Sharing Economy

Over the Easter holiday, my family and I took a short trip to Southern California. I have been a proponent of the “sharing economy” and am a believer that it is changing the landscape in a number of industries. In hindsight, I realized that we partook in the “sharing economy” for many of the details of our trip:

- Uber: We used Uber a couple of times. This is the most obvious and best known sharing economy provider. I have vowed never to take another taxi ever again. Unfortunately, I was forced to take one once in Rochester this year because they will not allow Uber there yet. Uber is cheaper, more convenient and usually a better vehicle than a taxi. Why take a taxi when you can Uber?

- Airbnb: We rented our house from someone through Airbnb. If you are not aware of Airbnb, it is an app where people list their house for others to rent. It can be the whole house or even just a room; it can be for just one night or even a full month. I can’t even imagine what people did 20 years ago to rent a place. I assume they would have to call a realtor or rental house service, or even (gasp) look in a newspaper at the classifieds. I read that in New York City, the number of active Airbnb units is equal to 20% (and growing) of the total number of hotel rooms in the city, so this is a serious game-changer.

- Turo: I know some people don’t understand why people would do this, but Turo is a car sharing app where people let other people drive their car for a period of time. This was the first time I used this. The choice of cars was dramatically better than would be possible through a rental company, the process was significantly more convenient, and to top it off, you get a better car for less money. Between Turo and Uber, why would I ever need to rent a car in the traditional fashion again?|

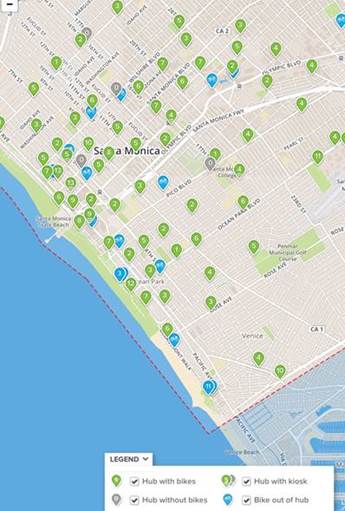

- Sobi: Sobi is short for “Social Bicycle”. This was the coolest sharing economy experience of the trip. I have been to cities where they have bike racks where people can return the bikes to another strategically located bike rack, which is pretty interesting. This was even better. They designed a bike with a GPS locator and a lock that is part of the bike. So, you can ride the bike anywhere and whenever you lock it, which can be anywhere, your ride is over and it is available for the next person. We would ride the bikes to our house and leave them there at night, and within a half hour, someone else would come and take the bike somewhere else. To find a bike, you just turn on your app and it shows you where all the bikes are. The cost is significantly less than the traditional bike rental model and it is considerably more convenient. I noticed that most of the bike rental places were full of bikes and no one was there…big surprise.

Sobi Bike Map

All of these things are instantly accessible from that little device in our pockets. So far, public stock investing directly into the sharing economy has been elusive, although there are rumors that Uber may go public soon. However, there are many industries being affected by this phenomenon, so it is important to recognize the current trends. The sharing economy is taking advantage of technology to reduce inefficiencies and to utilize otherwise unused assets. While it may be impossible to directly invest publicly in one of these companies, all of this technology depends on cellphone use, cellphone towers, bandwidth, “big data”, software companies, GPS, payment processors and more. More: The top 10 biggest sharing economy stories of 2015.

Chasing Yield

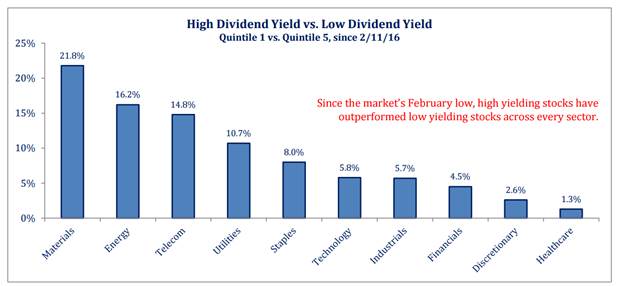

In past blogs, I have mentioned the market’s appetite for yield. The chart below, compliments of Strategas, shows that in every sector, since the February market low, high yielding stocks have outperformed low yielding stocks. This is pretty unusual since most bounce-backs off of market lows are characterized by money flowing into riskier stocks, which usually are not the ones paying high dividends. As I mentioned in "Dividend Stock Bubble", this thirst for yield has driven many dividend paying stocks to all-time high valuations.

Wall Street Bias

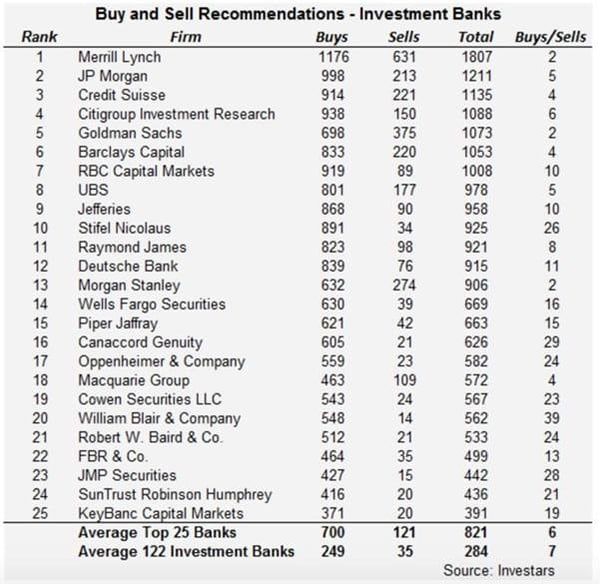

The chart below, forwarded to me by our own Raz Pounardjian, summarizes buy and sell recommendations by investment banks. As you can see, for a number of probable reasons, the recommendations are dramatically skewed to the buy side. This has almost always been true, including during market peaks.