Perceived Risk and Human Nature

The greatest opportunities in the market, on both sides, occur when there is a large gap between the actual risks to the market and the perception of those risks by market participants. For example, in 2007, as the sub-prime lending crisis grew, very few people saw those risks and the market dramatically underestimated those risks. This dichotomy allowed for the greatest shorting opportunity in generations. As always, the perception of risk moves like a pendulum, so as the actual risks came to fruition and were addressed, the fears and perception of risk moved to an extremely negative stance, thereby creating a great buying opportunity only a year later.

The odd thing about human nature is that our perception of risk is far from rational. For example, let’s say you live in a college dorm where the fire alarm goes off on a regular basis. The first time the alarm goes off, you will think it is a real alarm and your brain will calculate high odds (higher than the real odds) that there is an emergency. With every false alarm, your brain calculates lower odds of it being real, eventually to the point where you are extremely complacent and your brain is dramatically underestimating the odds of it being real. Once a real fire does occur, you are unprepared for it. Then, the next time the alarm goes off after the real fire, assuming you survived, you panic because of the previous experience. Meanwhile, the real odds of each alarm being a fire have remained exactly the same, but your perception has changed. Our perception of the likelihood of a bad event occurring is not very rational and is highly skewed by how recent a similar event has occurred. In the real world, this phenomenon happens all the time.

My guess is that we developed this instinct over the past 5,999,900 years. If we had not seen a tiger for a really long time, then we were most likely safe from being attacked by that tiger. If we just saw it lurking around yesterday, then we are probably still in grave danger. While this instinct saves us on the Savannah, it hurts us in the financial markets. Once a risk is known and addressed, the odds of it actually occurring mitigate and therefore investing based on that risk becomes ineffective or even dead wrong. When the market becomes complacent and ignores the alarms is when the real danger exists.

So, how is this coming into play today in the markets? These days, one of the biggest investment related subject matters relates to where oil prices are going. The consensus now seems to be that oil prices have stabilized as supply has adjusted to lower prices. This time around, pundits believe that there will be a ceiling to oil prices not much higher than the current prices because reactivating all of the idle fracking operations is easier than in the past. In the background of the energy industry, one of the risk bubbles referred to above has occurred. Financial institutions made incorrect assumptions and underestimated the likelihood of oil prices dropping as much as they did, which of course means that they overestimated the cash flows and overestimated the ability of their borrowers to repay their debts. This sounds just like a mini sub-prime mortgage crisis, doesn’t it?

So now, the last fire alarm in the energy industry was real and the casualties are still being counted. As oil prices rise and the surviving drillers want to reactivate the idled facilities, that will take money. To some extent, that money will need to come from lenders. Maybe the consensus is wrong and reactivating the oil fields will take longer than people think because lenders and operators will be gun shy. Is it possible that the market is wrong and that the big surprise will be that oil prices continue higher than everyone thinks because turning the spigot back on will not be as easy as expected? Related: Why Oil Prices Will Surprise Pundits

Oil Price (20 Years)

Retail Debacle

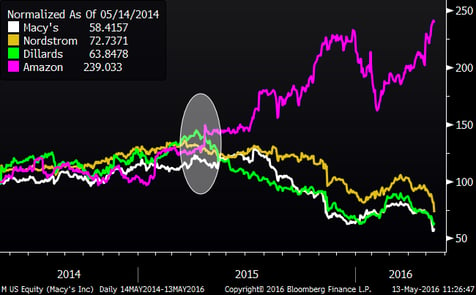

As you may have seen in the news, a number of high profile mall-based retailers have released poor results for Q1. The question this brings up is whether this is an indication that the U.S. consumer is weakening or whether this is a reflection of accelerating changes in consumer behavior. So far, the broader numbers on the consumer are still strong. If you look at the chart below, you can a clear divergence between the behavior of the mall-based retailers and Amazon.com, which is changing the landscape of how Americans purchase “stuff”. Look Back: Retail Debacle Part I