Stock Market Contest

I hope everyone had a great holiday season. As the new year begins, many people are thinking about the year ahead. With that in mind, it is time for the annual stock market contest. As I type this, the S&P 500 stands at 1990. Please submit your guess (S&P 500 value at year end) by responding to this email. Any and all are eligible. If you are reading this from a source other than an email, please send to bluce@carnegieinvest.com. The deadline is 11:59 pm on January 5th. I will not be sharing the names of the participants, except the winner if he/she chooses, but I will be sharing aggregated information for fun. Here is a chart of the S&P 500 over the last two years to give you a frame of reference:

2015 Returns

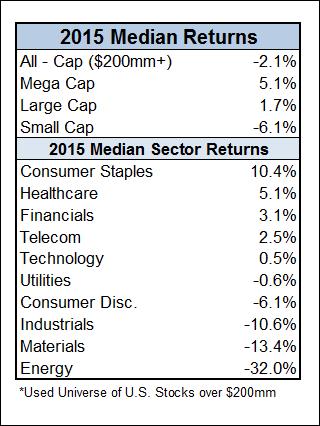

The table below shows the 2015 returns for various indices. From a capitalization standpoint, investors who were exposed to large companies did better than those who invested in small companies. Further, there was quite a bit of dispersion among sectors. Investors heavy in consumer, health care and technology did well last year, and those heavily exposed to materials and energy did poorly.

As Paul Harvey would say, “and now, the rest of the story”. The headline indices do provide us with a general idea of how the market did last year, but these indices are market capitalization weighted and mostly take into account larger stocks that are in ETFs. If we look at the typical (median) stock within sector and capitalization groups, it looks a bit different. Although the S&P 500 was up last year, the typical of those over $200mm in market cap was actually down 2.1%. Further, there are many who have talked about the strength of consumer discretionary stocks, but if you look at the typical consumer discretionary stock, it was actually DOWN 6.1%. A main reason the well-followed index was strong was because of the heavy weightings of large, well-performing stocks including Amazon, Netflix, Starbucks and others within the index.

Apple Spaceship

Over the holidays, I happened to watch two documentaries about Steve Jobs on Netflix. One of the projects he was working on before he died was the new Apple headquarters, which is currently under construction in Cupertino, CA and dubbed the “Apple Spaceship”. Click here to see some cool videos and 51 amazing stats about the $5 billion project. Some speculate that the construction of this incredible campus marks the peak of Apple’s success. We will check back on that one in ten years.

Have a great day and a happy 2016!