A.I. Story of the Week

If I wrote the blog more than once a week or so, I would call this the story of the day. Every day, there are new stories about new developments and advancements in artificial intelligence and related technologies. One story that grabbed my attention this week (Click Here to Read It) discusses how Hanover, a Microsoft machine learning project, is using A.I. to help treat cancer. With hundreds of cancer drugs and new research being published constantly, along with the uniqueness of each patient and their likelihood to respond to a given therapy, it is impossible for doctors to know everything there is to know in order to best treat the patient. A.I. can come up with insights without being specifically programmed to do so by “reading through” research papers, clinical trials, medical records, radiology reports, etc. This is amazing technology, and we are just scratching the surface of its potential. RELATED: Why Deep Learning is Suddenly Changing your Life - this is a good intro to A.I. and deep learning.

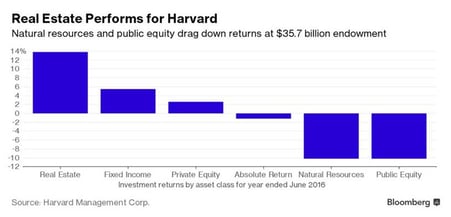

Harvard Endowment

The Harvard Endowment lost 2% for the fiscal year ended June 30, trailing the performance of many of its peers. Most remarkably, in my opinion, their public equities lost a whopping 10%. This during a time when the S&P 500 was up 4% and the average equity mutual fund was down 7% (how bad this is surprises me too). The endowment, which paid their former CEO $13.8 million, blamed bad stock-picking, especially in the healthcare sector. This goes to show that even having unlimited resources at hand does not guarantee good results. READ MORE: Harvard Endowment Losses Magnify Decade of Struggle

Apple to Buy McLaren?

Five years ago, if one had told you that Apple is reportedly in talks to buy McLaren, you probably would have asked which technology company McLaren is, because Apple would not possibly want to buy a car company. With advancing technology, the lines between sectors and industries are becoming blurred. These changes have investment implications too, and bring into question the utility of the old-fashion S&P sector classifications, but that is a topic for another day. While McLaren is denying the claims, many think this purchase would make a lot of sense – McLaren has incredible engineering and automotive expertise, and Apple has been developing technologies related to autonomous cars. Remember, Tesla’s first cars were actually made by Lotus. And take a look at the photos below…they both have (or will when Apple’s is complete) similar spaceship-like headquarters, so it is a perfect match.

I am leaving for a road trip shortly with my son, Clay, and we are attending the Clemson/Louisville game. I hope that when read my next blog, Clemson will still be undefeated!