Facebook is Everywhere

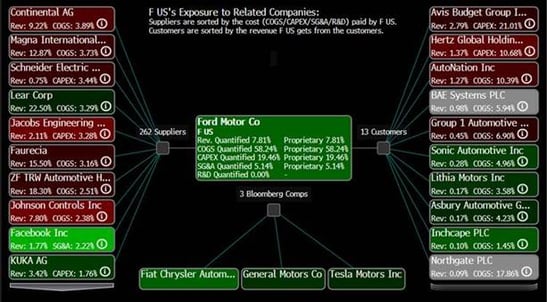

Many people have a hard time believing that Facebook is now almost a $300 billion (by market capitalization) company. I happened to be looking at the diagram below on Ford Motor Co., which shows their top ten quantified customers and suppliers. Fully expecting to see companies like Lear, Johnson Controls, steelmakers and other obvious choices, I was surprised to see Facebook. The fact that Facebook shows up as one of Ford Motor Company’s largest quantified vendors is a testament to what an incredible marketing engine Facebook is and that companies are willing to pay for that exposure. MORE: Facebook is Now Bigger than the Largest Country on Earth

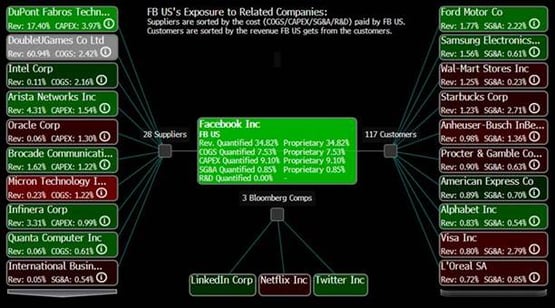

This of course leads to the next question, which is “What does this diagram look like with Facebook in the middle?”—Interestingly, their largest customers are a “who’s who” of massive consumer-related companies:

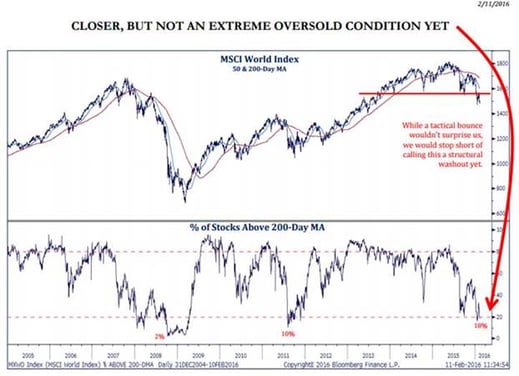

Are We Close to a Bottom

This is one of the most common questions investors and traders are asking. In a true bear market, it does not typically end while people are still asking this question. Rather, it ends when everyone stops asking questions and has “thrown in the towel”. The chart below, borrowed from Strategas, shows that only 18% of stocks in the MSCI World Index (an index of developed countries’ stocks) are above their 200-day moving average. This is a bear market type of reading and has only been this negative twice in the past decade; 2011 and 2008-2009. At first glance, this looks like a bullish signal and that the market should bounce. If you look more closely at 2008-2009, however, this indicator entered the same vicinity it is in now in the beginning of 2008. From that point forward, the index lost another 56%.

Dividend Cuts are Priced into Energy Stocks

A couple of months ago, the thought of dividend cuts in energy stocks was scary and if this occurred it would mean a major drop in their stock prices. As carnage has persisted in the space and stock prices have adjusted to the expectation of an almost doomsday environment, a new dynamic has emerged. Now, when these companies slash their dividend, the market hardly bats an eye and in many cases expects these companies to do so. One example this week was Anadarko Petroleum which slashed their quarterly dividend from $.27 to $.05. MORE: Yes There Will Be More Dividend Cuts

U.S. Dollar and Gold

I have mentioned the idea that the consensus belief is that the U.S. Dollar has been strong and will continue to be so. The chart below shows that it has not gone anywhere for the past year. If the U.S. economy is indeed slowing, and Europe is done weakening, it would be possible to envision an environment where the dollar is not so resilient. From a stock standpoint, companies in sectors like industrials have been fighting a fierce headwind against a stronger dollar. On a year-over-year-basis, starting in Q1, this headwind will be diminished. Could this mean that these extremely weak sectors could emerge as the new market leaders? Could many of the U.S. centric companies to which investors have flocked actually see outflows? Obviously, the strong U.S. Dollar has also been a headwind against commodity prices including oil and gold. Is it possible that if the Dollar weakens or even stays the same that commodities will benefit? The chart below shows the U.S. Dollar and gold prices. As you can see, gold has moved up almost $200/ounce this year. MORE: Gold Heads for Best Weekly Advance Since 2011

U.S. Dollar and Gold (Three Years)

JPMorgan CEO Buys 500,000 Shares

Bank stocks have been in question lately, with a number of fears circling and hurting their stock prices. Yesterday, one insider, JPM Morgan CEO Jamie Dimon, who arguably may know as much as any insider in the banking industry, put his money where his mouth his and bought $27 million worth of his own stock; he has already made almost $2 million (on paper) from this purchase. This marks the second purchase Mr. Dimon has made in the past five years. MORE: Dimon Just Spent a Year's Pay on JPMorgan Stock After Bank Rout - Bloomberg Business