Recent Market Action

The stock market weakness I have highlighted in previous blogs continues. Today, stocks were down fairly strongly. Fears have shifted from Greece to concerns about global and emerging market economic weakness. Last week’s currency adjustments in China attracted a lot of attention, not only as a sign of slowing growth in China, but because it raised concerns regarding a currency war. Of course, all of this feeds into expectations of when the Fed will raise interest rates. Not surprisingly, as the chart below highlights, the odds of a September rate hike have lessened:

Odds Of September Rate Hike (YTD)

Dow Jones Industrials (3 Years)

Existing Home Sales

Although the market was fearful today, there was some positive economic news. In July, existing homes sales reached their highest level in nine years. For the most part, U.S. economic indicators have remained relatively healthy and are not showing signs of impending economic weakness.

Existing Home Sales (15 years)

Tesla

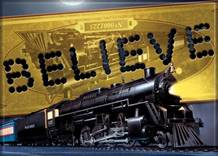

Tesla has announced that it will be raising money through a secondary stock offering. What I found interesting about this is that Elon Musk , the CEO and largest shareholder, is not using this as an opportunity to cash in, but is actually buying $20 million of stock in his company. Apparently, Elon Musk believes in TSLA. For some reason, the golden “believe” ticket from “Polar Express” just came to mind:

In any event, TSLA has been an amazing story. The day TSLA came public in 2010, I wrote a blog entry about the company and its high profile IPO. I received several responses saying that the company had a flawed business model and even that it would be bankrupt within two years. Since then, the stock is up roughly 1500% and the TSLA model appears to be gaining traction. Even Cleveland has Teslas everywhere now – perhaps this is a reflection of how cool Cleveland has become? To this day, people either love or hate this stock. Value investors see Tesla as a hyped stock trading well beyond its intrinsic value while some growth investors see TSLA’s technologies as revolutionary and Elon Musk as the next Thomas Edison. Where do you stand?