A.I. This Week

One can hardly read Twitter (or the newspaper for those that still do that) anymore without seeing a new story of how A.I. technology is driving new innovation. You most likely heard that Uber driverless cars went online yesterday in Pittsburgh, but another interesting development this week was that Project Wing, a unit of Google, is experimenting with Chipotle burrito delivery via autonomous drones at Virginia Tech. Watch: Google Tests Burrito Delivery via Drone at Virginia Tech I can only image kids laying out in the quad ordering burritos, only to have a drone come and drop off a barbacoa burrito (no extra meat, though, since that might exceed the weight limit on the drone). Clearly this is partially a marketing stunt by tying in Chipotle; it would never make sense to deliver burritos by drone any time soon – are there going to be hundreds of drones flying around campus, each with one burrito on them?

Looking beyond the marketing aspect, Virginia Tech is an FAA approved test site and the experiments are being run by the some of the brightest technology minds in the world. Burritos aside, one application that comes into mind is healthcare and first responders. Imagine if as soon as a call comes in, a drone could be dispatched to deliver Narcan or an EpiPen. Or, in a pursuit, instead of a helicopter, there is just a drone following the assailant. Or maybe instead of people having to go to the pharmacy, important prescriptions will be “droned” directly to those in need. There are many applications beyond just the delivery of Amazon goods and such, and while still in its infancy, this technology may be coming sooner than most people realize. MORE: Will Drones be Delivering your Medicine?

Drone Delivering Chipotle

Seasonality

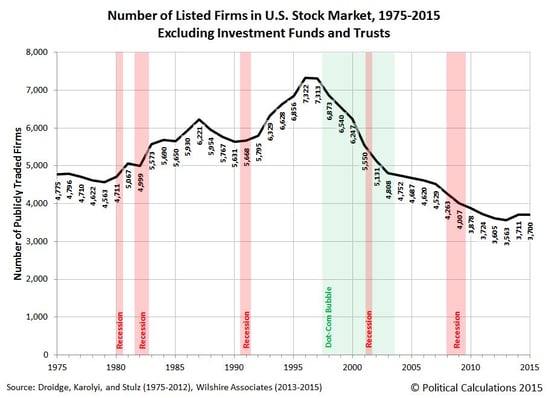

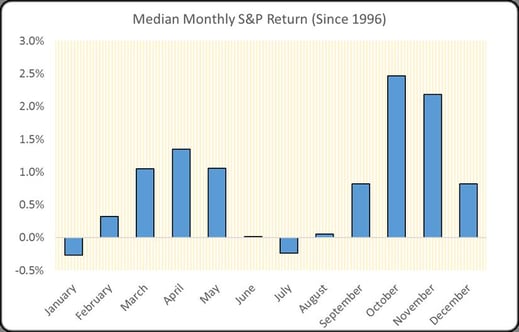

There are many who say that we are entering a weak seasonal period in the market. Taking the data over the past twenty years, which is roughly when the stock market moved into a new technology era, this does not seem to be the case. As the chart below illustrates, if anything, September through December have typically been strong months since 1996. Disclaimer: I am not a believer in trying to play seasonal patterns in the market since there can be dramatic and random variance from year to year, even if there is a weak seasonal correlation over time. For those feeling particularly numeric, here is a video that statistically describes what I am referring to: Watch: The Problem with Seasonality

Shown a different way, the chart below shows the same data in a heat map since 1996. To me, this looks mostly random rather than clearly patterned:

Heat Map of Monthly S&P 500 Returns (Since 1996)

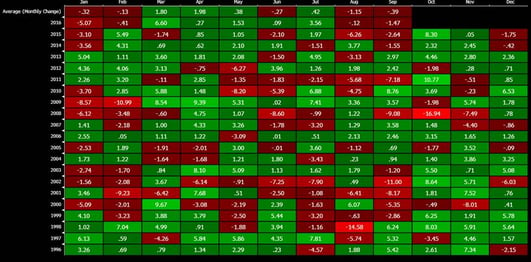

Where have all the Public Companies Gone?

An interesting trend over the past twenty years is that the number of publicly listed stocks in the U.S. has been in decline (see chart below). While it may be easy to assume that this trend might be due to tighter regulations and higher hurdles for public companies, it actually appears to be largely a result of M&A. In the past twenty years, pools of venture capital and private equity have dramatically expanded. Many public companies have been either taken public or bought out by M&A groups. Further, new companies are less likely to go public because they have access to so much more private capital than in the past, not to mention the fact that companies like Google and Facebook are on a buying spree of smaller technology companies before these companies even have a chance to think about going public. According to Fortune, there are now 174 private technology companies valued at over $1 billion (The “Unicorn” List). The decrease in the number of equities leads to a number of questions, some of which are covered in this piece from Bloomberg: Where have all the Public Companies Gone?