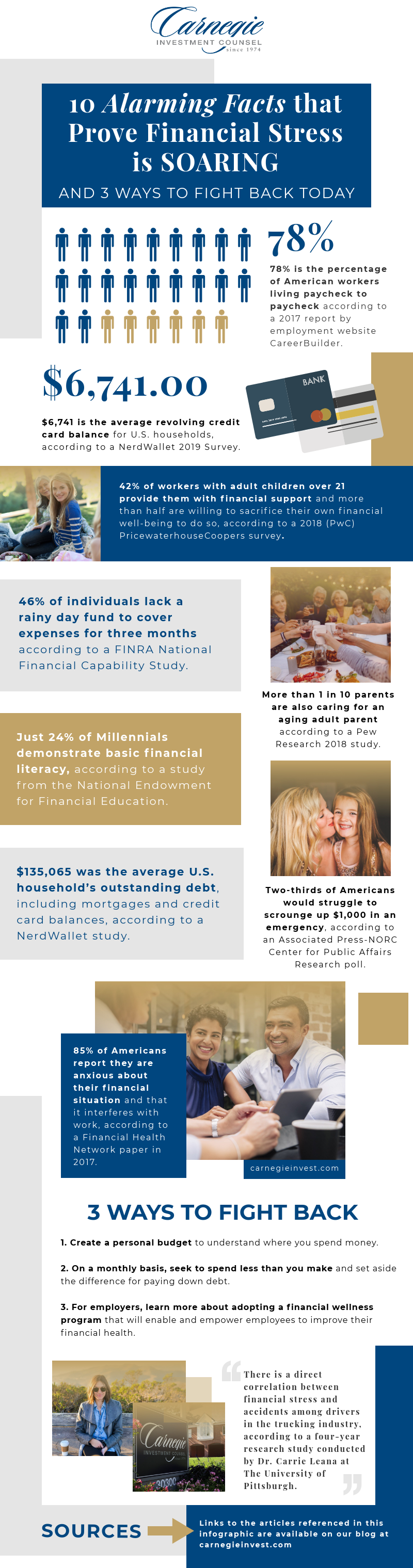

- 78% of American workers live paycheck to paycheck according to a 2017 report by employment website CareerBuilder.

- $6,741 is the average revolving credit card balance for U.S. households, according to a NerdWallet 2019 Survey.

- 42% of workers with adult children over 21 provide them with financial support and more than half are willing to sacrifice their own financial well-being to do so, according to a 2018 (PwC) PricewaterhouseCoopers survey.

- 46% of individuals lack a rainy day fund to cover expenses for three months according to a FINRA National Financial Capability Study.

- Just 24% of Millennials demonstrate basic financial literacy, according to a study from the National Endowment for Financial Education.

- $135,065 was the average U.S. household’s outstanding debt, including mortgages and credit card balances, according to a NerdWallet study.

- More than 1 in 10 parents are also caring for an aging adult parent according to a Pew Research 2018 study.

- Two-thirds of Americans would struggle to scrounge up $1,000 in an emergency, according to an Associated Press-NORC Center for Public Affairs Research poll.

- 85% of Americans report they are anxious about their financial situation and that it interferes with work, according to a Financial Health Network paper in 2017.

- There is a direct correlation between financial stress and accidents among drivers in the trucking industry, according to a four-year research study conducted by Dr. Carrie Leana at The University of Pittsburgh.

3 Ways to Fight Back Today

- Create a personal budget to understand where you spend money.

- On a monthly basis, seek to spend less than you make and set aside the difference for paying down debt.

- For employers, learn more about adopting a financial wellness program that will enable and empower employees to improve their financial health.

The Full Infographic

References

Living Paycheck to Paycheck is a Way of Life for Majority of U.S. Workers, According to New CareerBuilder Survey

U.S. employees aren’t confident about reaching financial goals, according to PwC

https://www.pwc.com/us/en/press-releases/2018/pwc-us-2018-employee-financial-wellness-survey.html

More than one in 10 U.S. parents are also caring for an adult

Poll: Two-thirds of U.S. would struggle to cover $1,000 crisis

In the U.S., 46% of individuals lack a rainy day fund.

https://www.usfinancialcapability.org/results.php?region=US

NEFE: Only 24% of millennials demonstrate basic financial literacy

https://www.nefe.org/press-room/news/default.aspx

NerdWallet: 2018 American Household Credit Card Debt Study by NerdWallet

https://www.nerdwallet.com/blog/average-credit-card-debt-household/

HR Drive: One in three workers say their personal finances are distracting at work

CCJ: Research leads Pitt Ohio to create emergency savings plan for drivers, employees