There is no denying the worldwide wave of populism hit America last night. The push-back from the common man against the establishment is real. There is evident global frustration with those in the political class who are viewed to be out of touch with the average person. It started in the Philippines in May, continued in the United Kingdom in June and now the ultimate insider candidate of Hillary Clinton has been deposed by a candidate never to have held elective office previously, Donald Trump.

There is no denying the worldwide wave of populism hit America last night. The push-back from the common man against the establishment is real. There is evident global frustration with those in the political class who are viewed to be out of touch with the average person. It started in the Philippines in May, continued in the United Kingdom in June and now the ultimate insider candidate of Hillary Clinton has been deposed by a candidate never to have held elective office previously, Donald Trump.

These are political waves though, not economic waves and the lessons learned in the Brexit vote are quite applicable to our own markets. After the Brexit surprise, the stock market tumbled 5.5% in a matter of days, only to rally and ascend higher soon afterward. The impact of a new administration on our everyday economic life is limited. The GDP of this country hit 3.9% in the third quarter of this year, up from 1.4% in the second quarter. We invest in publicly traded companies because we expect their values to be higher in the future. Only in the market of stocks is a sale a bad thing. Taking advantage of an emotional pullback is our focus at this time. The lessons from last night’s historic election are many and include:

1. Pollsters are dead.

This election, more than any, seems to prove that the traditional polling as a predictor of voting outcomes may no longer be effective. Exit polls distributed on Tuesday early evening were indicating a Hillary win, some placing her electoral votes in the low 300s. They couldn’t have been more wrong. Many feel that the reason behind this is that individuals are simply not participating in polls. Those that do are often likely to be misleading in their responses as they see the pollsters as part of the establishment they are trying to change. Nevertheless, so much went wrong with the polling this go around that their credibility has been unhinged and are likely a waning tool in the election coverage process. (Read more "US pollsters predict a Hillary Clinton win as voting starts".)

2. Artificial Intelligence is alive.

Carnegie Principal, Art Merriman pointed out the influence of Artificial Intelligence in our lives at the most recent Carnegie College. Armed with the power of IBM’s Watson, innovators are finding unique ways to leverage this technology. Predicting elections is no exception. (Read more from Business Insider "An artificial intelligence system that correctly predicted the last 3 elections says Trump will win".) We’ve been intrigued by the power of A.I. in everyday life and the implications on investment portfolios. Of course, new technology often looks good on paper but the real life application can be disappointing. AI is likely to gain credibility if it continues to display a successful predictive track record.

3. Uncertainty of election abated.

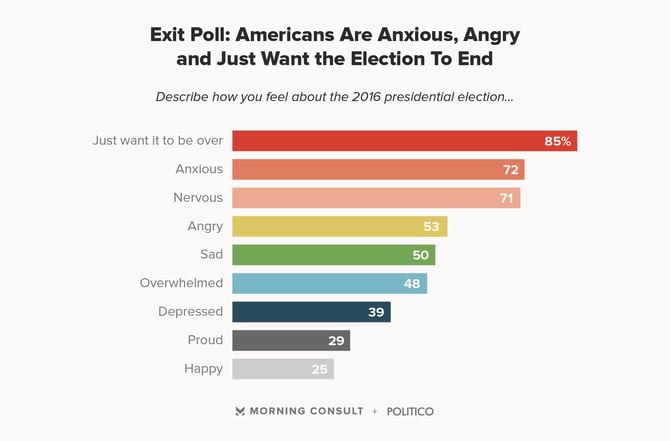

One area where almost everyone agrees is “election fatigue”. You probably don’t need a poll to tell you this, but according to Politico, 85% of Americans just want the election to be over. Unless you are a writer for Saturday Night Live, you likely agree. The good news is that there is no risk of a contested election from either party. Markets don’t like uncertainty and knowing the direction, whatever direction that is, is usually a positive.

4. Opportunities have shifted.

There seem to be some clear winners in this election. They include healthcare, defense, energy, pharma and biotech stocks. Proposition 61 forcing Drug Price Standards failed by a wide margin in California. Corporate tax reform is likely the number one agenda, including incentives to repatriate cash held overseas. Many companies sitting on foreign profits may soon be able to distribute capital back in the U.S. without double-taxation, benefiting shareholders and the economy in general. Defense companies look to benefit from government spending that was already gaining traction and will likely accelerate. Regional banks and financials in general should be able to enhance performance with a lighter regulatory load. Finally, restaurants and retail should get a boost as the threat of a $15 minimum wage under Clinton disappears.

5. Fear is high.

According to Strategas Research Partners, the 5-day put/call ratio is in the 99th percentile of all data and the highest in several years. Equity exposures have reduced sharply over the past few weeks and the VIX curve curve inverted last week indicating an increased level of fear. While the market may have anticipated a Trump win by the nature of these bets, periods of significant fear are often followed by strong market performance. The sentiment already seems to be in a bottom with bullish characteristics and a further short-term pull back would seem to make entry points more attractive.

6. Fundamentals still rule the day.

The coming days and weeks are likely to unsettle both equity and fixed income markets globally. As the reality of a Trump Presidency is digested, the markets will eventually look back to fundamentals for direction. While growth is slow by historical standards, markets have this priced this in already. Valuations are reasonable by many measures. In contrast to 2001 or 2008, when valuations were unsustainable in the former and earnings were vaporizing in the latter, current conditions seem stable if unexciting. With expectations so low, incremental positive surprises will reward those who are patient and committed.

Donald Trump surprised many with his historical upset of Hillary Clinton in the U.S. Election last night. In a year laden with populist undertones; a Trump victory shouldn’t have been so surprising after all. Whatever side of the aisle you reside, our job as your trusted adviser is to help you navigate through these periods of uncertainty. The markets have a way of humbling the smartest short-term plans. While we spent the last two hours crafting this response, the stock market actually turned positive. If you remain focused on your own long-term plans, and make decisions accordingly, this political event will hardly register as a blip. While it is a new chapter in the political life of America, it is just another day in the market.

There may be links provided within this blog that will connect you to a third party website not associated with Carnegie Investment Counsel. We make no representation as to the completeness or accuracy of information provided at these web sites, and we are not responsible for the information or content provided on these sites.