READ: Stocks on Track for Worst Start Since 1942

The first quarter was unusual in that both stocks and bonds were down. In fact, government bonds experienced their worst quarter in nearly forty years, so even the usual protection that bonds provide in turbulent times did not play out well this time around. Starting in November, the markets have experienced draconian internal sector and style rotations as, or more extreme than anything I have seen in my 25-year career. Some indices experienced one of their worst starts to a year since the Great Depression, after already experiencing significant drawdowns in the months prior. Long-duration stocks, which are those where expected earnings and dividends are further in the future – this includes forward looking growth and disruptive innovation stocks – have been strongly sold off. As of this writing, the well-known ARK Innovation ETF, a proxy for the long-duration disruption innovation space, is down over 49% year-to-date after declining almost 25% in 2021.

Money from this space has rotated into short-duration stocks, which are allegedly safe “value” stocks with current earnings and dividends. The latter are mostly old economy, slow growing stocks which in some cases now carry valuations higher than their high-growth counterparts. The major indices and benchmark stocks tend to fall in this latter category and as such, the behavior of the typical benchmarks has not well-reflected the underlying dynamics of the market. The benchmarks are now more concentrated than ever in a handful of stocks and are probably the least reflective of the “market” in their histories.

While it is no surprise to see some of the strongest stocks of the last two years correct, the rapidity and magnitude of these corrections in many cases has been quite extreme. Recent stock price movements have been exacerbated by the proliferation of ETFs, algorithmic trading, and the influence of online communities. These dynamics have added to volatility in both directions and have, in many cases, pushed stocks beyond what would historically be considered reasonable limits. In the end, we are confident this will create exceptional opportunities for us, as more than ever, the “babies are being thrown out with the bath water”. These changes in market structure also mean we must be prepared to endure more extreme short-term drops and exhibit a higher degree of patience during fearful and extreme times.

Even with all the fears and volatility surrounding inflation and otherwise, in most cases, although their stock prices have diverged from fundamentals, most of the companies in which we are invested continue to grow and execute well – there will always be a few exceptions, of course. While it may not be talked about much in the current sea of fear, there are still some positives in the economy that are not typically the ingredients of a meaningful recession, including:

- Strong corporate profits

- Unusually high household savings rates

- Low debt loads

- Plentiful job openings

Market Sentiment

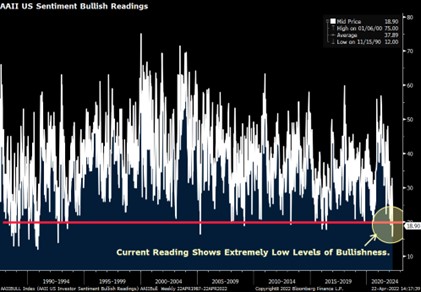

To even the most casual observer, it is evident that sentiment is bad right now -- Click to Read: Bearish Sentiment Surges to Highest Level Since the Financial Crisis. In fact, some of the most followed sentiment indicators are showing historic extremes. Although it never feels like it at the time, these moments are typically great buying opportunities and NOT times to “throw in the towel”, which many people do during these emotional moments. Below is a chart of consumer confidence going back to 1990:

The levels we are seeing today are lower than 98.5% of the time since 1952 and there have only been a handful of readings as low as we are seeing now. If current fears continue to fester, it is unlikely to drive confidence down much further. On the other hand, it is quite possible that some of the nightmares facing the markets will turn out better than feared. This would likely lead to better consumer confidence numbers and potentially a reversion of the extreme shift away from long-duration growth into “safety”. With Main Street expressing extreme pessimism, along with an entire subsector of growth stocks having experienced draconian declines, I believe that this will create a great opportunity in certain areas of the market. The other side of this trade, wherein money has blindly chased “value” (which in many cases is more expensive now than its growth counterparts) and “safety”, may not turn out as hoped. Typically, when consumer confidence plummets, so do long-duration growth stocks, when consumer confidence normalizes, these stocks tend to do very well. You will note that the only lower readings in the past 30+ years were in 2008-2009 and 2011, which were both incredible buying opportunities (nobody thought so at the time, of course).

Below is a chart showing the degree of bullishness in the market right now. Again, one will notice that the current sentiment readings are abnormally negative.

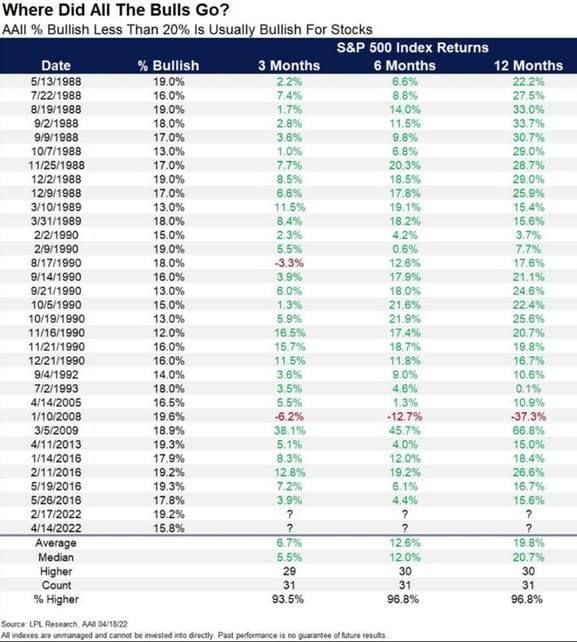

The table below dissects the data above to look at how the market has responded after being at extreme levels like today. As you can see, 30 out of 31 times, the stocks have been higher one year later.

While we are certainly not in the business of predicting bottoms, or even the general market over short-term time frames, history would suggest that the extreme emotion and sentiment that the markets are currently exhibiting is usually a time to be opportunistic. I can say firsthand over my career, that this has almost always held true, and that it has almost always been better to buy when “blood is in the streets” rather than jump ship when emotions are at their highest.

Inflation

Inflation and fears of inflation are at the core of the concerns of the markets and Main Street and have been the driving factor in the stock market and sentiment indicators mentioned above.

Inflation is a function of supply and demand. We know that we have constrained supply resulting from the pandemic, overstimulated demand (fiscal policy juice especially during covid) and further constraints in supply resulting from the Ukraine/Russia conflict, which has exacerbated short-term inflation and the fears of inflation spiraling higher. These fears have played a meaningful role in the dramatic sector rotation out of long-duration stocks (like disruptive innovation stocks) and into short-duration stocks (slow-growing old economy stocks where earnings and dividends are evident today). The question is not whether inflation will soon return to the Fed’s past stated goal of 2% -- it won’t anytime soon – but for the hysteria to wane, that there just needs to be a deceleration in inflation, which as I discuss below could be sooner than most believe.

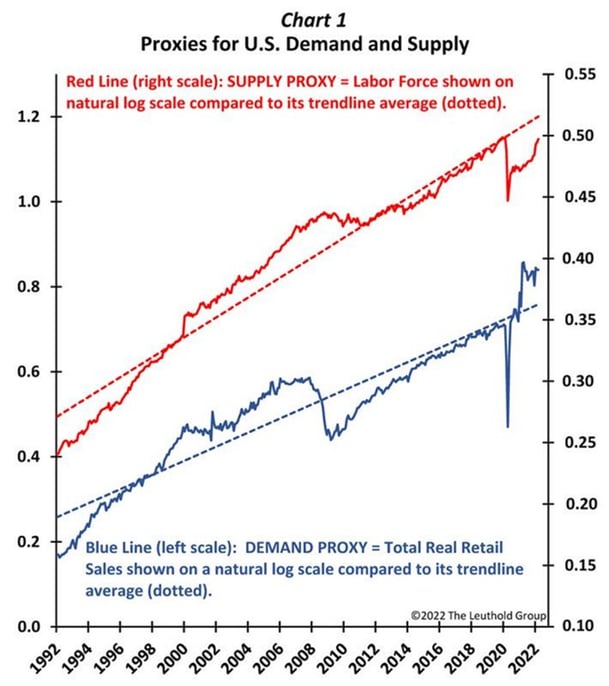

In the past 30 years, supply and demand has generally remained in check. There are two major outliers, the first being the Great Financial Crisis, wherein demand dropped considerably and supply remained robust, thereby resulting in deflation. This time around, we have seen a meaningful decline in supply caused by pandemic-related shutdowns and supply chain issues. At the same time, consumer demand – boosted partially by policy stimulus – surged above trend. As a result, we are currently looking – in the rearview mirror – at year-over-year inflation in excess over 8%. The chart below from the Leuthold Group illustrates how supply dropped below trend at the same time as demand popped above trend, leading to rapid inflation:

In the above chart, one will notice that the diversion in supply and demand has begun to narrow, which should help to ease inflation pressures soon. If we indeed begin to see less extreme inflation rates, that would likely result in less extreme sentiment levels and in turn strength in the parts of the market that have been hit hardest by inflation fears, some of which we own – currently these stocks are pricing in extreme negative sentiment and extreme expectations of inflation. Also worth noting is that at least in the last 30 years, inflation was always function of only the demand side, and supply was strong. As such, a meaningful decline in demand was required to temper inflation. In today’s case, supply is also impaired, so if supply can improve to more normal levels, that alone will have a measurable effect on inflation. It is possible that unlike past episodes of inflation, wherein demand destruction was the only weapon, that today’s issues could be solved with a lot less demand destruction as in the past as supply normalizes. That said, demand moderation is a function not just of Fed policy, but also a function of fear and inflation itself, all of which are currently in full swing. On the supply side, higher inflation and low consumer confidence along with the decline in Covid fears all stimulate more supply. At the same time, increasing costs compel companies to improve productivity, again improving the supply-side dynamics.

The Fed raising the Fed Funds rate may be already priced in. In many ways, there has already been a free-market tightening cycle starting about a year ago, the effects of which tend to start about a year later. Unlike the past, when the market rates would respond to moves from the Fed, like in the 1970s with Paul Volker, the market is ahead of the Fed, already pricing numerous fed hikes in. Additionally, M2 money supply, the US dollar and the yield curve all reversed around that same time, roughly one year ago. Many expect a tough road ahead as the Fed seemingly is beginning its tightening campaign. But the stock market has ALREADY struggled (some parts in an extreme manner), because of front-running policy tightening and essentially a free-market tightening policy. Please note the charts below illustrating some of inflation-mitigating factors that started about a year ago, around the same time that long-duration stocks peaked:

- The U.S. Dollar turned stronger last May. This typically points to inflation moderation a year or so later.

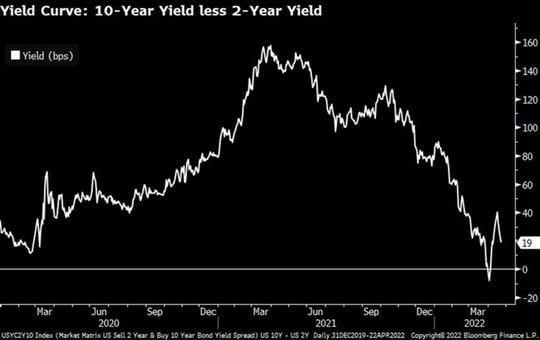

- The yield curve started flattening last April. This tends to suggest a moderation in inflation around a year later.

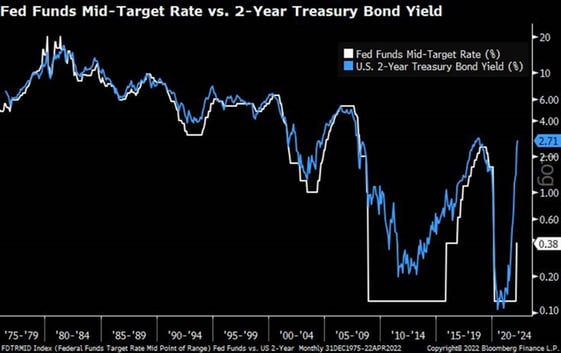

- Unlike in the 1970s, when Volker would raise rates and market rates would respond to Fed rate hikes, note the chart below, which illuminates the fact that the market has already acted in advance of the Fed, starting almost a year ago:

- Below you can see that M2 money supply growth has dropped considerably in the past year. Inflation tends to lag this too by about a year:

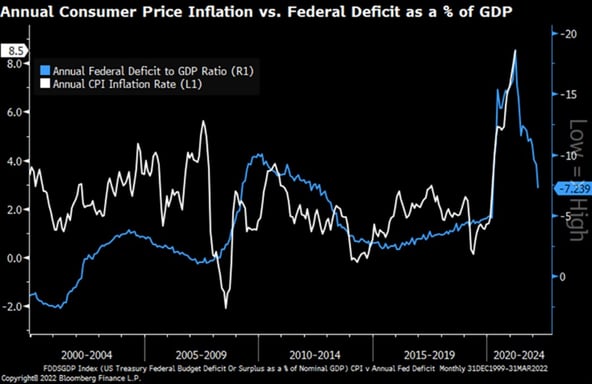

- The chart below shows the federal deficit along with a one-year lagged inflation rate. In this chart, again one can see that this started dropping about a year ago and again drops in inflation tend to follow, lagging by around a year.

So, while the nominal Fed Funds rate has just begun to rise, that may not be the “main event”. We can see that other factors that affect inflation have been in the works for over a year now. If past trends hold true, then it seems reasonable to believe that the economy is entering the appropriate lag time (about a year) where monetary, fiscal, dollar and yield curve policies should start to have a moderating effect on inflation. Further, in the most recent data, labor participation rose meaningfully for the first time in two years (good for the supply side of the inflation data), and freight/shipping rates are beginning to decline.

If any of the above concepts turn out to be true, then that would likely mean we are closer to a moderation in inflation than the market fears. If that is the case, it should be very good for the stocks that have been “thrown out with the bath water”. Depending on the degree to which the economy slows, it may not be so good for the “safety” and old-economy stocks that have benefitted from the fund flows out of the long-duration stocks.

Technological Innovation

Anyone who knows me, knows that I cannot have a very long market/economic conversation without bringing up technological innovation. I believe that technological innovation plays a part in all of this too. Technologies like digitization, automation, artificial intelligence, fintech innovation and others have created a structural deflationary force that did not exist in the past. With higher inflation, the acceleration of the technology revolution will likely continue and have an offsetting effect – at least partially – on inflation. Today’s labor shortages and onshoring efforts will spur more investment into automation and innovation. While stocks of companies in these areas have been among the hardest hit due to their long-duration nature, I believe that technological advancement will continue to accelerate even in a more inflationary environment and that the recent and extreme pullback will create great opportunities for long-term investors.

Corporate America does not roll over when confronted by challenges. Think about all the things we did during covid to adapt. When people could not come into restaurants, they expanded/created curbside pickup. When people could not come into the office, they met on Zoom. When news channels could not broadcast in person, they figured out how to do it from home. When American businesses are confronted with challenges, they adapt, improve processes, and grow. This is at the heart of why our economy grows and stocks go up over time and technology is facilitating these changes faster than ever. During times like we are in, these innovative and forward looking companies are the stocks that will experience the most extreme short-term volatility because they are not yet mature or seemingly “safe” companies. Over the long-term, however, these also tend to be some of the best opportunities.