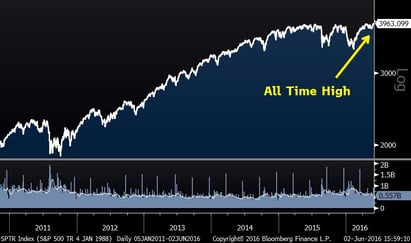

Stocks at All-Time High

Including dividends, the stock market as measured by the S&P 500, is at an all-time high as yesterday’s close. I am guessing that most investors do not feel like this is the case or that their portfolio values are reflecting all-time highs.

S&P Total Return Index (Five Years)

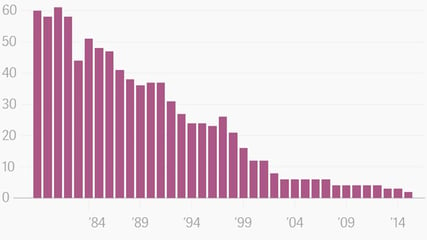

AAA-Ratings – Endangered Species

After April’s downgrade of ExxonMobil, there are only two S&P AAA-rated companies left in the U.S.: Microsoft and Johnson & Johnson. Does this mean that the strength of the best U.S. companies has diminished over the years, or is it a reflection of changing metrics for the rating agencies? MORE: NYT -- AAA Rating is a Rarity

Number of AAA-rated Non-Financial Companies in the U.S.

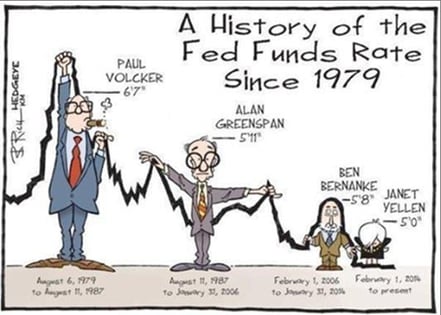

Fed Funds Rate

There is always a lot of speculation around which direction the Fed Funds Rate might be headed. According to the sophisticated analysis below (which has likely been more accurate than many market pundits), rates will stay low for a while:

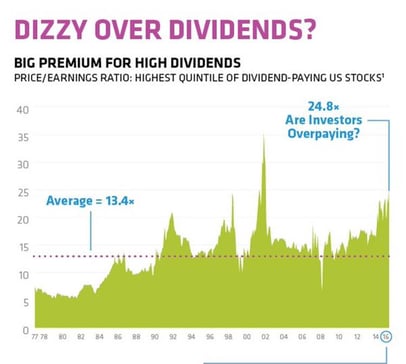

Dividend Bubble

I have been talking and blogging about the phenomenon taking place in the market where investors (speculators too) have been pouring money into stocks and sectors that pay high levels of dividends. Given how low interest rates are in fixed income and other traditional sources of income, it should not be surprising to see such a move. BUT, how much is too much? At what point do these companies become over-valued because their stocks have been blindly bought just for the dividend. It is hard to say exactly when and if the tide will change, but history would suggest it will at some point. Value-oriented investors might suggest that these traditionally stable and low-risk holdings are now as risky as ever. As the chart below shows, the valuation of the highest dividend paying stocks are at all-time highs, outside of bear markets when the “E” of the “P/E” collapsed and drove P/E ratios higher. Theoretically, if interest-rates rise, or the expectation shifts to higher rates, more traditional sources of investment income would become more attractive again, and perhaps this “bubble” would deflate…but hopefully not pop.