalating trade war with China. Equities have reacted negatively leading to headlines indicating how far the indexes have fallen off the peak.

The resulting chart can be a little unsettling.

Topics: Investing

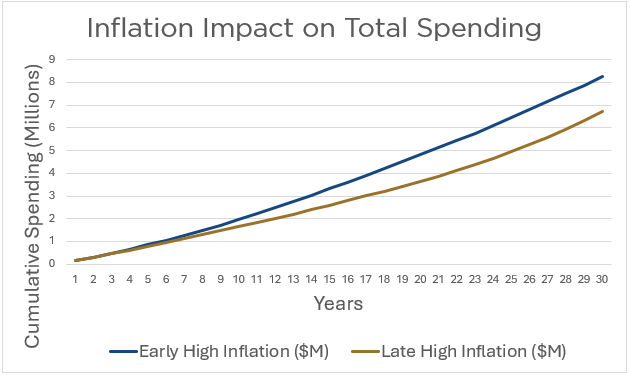

Retirement is about more than just building up savings—it’s also about figuring out how to spend those savings in a way that lasts. One common approach is to use a fixed or “safe” withdrawal strategy, like the “4% rule,” where you spend a set percentage of your portfolio each year. But life doesn’t move in a straight line, and neither does the market. That’s why it’s important to regularly revisit your financial plan to determine whether adjustments to your spending might be needed.

Topics: Financial Planning

.png)