Your nonprofit has ambitious goals; whether you’re planning to expand one of your programs, construct a new building, or set up an endowment fund, uncovering major donors who are eager to provide significant financial support is essential to your success. But among all the individuals stored in your database, how do you know which ones are the most promising prospects to pursue?

That’s where nonprofit wealth screening comes in: This process allows you to hone in on potential major donors and construct a data-driven strategy to solicit them. In this guide, we’ll walk through the basics of wealth screening, including best practices for using wealth screenings to find major donors for your nonprofit.

What is nonprofit wealth screening?

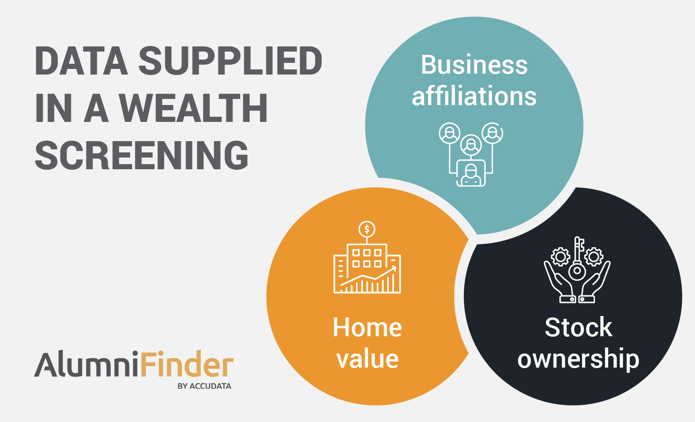

Through wealth screening, your nonprofit can identify prospective and existing donors with the highest capacity to give to your mission. According to AlumniFinder, the data supplied in a wealth screening includes:

- Business affiliations. Learn more about your donors’ careers, employers, and income to pinpoint individuals who are likely to have considerable financial resources that they can contribute to your nonprofit.

- Stock ownership. By looking into your donors’ stock ownership, you can unlock a more complete picture of their ability to give. Plus, you can make it easy for these individuals to support your nonprofit by accepting stock donations on your website.

- Home value. Real estate ownership is another indicator that your donors have accumulated substantial wealth that would make them ideal major contributors to your nonprofit.

These financial indicators—combined with an affinity for your cause and a history of philanthropy—can reveal which individuals in your database have the highest potential to become major donors.

What are the benefits of wealth screening for nonprofits?

Before you host your next annual gala or launch a capital campaign, take the time to conduct wealth screening. Beyond uncovering major prospects, you’ll be able to tap into the following benefits:

- Improved fundraising and stewardship strategies. Wealth screening allows your nonprofit to understand the giving potential of its donor base as a whole. With this information, you can set more realistic fundraising goals and make tailored fundraising asks.

- Better resource allocation. In an ideal world, your nonprofit would build one-on-one relationships with each of its donors. However, with limited time and resources, you need to concentrate your efforts on high-capacity donors who are likely to make impactful gifts to your mission. Wealth screening helps you zero in on these donors.

- Increased matching gift funds. As you learn more about the companies your donors work for, you can find out which donors have employers with matching gift programs. Through these programs, companies match their employees' gifts to nonprofits—often at a 1:1 ratio. You can make the most of these opportunities by reaching out to eligible donors and encouraging them to submit a match request.

The nonprofit landscape is always shifting, making it all the more important to adopt a data-driven approach to your strategies. By conducting wealth screening, you can access the insights you need to refine your fundraising and major donor strategies over time.

4 Best Practices for Using Wealth Screenings to Find Major Donors

If your nonprofit is ready to leverage wealth screenings to identify more high-potential major donors, consider these best practices to maximize your results.

-

Start with a clean database.

Wealth screening is an element of prospect research, during which your nonprofit evaluates its database for both financial and philanthropic indicators, including interests and previous charitable involvement. Because of this reliance on donor data, it’s essential to have a clean and accurate database to reference during your research.

Some key steps you can take to tidy up your database include:

- Eliminating duplicate records.

- Correcting inconsistent formatting.

- Updating outdated or missing details.

- Removing lapsed or deceased donors.

If you spot any major gaps in your donor data, consider conducting a data append to address them. A data append service can augment your database by pulling information from reliable third-party sources, helping you acquire more insights for your major donor strategy.

Additionally, create data entry rules and procedures that standardize data input and formatting. This step ensures that your staff members are on the same page with data entry, allowing you to maintain a healthy, consistent database moving forward.

-

Segment your supporters.

While you can use wealth screenings to pinpoint major prospects for your nonprofit, remember that no two donors are alike. To cultivate donors effectively, it’s best to reference and appeal to their specific interests, preferences, and history with your organization. After all, according to Double the Donation’s nonprofit fundraising statistics, personalized emails have average open rates 82% higher than generic emails.

Consider creating further segments within your wealth screening research based on information in your database, such as:

- Demographics

- Location

- Interests

- Past giving

Once you have these segments, you can craft tailored fundraising messages that will resonate with the donors in each segment. For example, you might invite a major prospect in your local area to attend an upcoming event to learn more about a new program you’re planning. Alternatively, you might reach out to a lapsed donor to discuss the impact of their past contributions and begin to rebuild that relationship.

-

Consider using expert wealth screening services.

Wealth screening can require a lot of time, energy, and effort from your nonprofit’s staff—especially if you’re new to it. By leveraging professional wealth screening services, you can expedite the process and minimize the burden on your team members.

When researching screening service providers, keep an eye out for offerings such as:

- On-demand online access to your wealth screening findings.

- Customer support, including answering questions and training your staff.

- Manual verification of your top major prospect information to ensure maximum accuracy.

- Prospect generators that automatically identify major donor prospects for your nonprofit.

Ultimately, taking advantage of wealth screening services will free up your staff’s time and energy. This way, you can focus your efforts on other aspects of your major donor strategy—from improving your donation page to hosting engaging events that bring prospects closer to your mission.

-

Integrate Wealth Screenings with Your Fundraising Strategy

Wealth screening should be a core strategy not only for identifying potential major donors but also for shaping your entire fundraising strategy. It provides invaluable insights that can enhance event planning, grant writing, and your annual campaigns.

By leveraging wealth data, your nonprofit can invite potential major donors to exclusive events, offering a unique opportunity for personal engagement. Using the data to identify individuals with foundations or donor-advised funds can help you tailor your grant proposals more effectively, increasing your chances of success. Do you need a matching donor for an upcoming campaign? Look at your wealth screening data cross-referenced with past giving to identify people who have the capacity to give more and already love your organization!

One More Tip: Don't Only Ask For Cash!

Once you've identified those donors that can have a bigger impact on your organization, make sure you don’t only ask for a cash donation! People are more likely to give higher amounts when they think of their wealth as a whole, not just what they have in their bank account. Download our 11 Ways To Give Guide that will educate you and your donors about all the unique ways they can support your organization, such as donating life insurance policies, stocks, royalties, and more!

Use Wealth Screenings to Find Major Donors

As you apply your nonprofit wealth screening results to your major gift strategy, track metrics such as your major donor acquisition rate and average gift size to evaluate your success. Continue to look for opportunities to improve your efforts, whether by enhancing your data with new information or rethinking your supporter segments to refine your solicitation approach. Taking these steps ensures that you make the most of the donor data at your disposal.

Looking for a Financial Advisor for Your Nonprofit?

Finding the right investment advisor shouldn’t be overwhelming. At Carnegie Investment Counsel, we understand the unique challenges nonprofits face when securing their financial future. We’re here to bring clarity and expertise to the process. Schedule a complimentary consultation today!

This blog is for informational purposes only and is not meant as financial, legal, or tax advice. Please seek professional advice from qualified tax, legal, and/or financial professionals before making any financial decisions.

Carnegie Investment Counsel (“Carnegie”) is a registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. For a more detailed discussion about Carnegie’s investment advisory services and fees, please view our Form ADV and Form CRS by visiting: https://adviserinfo.sec.gov/firm/summary/150488.