Legacy giving serves as a tried-and-true (if often underutilized) source of revenue for nonprofits.

Planned gifts like bequests provide a range of benefits, including stable funding over time and opportunities to deepen relationships with your organization’s most dedicated supporters and their families. Creating a thriving legacy giving program is a worthy investment for organizations of all sizes.

But even with a well-managed program, you may be inadvertently limiting the potential of your investment by keeping a narrow focus on just one type of gift.

To help you maximize the impact of your legacy giving program, we’ll take a look at today’s legacy and non-cash giving options that might be excellent choices for some of your nonprofit’s donors.

Types of Legacy Gifts

Legacy gifts are typically thought of as deferred donations, disbursed to your nonprofit after a donor passes away and their will is executed.Bequests are the primary type of gift that fall under this umbrella. They’re relatively straightforward—a donor simply adds the appropriate language to their will stipulating that a flat amount or percentage of their remaining estate should be paid to your organization upon execution. These gifts are highly accessible to donors at all giving levels, and they’re easy to promote, so it makes sense that they’re prioritized by new legacy giving programs.

However, bequests are far from the only option available. Posthumous legacy giving fits within the broader category of planned giving, consisting of any gifts that are made as part of a donor’s estate or financial plans and that aren’t necessarily deferred.

Other types of planned gifts include:

- Charitable gift annuities provide donors with fixed income payments for set terms from an initial irrevocable gift that is invested and grown by a nonprofit

- Charitable remainder annuity trusts that provide donors with fixed payments based on a percentage of the trust’s initial assets

- Charitable remainder unitrusts that pay donors back with fixed percentages of the trust’s fair market value, which can grow over time

- Pooled income funds, which essentially function as mutual funds in which a group of donors makes a large joint contribution in exchange for performance-based payments over time, with the nonprofit receiving a donor’s shares when they pass away

- Beneficiary designations on unused retirement assets and life insurance policies, which are deferred and fairly straightforward like bequests.

Take a closer look at these and other types of mutually beneficial financial arrangements with FreeWill’s guide to the types of planned gifts.

One important note to keep in mind: Never give your donors explicit financial or estate planning advice. Leave the nitty gritty and judgment calls to their financial and legal professionals.

For your nonprofit’s development team, the goal instead is to understand these gifts and their general tax benefits so that you can raise them as relevant options with prospects as opportunities arise.

Other Types of Non-cash Gifts

It’s no secret that the world of philanthropy is increasingly driven forward by major donors and funders. These donors want to give to the causes that matter to them, but they’re also interested in strategically managing their philanthropy. Meet your donors where they are by providing even more flexible giving options.In many cases, this means accepting a wider range of non-cash gifts. Between demographic trends, the boom economic years of the past decade, and the emergence of new financial vehicles, these gifts represent bigger opportunities for nonprofits than ever before.

Popular types of non-cash donations given to nonprofits include:

- Gifts of stock, usually liquidated upon receipt by a nonprofit

- Grants from donor-advised funds (DAFs), akin to philanthropic savings accounts, that have exploded in popularity in recent years

- Qualified charitable distributions (QCDs) from traditional IRAs, which allow retirement-age donors to maintain RMD compliance while reducing their tax bills

- Gifts of cryptocurrency, which help you open giving opportunities and forge relationships with younger and more diverse cohorts of donors

- High-value in-kind donations of real estate, vehicles, art, and more, which may be mutually beneficial choices for donors depending on their situations

Many nonprofits use their legacy and planned giving programs as springboards to begin branching out into new forms of non-cash giving, using similar processes for identifying, cultivating, and stewarding them over time. Again, the key is to be aware of the options available so that you can recognize opportunities as they arise with your donors.

Interested in learning more about unique ways donors can support your organization? Download our guide, 11 Unique Ways to Support Your Favorite Organization. In our guide, you’ll explore 11 different charitable giving options that can revolutionize your revenue streams. From traditional methods to innovative strategies, each option offers a unique opportunity for both your nonprofit and your generous donor. Download the guide today!

How to Approach Planned Giving When You're Just Starting

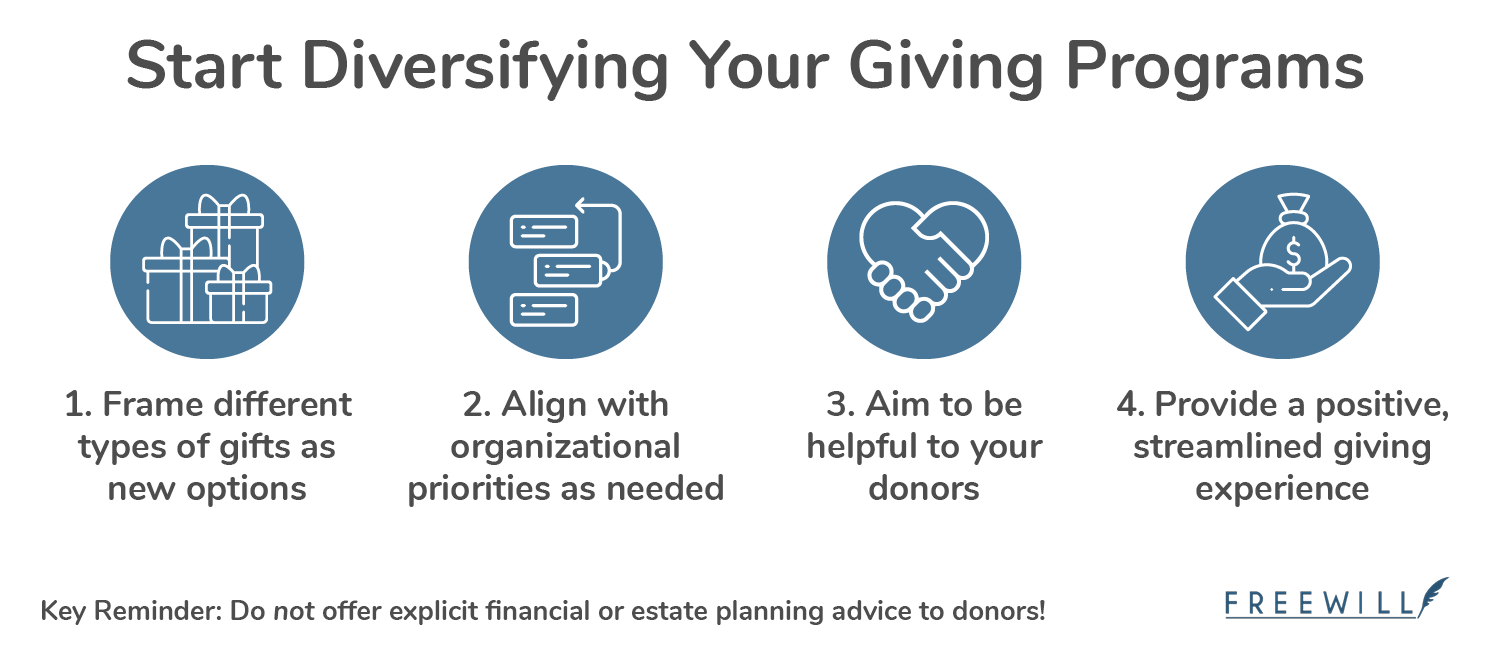

Let’s say you already have a preliminary legacy giving program in place and regularly solicit bequests from donors. How do you begin diversifying your efforts to secure different types of planned gifts and new non-cash gifts?

Consider These Best Practices:

Frame different types of gifts as new options. Build out your giving programs organically as you learn more about donors’ giving motivations and priorities. Ensure that your development team understands the range of options available and has a working understanding of the benefits and loose prospect profiles for different gifts.

Get more intentional to align with organizational priorities. If you already know that your nonprofit wants to secure more DAF grants, for example, go ahead and research your target audience for DAFs, send surveys to your donors, create initial prospect lists, and begin reaching out in targeted ways. Broad mentions of DAFs in your newsletter and quick email blasts are easy ways to kickstart the process, as well.

Aim to be helpful. Position your nonprofit as a helpful partner by providing educational materials on the benefits of modern ways of giving. Many organizations expand their Ways to Give pages with additional content or create standalone planned giving microsites to serve as central hubs. (Again, be careful to not provide explicit estate or financial planning advice.) It's essential your website is up to date and easy to use. Check out this list of 6 ways your website could be hurting your major giving program.

That's why we started providing custom built stock donation landing pages for our clients at Carnegie. We recognize that donors need a streamlined and accessible way to make donations of stock. Meeting the donor where they are is essential, but you don't want another landing page to build.

We work with the organization to align with their branding and goals and give them a link to share with donors and put on their website. Then we make it easy by following up with the donor (yes, by a real human!) and getting the process started. That way, you have less to do and know that the donor is being cared for.

Be prepared to offer a smooth experience. When a donor decides to give in a new way for the first time, the process needs to be a positive one. This is a valuable opportunity to reinforce your relationship by offering a streamlined giving experience. Understand the steps that both you and your donor will need to take and invest in the tools you’ll need to handle them—for example, you may want to build a user-friendly online process for donors to report their gifts of stock to avoid information getting lost between your brokerages.

At Carnegie, we make it easy for our clients. We know you worked hard to cultivate that gift and have enough to worry about. We can work directly with the donor or their financial advisor to facilitate the donation of stock and send necessary receipts and tax information. You will be able to rest easy knowing the donation is being handled, and can enter them into your stewardship process.

Major giving is more important than ever in the nonprofit world, and donors are looking for ways to give more strategically. The key is to meet them where they are. Legacy giving programs serve as ideal launchpads for diversifying your nonprofit’s development efforts, and thankfully, the relative simplicity of bequests makes it easy to get started.

Understand your (and your donors’) options, have a plan, gather the tools and resources to provide a stellar legacy giving experience, and you can raise more for your mission.

Looking for a Financial Advisor for Your Nonprofit?

Finding the right investment advisor shouldn’t be overwhelming. At Carnegie Investment Counsel, we understand the unique challenges nonprofits face when securing their financial future. We’re here to bring clarity and expertise to the process. Schedule a complimentary consultation today!

This blog is for informational purposes only and is not meant as financial, legal, or tax advice. Please seek professional advice from qualified tax, legal, and/or financial professionals before making any financial decisions.

Carnegie Investment Counsel (“Carnegie”) is a registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. For a more detailed discussion about Carnegie’s investment advisory services and fees, please view our Form ADV and Form CRS by visiting: https://adviserinfo.sec.gov/firm/summary/150488.