New Sheriff

My plan was to talk about how there is a “New Sheriff in Town” as Google, aka Alphabet, has taken over as the most valuable (by market cap) company in the world. Unfortunately, this state only lasted a day and Apple has taken back the crown, at least temporarily. The chart below shows GE, Exxon Mobil, Apple and Google since the beginning of the century. A mere fifteen years ago, Google was not even a public company and Apple was barely surviving. They have since surpassed two companies that for generations were considered the biggest and best companies on the planet. I wonder what a chart like this will look like in another 15 years? RELATED: The Rise and Fall of the Largest Corporation in History

Most Valuable Companies (by Market Cap - Since 2000)

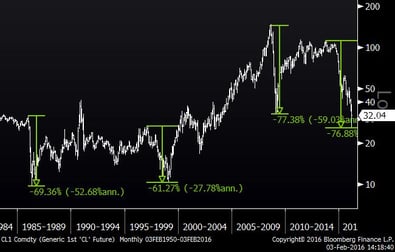

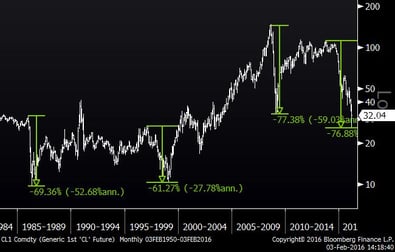

Oil Prices

I have shown similar charts before, but below I illuminate the magnitude of the other major oil price declines in the last 30+ years. With so many questions related to how long this can last or how much further prices can go, it is good to put it in a historical perspective. This move down has already matched the biggest oil price decline in at least 30 years; in terms of duration, it is currently the second longest.

Oil Price Declines (Since 1983)

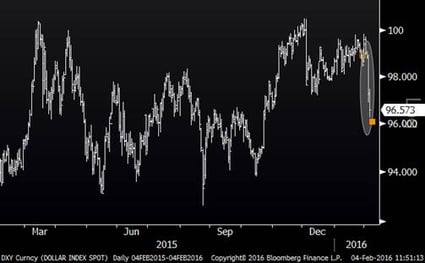

Dollar Weakness

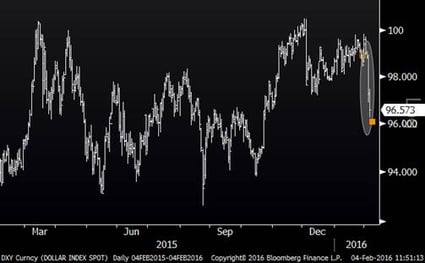

The S. Dollar has been very weak over the past two days and the market has acted accordingly:

- Staples Weak: Consumer staples have been very strong over the past few years, especially last year as investors sold companies exposed to international weakness and bought lower risk U.S.-centric companies like staples. This has brought the valuations of these staples companies to all-time highs. Apparently with the strong move down in the dollar and more of a focus on domestic weakness, investors have begun to sell these holdings.

- Discretionary Weak: Like staples, these have been a safe-haven from global weakness and now that the attention has shifted home, investors are concerned.

- Energy/Materials Strong: Energy and materials have been quite strong. As the dollar drops, commodities rise. So, outside of the fundamental supply and demand equation, if the dollar drops, money will tend to flow into commodity-based companies.

- Industrials Strong: Industrials have been crushed over the past year. Part of this is due to global economic weakness and part of it is due to currency issues. If the dollar weakens, this will help these companies from a currency standpoint. Plus, if the worst is over in other parts of the world, considering these stocks have already been beaten down, money may flow from the former domestic safe havens into these stocks.

Interestingly, the trends above are the polar opposite of what happened last year in the stock market. Could it be that this year’s leaders are the laggards of the past couple of years and vice versa?

The chart below shows the US Dollar Index. Although the media and others keep highlighting the recent strength in the Dollar, we are almost to the point where it will be down on a year-over-year basis.

US Dollar Index (One Year)

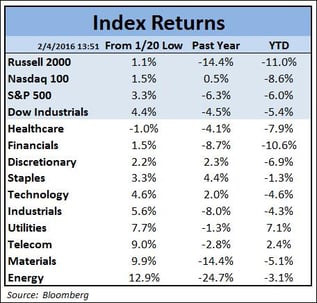

Index Returns

There are number of conclusions one can make from the table below. One thing is for sure: There are a lot of moving pieces right now, and the market has been anything but stable.