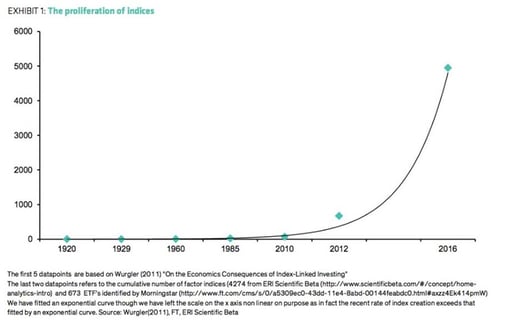

The Proliferation of Indices

The chart below shows the growth in the number of indices over time. Just over the past couple of years, this measure has exploded. Why is this happening? In the past few years, there has been a push toward passive investing versus active investing. Investors are being sold on this idea by companies who provide so called “passive” investment strategies like ETFs. These ETF providers are always looking for more products to sell and, as a result, work with indexing companies to create new indices on which to base their ETFs. Now, there are over 5,000 indices – more than the number of stocks in the Russell 3000. RELATED: Passive Investing is Worse than Marxism.

In the past, the idea of passive investing meant buying a market basket of stocks with the idea of participating in the broader returns of the market. Passive investors were not trying to be value, growth or sectors focused and were not trying to take advantage of shorter-term market inefficiencies. Today, there is an ETF to fit every bias and every fundamental/technical strategy. Investors think they are passively investing and feel good about it because the media and the ETF industry tells them that they are doing the right thing. But, if investors are buying and selling concentrated ETFs, it is not passive investing at all, and in the end, they are no safer than they were when they were buying and selling individual stocks or paying a professional manager to do so. In fact, they may be worse off because of a perceived margin of safety and diversification that may not exist in their portfolios.

Driverless Ubers – They’re Heeeere

Believe it or not, self-driving Ubers are now on the road in Pittsburgh, PA, and I am told Cleveland might be next. For some reason this reminds me of this scene from my childhood: Click to Watch. The introduction of driverless cars, in my opinion, is just the beginning of a new technological revolution driven largely by A.I. (Artificial Intelligence). A.I. is an exciting term that marketers and the media have gravitated to, but essentially it is nothing more than advanced data analytics. The ability of computers to crunch huge amounts of data fast enough has finally caught up and driverless cars are just one application. The implications of A.I. and the changes it will bring are profound and I believe that it could be on a similar scale to the industrial revolution or the invention of the internet. The question is, will you be merely an observer (or worse a victim) of this revolution, or will you be a benefactor? I plan to be the latter. MORE: The Implications of Driverless Cars