Texas Tea

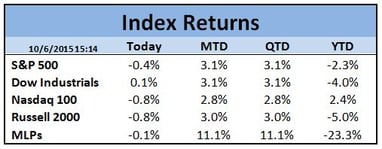

As you may have noticed, energy stocks and particularly MLPs have moved sharply higher since the new quarter started last week. Whether this is a “dead cat bounce” remains to be seen. Consensus thought has been that even though rig counts are down, efficiency gains have meant that production itself has not dropped. With that in mind, I thought the chart below might be interesting. It shows a dramatic reduction in U.S. rig count, which I showed in a recent blog, along with U.S. crude oil production. As you can see, production has begun to tick down. Will it end up being just a tick, or are we on the verge of a measurable drop in production?

U.S. Rig Count (Blue) and Oil Production (White)

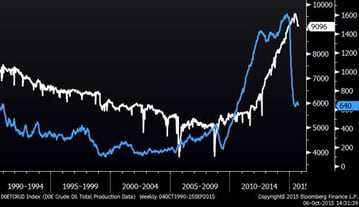

Mutual Fund Flows

As many people already know, there has been a secular shift away from traditional mutual funds and toward ETFs and indexed mutual funds. A chart like the one below borrowed from Strategas, clearly shows the shift:

Many investors have sought out the lower cost structure and better index tracking of ETFs. Additionally, active institutional money managers and hedge funds frequently use ETFs for shorter term exposure to specific themes or sectors. The by-product of this shift has likely led to a higher correlation among stocks within the same ETFs, especially during strong downturns. Since more money is flowing in and out of the ETFs, and therefore buying and selling every stock within the ETF, the best and worst companies within ETFs are treated the same. During tumultuous times like August, this can result in sharper and quicker moves than in the past, with no differentiation between cheap/expensive or good/bad.

Many investors have sought out the lower cost structure and better index tracking of ETFs. Additionally, active institutional money managers and hedge funds frequently use ETFs for shorter term exposure to specific themes or sectors. The by-product of this shift has likely led to a higher correlation among stocks within the same ETFs, especially during strong downturns. Since more money is flowing in and out of the ETFs, and therefore buying and selling every stock within the ETF, the best and worst companies within ETFs are treated the same. During tumultuous times like August, this can result in sharper and quicker moves than in the past, with no differentiation between cheap/expensive or good/bad.

Tight Job Market?

There are lots of ways to measure the job market. The chart below shows the percentage of NFIB respondents who classify current job openings at their businesses as “hard to fill”. By this measure, the labor market is tighter now than at any point in time since 1986 except the late 1990s. Wage inflation, however, as I showed recently, is still tame for now.

NFIB: Jobs Hard to Fill (since 1986)

Uber-esque Toll Road

As anyone who has skied in the Vail/Aspen/Breckenridge area of Colorado knows, I-70 can become quite congested during busy ski weekends. Taking a page out of the Uber handbook, drivers on the route can now drive on a new lane on a 13-mile stretch of this road. The kicker is that like Uber, it will incorporate surge pricing. During the most busy times, drivers will have to pay $30 to use the lane, while during slower periods it will cost only $3. $30 may seem like a lot, but considering the amount of money people spend on a ski weekend, my guess is that they won’t hesitate to pay such a pittance to cruise past all of the “regular” people.

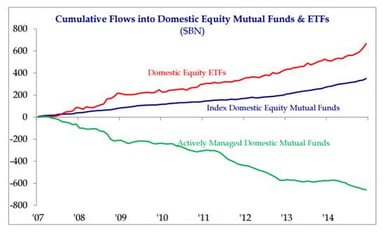

Market Returns

Although the equity markets are relatively flat today (as of 3:15), the table below shows that stocks have been strong in the first few days of the fourth quarter. The MLPs, which have been very weak for the year, have been especially strong since the new quarter began. The MLPs hold on to their spot as a “guest index” on the table below, but biotechs, which have been unusually volatile lately, are a close second.