Mega-Cap Tech Stocks

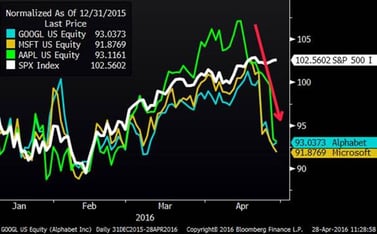

In the past week, Microsoft, Apple and Google all had weak earnings reports and were punished accordingly. Since their recent highs, these stocks have lost roughly $200 billion in market capitalization. Put another way, that is more than ten times the total value of all residential real estate in Cleveland or, perhaps more interestingly, 50 Freedom Towers in New York could have been built with this money.

On a positive note, another huge technology stock, Facebook, released earnings today and is moving to new highs. With today’s move, Facebook has a larger market capitalization than healthcare giant, Johnson & Johnson. MORE: Facebook is Everywhere and Planet Facebook

GOOGL, MSFT, AAPL and the S&P 500 (Year to Date)

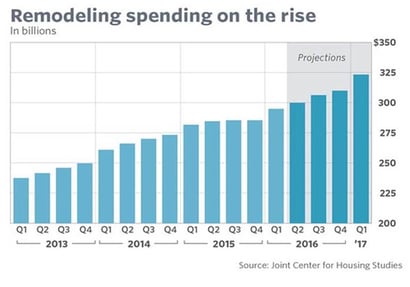

Remodeling Boom

Over the past few years, home remodeling has boomed. This is partially due to people deciding to upgrade their current homes instead of buying another house as a result of a shortage of quality housing inventory. Seven years ago, “shortage” and “housing” were the last words you would ever expect to see together in a sentence. MORE: Behind America's renewed mania for home renovation

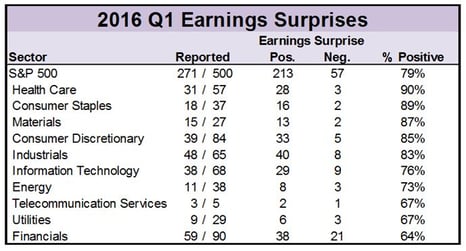

Earnings Season

Going into earnings season, Wall Street was nervous about the weakening economy and the potential for a bad earnings season. Through today, with a little more than half of S&P 500 companies having reported, a whopping 79% of companies have beaten street expectations by an average of 4.2%. The all-time record is 79.5%, which occurred in the third quarter of 2009 – shortly after the beginning of the great bull market. Apparently, the media and Wall Street were wrong about this earnings season. Click here to see what Gomer Pyle has to say about this.