As 2019 was ending, I was reading a few articles and blog posts recapping the last decade of stock market returns.

Throughout this period, there were many instances where you could have been scared out of the market or sought signals that would indicate a “top” in the market.

For example, remember in 2013 when actress Mila Kunis said she was going from cash into stocks? The S&P 500 is up about 140 percent since she made that announcement.

Or how about in 2016 when the cover of Barron’s (a popular financial magazine) boasted “Get Ready for Dow 20,000?” The Dow Jones Industrial Average is in shouting distance of 30,000 or about 57 percent higher from the date of publication.

Ben Carlson and Michael Batnick of Ritholtz Wealth Management said something about the Great Financial Crisis of 2008 and stock market top signals on their Animal Spirits podcast that resonated with me:

“I think 2008 broke a lot of people’s brains. The joke is that there are people for the last decade and forever and ever are constantly looking for the signal.”

Stay in Your Lane

Instead of focusing on trying to find telltale signs indicating when the next recession or bear market will occur, investors should concentrate on the things they can control: their rate of savings, their behavior, their asset allocation, their health and their attitudes.

It is said that more money is lost trying to predict stock market corrections than in actual stock market corrections.

I do not blame anyone for being anxious about the ills of the world considering that we live in a society where more people have a voice (thanks Twitter and Facebook) and news/opinions travel more quickly than ever before. Pessimism sounds more sophisticated than optimism. However, you would be better off telling yourself “there is a good chance the U.S. is going to be fine long-term” and invest with that mindset. History has proven that it is hard to make money over a long period of time in the markets if your outlook on the world is not optimistic.

Onward and Upward

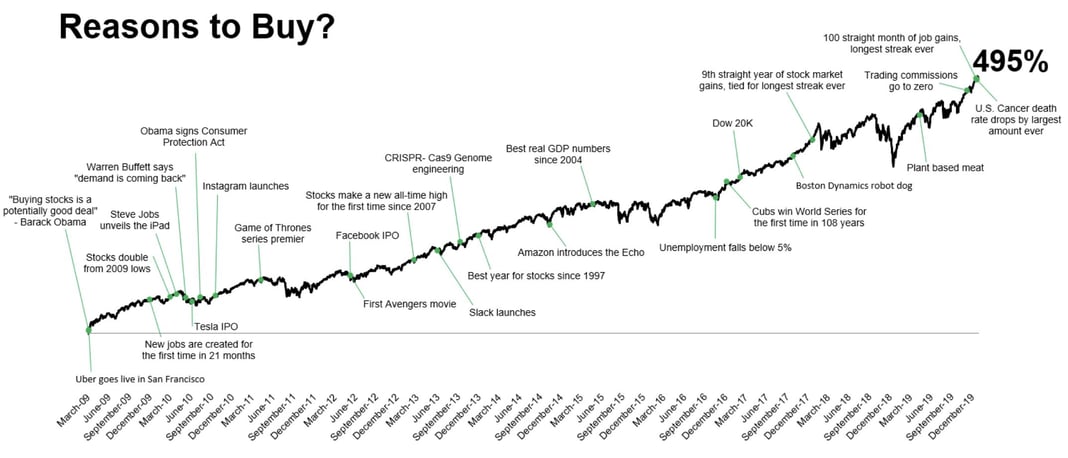

In my previous blog, I shared a chart that showed the S&P 500 index over the last decade superimposed with all the concurrent worries and negative headlines. The same chart was recently published but with all the reasons to buy stocks along with positive developments that occurred during the same period:

(Source: The Irrelevant Investor, Michael Batnick)

It may not seem like it, but the world has been improving slowly but surely every year. Think about how much our lives have improved with advancements in health care and technology; along with the decline in poverty and cancer death rates.

As we look ahead to 2020 and beyond, there will be no shortage of things to worry about, but remember that things are probably better than you realize. If I were a gambling man, I’d bet the world will continue to improve moving forward.

Comments or thoughts on this blog? I'd love to hear from you. Reach out to me at rpounardjian @ carnegieinvest.com.

Want to learn more about working with Carnegie Investment Counsel?

Carnegie Investment Counsel is a registered investment adviser with the Securities and Exchange Commission (SEC). The opinions presented are subject to change without notice. Performance information was obtained from third party sources. Although these sources are widely used, and Carnegie deems these sources reliable, Carnegie makes no guarantee as to the accuracy of the information provided by these third parties. The information provided is for general informational purposes only and should not be considered a solicitation to effect transactions in securities or personalized investment advice. Past performance is not a guarantee of future performance.