The Sharing Economy

I am fascinated by the new “Sharing Economy”. The sharing economy is the new trend of people sharing their skills and resources with total strangers. Technology has brought people together like never before and in ways never imagined. The most recent sharing economy entity that has caught my attention is skillshare.com. On skillshare.com, people sign up to learn random skills about a variety of subjects. The key here is that the “teachers” are other users—total strangers—sitting at home behind their computers showing people the skills that they are passionate about. Once they get more than 25 viewers, these “teachers” start to get paid. Some examples the exploding Sharing Economy are (these all have links you can click):

- Airbnb: Home and room sharing.

- DogVacay: When on vacation, you leave your dog at someone’s home instead of a kennel.

- Getaround: You let people use your car. If out of town, you can leave it with Getaround and get paid.

- Uber: Ride sharing.

- TaskRabbit: Mobile marketplace for people to hire others to do jobs and tasks.

- Spinlister: Sharing of anything rideable like bikes, skis, surfboards, etc.

- Lending Club: Peer-to-peer lending.

- Fon: Wifi-sharing. If you share a slice of your wifi, you get access to everyone else’s wifi on the platform.

- Yerdle: You give unwanted “stuff” away in exchange for Yerdle credits, which then entitle you to get other people’s “stuff”.

- JustPark: Parking spot sharing. Uses surge pricing to share parking spots. If you are gone or out of town, you make your urban parking spot available…and get paid!

- Vayable: P2P tour guides. If you know a lot about your area, you get paid to give people tours. If you are somewhere else, you go here to get a tour.

- HomeDine: Share your home-cooked meal.

The Fed

By the time you read this, the Fed will have most likely have raised the Fed Funds Target Rate by .25% for the first time in almost a decade. There will be commentary regarding this and countless articles will be released talking about the implications of the rate hike. What you may not read is that, at least in the past 35 years, the market has actually risen during periods of rising rates. It may not happen the same this time, since rates are now coming off of the bottom, but it is interesting nonetheless. So much for Econ 101. The chart below shows the S&P 500 and the Fed Funds target rate since 1980: Stocks and the Fed Funds Rate (Since 1980)

On a related note, I am reminded that Star Wars opens tonight. Which of the following two faces, both of whom will be headline stories on tonight’s news, do you think more Americans know?

2016 Forcasts

The anxiously awaited 2016 forecasts from the top strategists on Wall Street have been released by Barron’s. This year, five of the ten strategists are predicting the S&P 500 will finish the year at 2200, which is roughly eight percent higher than the current price. Last year, they predicted a similar gain, and in fact, every time I can remember looking at this, they predicted something in this range. Looking into 2016, their favorite sector seems to be Financials. Looking back at this year, they predicted a 10% rise in the market. An equal weighted portfolio of the sectors they liked would currently be DOWN 5.1% YTD. An equal weighted portfolio of those they did not like would currently be UP 5.8% YTD. As often happens, these superstar strategists seemed to reflect consensus, where money is already invested, and investors were actually better off doing the opposite of what these seven-plus figure strategists suggested. Interestingly, only one strategist disliked Energy going into this year and three were positive. Below are the predictions for 2016…will they be correct this year?

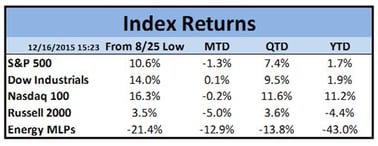

Market Stats