Rig Count

I have shown oil price charts a number of times in previous blogs, but I have not highlighted rig counts for a while. In the chart below, the white line is oil prices and the yellow line is the number of active oil and gas rigs operating worldwide. Historically, and not surprisingly, major declines in oil prices have been followed by major declines in rig counts. This time is no exception. The current rig count decline has been as big and as steep as any decline since the 1980s.

Oil Price and Rig Count (25 Years)

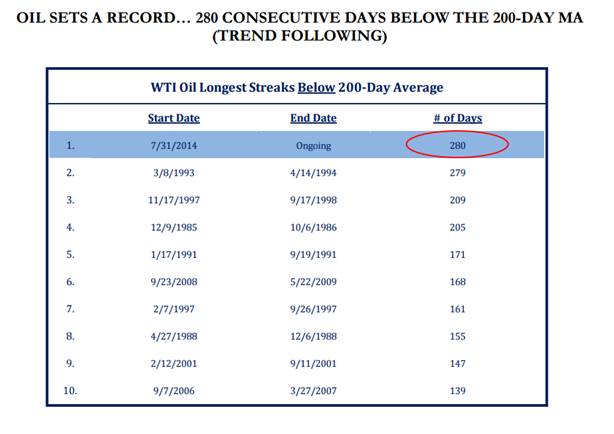

Length of Oil Decline

Thinking more about the current decline in oil prices, the table below (borrowed from Strategas) notes that oil has now been below its 200-day moving average for the longest period in its history. Oil currently sits at $44, while its rapidly declining 200-day moving average is in the low $50s.

Rate Hike

The implied future probability of the Fed hiking interest rates on Thursday is now 26%. As such, if they were to raise rates, it would be a surprise to the market. Currently, the market is expecting an increase in December (59%), with October showing a 40% likelihood. Previous to the recent market volatility, the expectation for a hike this week peaked at about 54%. Several countries and other entities have expressed their belief that a hike this week would be a mistake.

Credit Card Delinquencie

Credit card delinquencies have reached the lowest level since 2006, which is as far back as I can retrieve data. This is reflective of a stronger consumer and tighter standards following the “Great Recession.” Most data shows that the U.S. consumer is healthy.

Credit Card Delinquency Rate (since 2006)

Tesla

I had the opportunity to drive the new Tesla P90d the other day. This car (if that’s what you want to call it) does 0-60 mph in a ludicrous 2.8 seconds and is the most amazing machine I have ever operated. Everything about this car is smart; it is no surprise that it was the highest rated car ever for Consumer Reports. Apparently, the new SUV has 50,000 units pre-ordered. If you have a chance to drive a Tesla, do it!