Apple

With Apple down about 25% from its highs, concern is mounting related to slowing iPhone sales and questions are arising related to their ability to come out with new and innovative products. Apple has always been great at “seeing around the corner” and coming up with incredibly innovative products that consumers did not even know they wanted or needed. As Henry Ford said, “If I had asked people what they wanted, they would have said ‘faster horses’”. With the shares trading at a 10 P/E ratio and 5x EV/EBITDA, the market certainly thinks that with Steve Jobs gone, the company’s ability to “see around corners” has diminished. Time will tell whether this is true or not. But even if it is not true, Apple currently has almost $150 billion in net cash on their balance sheet. It might be that their next big idea will not be related to what they know, but who they know. Perhaps they will use that cash to invest in another company that is still seeing around the corner.

Three Themes for the Future

In thinking about year end, and what themes there might be going forward, three things strike me as growing trends, regardless of the economy, China, or political unrest:

- Autonomous Cars: Click to read at 12/2 blog on this subject

- The Sharing Economy: Click to read 12/17 blog on this subject

- Cloud-based Software: Stay tuned for future commentary.

Are there any themes that you see? I am always happy to hear from blog readers, so feel free to share your thoughts.

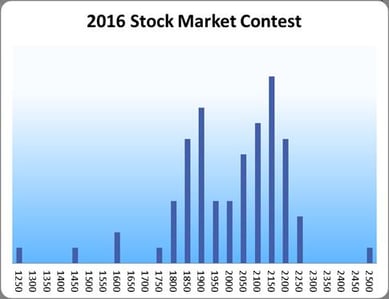

Stock Market Contest

I received lots of responses to the stock market contest this year. The results were more bearish then normal, with the median guess being that the market would close the year at 2019 (a mere 2% gain from when the guess was made). Usually, the majority of participants are bullish, with a few bearish guesses mixed in. This year, as is illustrated below, there are two clear camps, and of course a few outliers. The Wall Street Strategists guessed that the market would finish the year at 2200. It will be interesting to see who ends up being closer, the blog readers or the three-comma salaried Wall Street strategists. So far, my bet is on you!

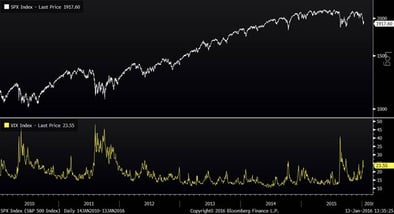

January to Remember

As I type this, the S&P 500 is already down over 7% in the first eight days of the year, marking the worst start to a year on record. Individual investors, who are normally contra-indicators, are becoming squeamish. That said, some of the typically contrarian indicators (like the VIX below) have not yet spiked, which would suggest that the pain may not be over yet. The chart below shows the S&P 500 and the VIX, which is a measure of volatility, over the past six years. As you can see, virtually all of the market bottoms are accompanied by spikes in the VIX. While it has recently moved higher, it has not spiked like it did in 2010, 2011 or August of this year.